Whether you’re facing an unexpected bill or just running low before payday, several apps can help you advance yourself cash from your next paycheck.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Apps like EarnIn, Tilt, and Dave offer access to up to $50 (or more) in minutes, with no credit check and minimal fees. Below, we rank the best apps for borrowing $50 based on cost, speed, and features so you can find the fastest, cheapest option for your situation.

EarnIn

Why we picked it

EarnIn offers “Cash Out” advances, allowing you to access $50 or more of your earnings ahead of your next paycheck. To get started, you’ll need to link your bank account and provide your employer email to verify a steady income. You can borrow up $300 maximum daily and up to $1,000 maximum per pay period, depending on your earnings.

EarnIn doesn’t charge any mandatory fees if you choose a standard transfer; just tip what you think is fair (or don’t tip) and the funds typically arrive within one to three business days.

For instant access, EarnIn charges a Lightning Speed fee starting at $3.99 per transfer to a deposit account or $3.99 for cash-out transfers. If you’re using the EarnIn Card, fees can vary based on your direct deposit setup, with a $5.99 fee for cash-only transfers without a qualifying deposit.

- No mandatory fees

- Fast access to funds

- No credit check

- Balance Shield Alerts

- Requests tips

- Maximum of $300 per day

| Lightning Speed fee | $3.99 – $5.99 |

| No-fee funding time | 1 – 3 business days |

| Loan amounts | $50 – $1,000 |

Our experience with EarnIn

LendEDU test run results: We found EarnIn one of the smoothest to set up. Linking a bank account and verifying your hours takes less than 10 minutes. The app clearly breaks down what you’re eligible to borrow and lets you choose how fast you want it.

Details

| Max. advance | $750 per pay period |

| Fees | $0 for standard delivery (1–3 days); $2.99 for instant |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Balance Shield low-balance alerts, get paid up to two days early |

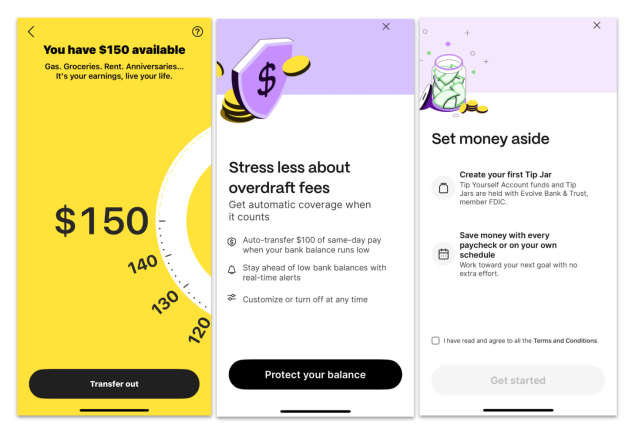

Current

Why we picked it

Current allows users to get multiple advances in a single pay period, with a maximum funding amount of $500. Once you qualify with Current, you can request cash and agree to pay the expedited transfer fee. You’ll pay back what you owe by your next paycheck.

After signing up for a Current checking account, you can see whether you qualify for an advance. If so, you can request one and choose to make a standard or expedited transfer. You’ll be notified of the fee beforehand.

- Multiple advances in a pay period

- No credit check

- Includes premium account features

- Budgeting and tracking tools

- Monthly fee

- Expedited access fee not disclosed

| Expedited access fee | Charges a fee but doesn’t disclose it |

| No-fee funding time | 1 – 3 days |

| Loan amounts | $50 – $500 |

Our experience with Current

LendEDU test run results: We liked how easy it was to qualify after setting up a direct deposit—just $200 per month gets you access. Once eligible, you can borrow exactly what you need, multiple times a month, up to your $750 limit. The app made it clear how much was available and when repayment would happen.

Details

| Max. advance | $750 |

| Fees | $0 for standard (1-3 days); Fees apply for instant |

| Direct deposit required? | Yes (at least $200/month) |

| Credit check? | No |

| Bonus features | Savings pods, cashback, teen banking |

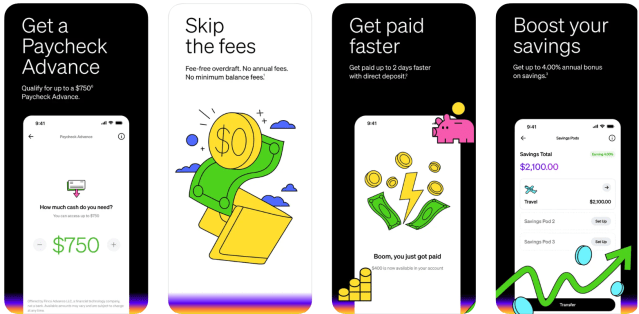

Tilt

Why we picked it

To borrow $50 from Tilt (formerly Empower), connect your bank account and see how much you qualify to borrow. Once you approve the amount, choose between standard transfer and getting the funds within an hour. You’ll repay it automatically out of your next paycheck.

Tilt charges an $8 monthly membership fee, which includes a whole host of money management tools and reimbursement for any overdraft fees if your repayment causes your bank account to overdraft. The amount you qualify for is based on your banking activity. You can choose from the standard transfer (within one business day) or pay a $3 fee to get funds as fast as one hour. You can sign up for a 14-day trial to see whether it’s for you.

- Financial management tools included

- Instant access to funds

- No credit check

- AutoSave feature

- Monthly subscription fee

- Instant access fees can be high

| Instant access fee* | $11 |

| No-fee funding time | 1 business day |

| Loan amounts | $10 – $400 |

Our experience with Tilt

LendEDU test run results: Tilt’s credit boost tips and spend tracker were surprisingly useful. The monthly fee’s a downside, but the app made it easy to cancel. Many users like that you can connect a bank account and get your first advance in just a few minutes.

Details

| Max. advance | $400 |

| Fees | $8 per month; 14-day free trial |

| Direct deposit required? | No, but helps with eligibility |

| Credit check? | No |

| Bonus features | Budget tracker, automatic savings, free trial |

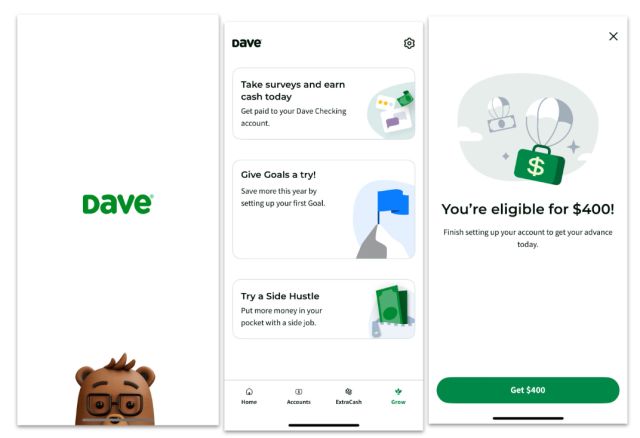

Dave

Why we picked it

Dave allows you to borrow up to $500, but it’s especially accessible for a smaller amount like $50. The app charges a $1 monthly subscription fee and express transfer fees ranging from $3 to $15 for Dave Checking accounts and $5 to $25 for external bank accounts. These fees vary based on the amount you borrow and how soon you want the funds.

Dave stands out for its budgeting tools and ability to help you avoid overdraft fees, making it a suitable choice for those who occasionally need a small, quick cash boost. However, if you’re looking to minimize fees, it might not be the cheapest option for a $50 loan compared to alternatives (such as EarnIn), and in 2024 it received an FTC complaint for misleading marketing. While Dave has taken swift action to correct their practices, we think it is worth noting.

- No interest or late fees

- No credit check required

- High maximum limit of $500

- Reports repayment to the 3 major credit bureaus

| Express access fee* | $4 – $26 ($3 – $15 for Dave Checking accounts; $5 – $25 for external bank accounts) |

| No-fee funding time | 2 – 3 days |

| Loan amounts | $5 – $500 |

Our experience with Dave

LendEDU test run results: Dave is one of the fastest apps to set up. We liked that you can link your own bank or use Dave’s. The side hustle ideas felt generic, but still a helpful perk.

Details

| Max. advance | $500 |

| Fees | $0 for 1–3 day delivery to external bank account; 1.5% of transfer amount for 1-hour delivery to external debit card; $0 for instant delivery to Dave Checking account |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Side hustle finder, budgeting tools, Dave Spending account |

Cleo

Why we picked it

Cleo offers advances of up to $250. To access cash, you’ll need to subscribe for $5.99 or $14.99 per month, depending on the plan. Express transfer fees can range from $3.99 to $9.99, depending on the amount and speed required.

Cleo also provides budgeting tools, spending insights, and even a quirky AI chatbot to help you manage your money. It might be suitable for someone who needs a combination of quick cash and financial guidance, but the subscription fee can make it less appealing if you’re only looking for a one-time advance.

- No credit check

- Helpful money management tools

| Express access fee* | $9.98 – $24.98 |

| No-fee funding time | 3 – 4 days |

| Loan amounts | Up to $250 |

Brigit

Why we picked it

With Brigit, you can download the app, sign up for a monthly plan, and connect your bank account. As soon as you’re approved, you can request an advance and select your repayment date.

Brigit lets you borrow up to $500 once your account is approved and you’ve signed up for a monthly plan. The app has a free tier, but it won’t allow you to access Express transfers. You can choose between a Plus membership ($8.99 monthly) and a Premium membership ($14.99 monthly). Once approved, you can request an advance from you paycheck.

- Overdraft protection

- Budgeting tools included

- No credit check

- Credit monitoring

- Monthly subscription fee

- Maximum advance of $500

| Express transfer fee* | $10.98 – $14.99 |

| No-fee funding time | 2 – 3 business days |

| Loan amounts | $25 – $500 |

MoneyLion

Why we picked it

MoneyLion allows you to request Instacash after verifying your identity and linking your bank account. Just select the amount you want and agree to any applicable fees. You must repay it by your next paycheck.

Standard transfers are free. The optional Turbo delivery fee depends on the amount you borrow and whether you want the money transferred to a MoneyLion or an external account. To borrow $50, it costs $3.99 to transfer it to a MoneyLion account and $5.99 to an external account.

- Higher advance limits

- Additional financial services available

- No credit check

- Lower fees and higher limits with RoarMoney account and qualifying recurring direct deposits

- Fees for Turbo access

- Requires bank account linkage

| Turbo access fee | $3.99 (MoneyLion account) or $5.99 (external account) |

| No-fee funding time | 1 – 5 business days |

| Loan amounts | Up to $100 for external accounts, or up to $1,000 with a RoarMoney account and qualifying recurring direct deposits. |

Our experience with MoneyLion

LendEDU test run results: We liked that you can start with your existing bank account—just link it, verify income history, and you’ll see how much you qualify for. Fees for instant delivery can add up, but the standard option is free if you’re willing to wait. Unlocking higher limits through RoarMoney direct deposit is easy to do from inside the app.

Details

| Max. advance | $500 (up to $1,000 for RoarMoney + direct deposits) |

| Fees | $0 for standard delivery (1–5 days); $0.49–$8.99 for instant |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Credit builder loan, high yield savings, personal loans |

Albert

Why we picked it

Albert’s Instant Advance allows users to borrow up to $1,000, subject to Albert’s approval. The app charges a $4.99 fee for instant access, in addition to monthly fees of $9.99 or $14.99, depending on which plan you select. Albert also includes budgeting, automatic savings, and subscription tracking tools, offering a more comprehensive financial management solution than some other apps.

However, while the app is helpful for small, short-term needs, its membership fee may not be ideal for those seeking a cost-free option. This app can be a valuable choice for users who can benefit from the full suite of financial tools Albert offers, but if you only need a one-time advance, you might consider other alternatives.

- Budget, bank, save, and invest all in one app

- Cashback-earning debit card

- Investing support for beginners

- 30-day free trial

| Instant access fee* | $14.98 – $19.98 |

| No-fee funding time | 1 – 3 business days |

| Loan amounts | Up to $1,000 for cash advance, up to $10,000 for loans |

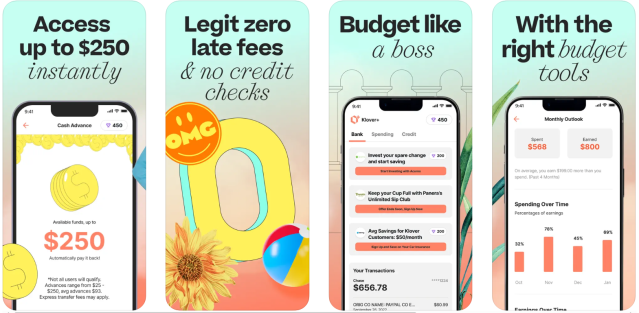

Klover

Why we picked it

Klover lets you borrow up to $200 without a credit check, making it a convenient option for quick, small loans like a $50 advance. Klover’s fee-based structure can range up to $15.98, depending on the amount borrowed and how fast you need the funds. While the app advertises free advances, expedited transfers may incur fees, which vary based on the speed of delivery and your financial profile.

Klover also offers financial management tools, like budgeting assistance and rewards for sharing data, making it an appealing choice for users looking to build better financial habits. However, with fees potentially higher compared to several alternatives, Klover might not be the cheapest option if you frequently need to borrow small amounts.

- Qualify without a credit check

- Agree to share your data with the app instead of paying fees or interest (but expedited transfer fees still apply)

| Expedited access fee | Up to $16.78 |

| No-fee funding time | 1 business day |

| Loan amounts | $5 – $200 |

Our experience with Klover

LendEDU test run results: You can get an advance without paying a dime—but you might need to jump through a few hoops. The points system can feel a bit like a game, which won’t be everyone’s vibe. Also, giving away your data in exchange for no fees could feel a bit icky.

Details

| Max. advance | Up to $200 |

| Fees | $0 for standard delivery; $1.49 to $19.99 for express delivery |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Points system to increase your limit, budgeting tools |

No matter which company you choose, make every effort to repay the loan in full and on time. If you can’t do it in one fell swoop, I advise not taking another loan until you repay the first one in full.

FAQ

How much does it cost to borrow $50 in minutes?

The cost to borrow $50 in minutes varies by app. Here are the costs for several of our top-rated cash apps:

- With EarnIn, you’ll pay a flat fee between $2.99 and $5.99, depending on the amount you advance.

- MoneyLion charges $3.99 to transfer to a MoneyLion account or $5.99 to an external account.

- For Brigit, the fee ranges from $10.98 to $14.99, including a monthly membership fee.

- Tilt charges a flat fee of $11, which includes its $8 monthly subscription fee.

These apps don’t charge interest, just the fees mentioned above. The amount you can borrow and the speed of access depend on your financial habits, income, and app-specific requirements. Choose the app that balances cost and speed based on your immediate needs.

What is my best option to get $50 ASAP?

If you need quick money and have access to an app mentioned above, these can be excellent options due to their fast funding times and minimal fees. We found that EarnIn was the lowest-cost app to borrow $50. Borrowing from a friend or family member is also quick and cost-effective if you have someone willing to help.

Can I get a $50 without a bank account?

It’s possible to get a $50 loan without a traditional bank account. Some apps let you receive money in an in-app account, which you can transfer later. However, most apps require you to link a bank account to withdraw funds and repay from your next paycheck.

Even when not required, many apps still review your banking activity to decide how much to lend.

Other common requirements include:

- Employment: Proof of a full-time job or steady gig income.

- Income: Regular direct deposits or pay stubs to show repayment ability.

- Age: Must be 18+ and a U.S. citizen or resident.

What are the best alternatives to get $50 quickly?

Check out the table below for our recommended alternatives.

| Method | Best for |

| Buy now, pay later | Purchasing goods or services now |

| Credit card | Revolving credit for purchases |

| Friend or family loan | Interest-free short-term loan |

| Payday loan [last resort only] | High-interest short-term borrowing |

Can you borrow $50 from Venmo?

Venmo does not offer traditional loans or cash advances. However, you can request money from friends or family through the Venmo app. If they agree to send you money, it will be available in your Venmo balance immediately. Venmo also has a Venmo Credit Card for purchases, but this requires an application and approval process similar to other credit cards.

Can you borrow $50 from PayPal?

PayPal offers several options for borrowing money. For personal users, PayPal Credit allows you to make purchases and pay for them over time with no interest if paid in full within six months on purchases of $99 or more. For business users, PayPal Working Capital provides business loans based on your PayPal sales history. However, PayPal does not offer direct personal loans or paycheck advances like the apps mentioned.

Can you borrow $50 from Cash App?

Cash App’s Borrow feature lets some users borrow between $20 and $400, depending on eligibility. If you have access to Borrow, you can easily request a $50 loan and repay it, with a flat 5% fee, within about four weeks.

However, not all users qualify, and the feature is still being rolled out. If you don’t see the Borrow option in your app, it means it’s not yet available to you or in your state.

If you need money right away and are considering using an app, first, make sure it’s legitimate (the ones mentioned above are), and understand how repayment works. Also, discern whether the loan is for a need versus a want. Steer clear of taking out a loan for a want; only use them for urgent needs.

Recap of apps to borrow $50 from your next paycheck in minutes

About our contributors

-

Written by Sarah Li Cain

Written by Sarah Li CainSarah Li Cain, AFC®, is a finance writer with more than 10 years of experience in consumer financial products, mortgages, banking, and insurance. She also works with brands to launch and produce podcasts.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.