Our take: If you’re comfortable handling your taxes solo, Cash App Taxes is one of the best free options out there. It covers both federal and state returns with no upsells, though you won’t get one-on-one support or help with more complex filings.

Tax Preparation Service

- 100% free

- State and federal returns

- Can handle most situations

- Use on mobile device or computer

- Maximum Refund, Audit Defense, and Accurate Calculations Guarantee

- Requires Cash App account

- No personalized support or guidance

- Doesn’t calculate underpayment penalties

- Prior reports of improper fraud investigations

- Can’t do taxes for minors, businesses, international, Puerto Rico, or multi-state filings

How much time, money, and—let’s face it, stress—did you spend doing your taxes last year? The IRS gauged it at 13 hours and $290 for the average taxpayer, not including any miscellaneous nail-biting anxiety.

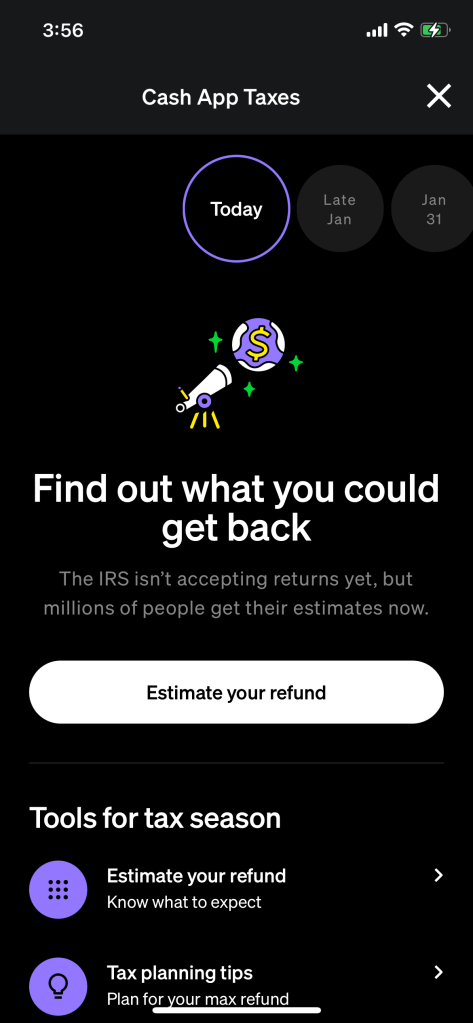

But what if you could get your taxes done in just a few minutes, for free? That’s what the popular Cash App says it can do, but is it really true? And if so, how good is it? We’ll help you decide in this Cash App Taxes review.

What is Cash App Taxes?

Cash App is an immensely popular mobile app, with over 57 million users. It first launched in 2013 as a way for people to send money to each other via peer-to-peer transfers. Since then, it’s expanded to offer a variety of financial services like credit cards and investments.

In 2021, Cash App’s parent company took a different turn, purchasing Credit Karma Tax for $50 million and tucking it into the Cash App portfolio to offer free tax prep services for its own users. Although the company doesn’t say as much, it’s likely a loss-leader to get more people to sign up for an account.

Cash App Taxes pros and cons

Pros

-

100% free

In our view, it’s probably one of the best all-around free tax filing programs there is. It literally does not offer any paid options for its tax prep service, for anything.

-

State and federal returns

Cash App Taxes can do both.

-

Can handle most situations

Cash App Taxes can handle an extensive range of tax situations, including those for joint filers, freelancers, gig workers, and more, if you’re reporting money made on various peer-to-peer payment platforms. You can find a full list here.

-

Use on mobile device or computer

You’ll need the mobile app to get started, but after that, it’s your choice whether you want to do it on your phone, laptop, or computer.

-

Maximum Refund, Audit Defense, and Accurate Calculations Guarantee

These offer some extra peace of mind for 2024 tax filers, which we presume will be offered for the 2025 tax year, too.

Cons

-

Requires Cash App account

If you’re not comfortable downloading a mobile app—at least to get the process going—then Cash App Taxes isn’t for you.

-

No personalized support or guidance

Cash App Taxes isn’t a replacement for a tax professional who can answer individual questions you might have, nor does it offer tax strategies and guidance for future tax planning.

-

Doesn’t calculate underpayment penalties

If you didn’t pay enough throughout the year, you’ll need to find a tax preparer who can help you calculate the fees.

-

Prior reports of improper fraud investigations

The Consumer Financial Protection Bureau ordered Cash App to pay $175 million in early 2025 after it shirked its duty to help fraud victims.

-

Can’t do taxes for minors, businesses, international, Puerto Rico, or multi-state filings

Cash App Taxes can do a lot, but it can’t do everything. While it can handle income from small businesses, if you need to file a separate business tax return, you might need a different solution.

Is Cash App Taxes safe?

Yes, it’s as safe as most other online services.

Cash App Taxes uses industry-standard security protocols like 128-bit encryption and two-factor authentication. It’s also an Authorized IRS e-file Provider, so it must comply with certain standards. It even offers a bug bounty program to reward white-hat hackers who flag security issues in advance.

That said, don’t let those things lull you into a false sense of security. Cash App Taxes—by its very nature—brings certain risks:

- Form errors: You must manually enter data from specific forms, such as 1099s, into Cash App Taxes. Triple-check them to avoid fat-fingering any mistakes.

- Deleting photos: You can enter your W-2 by snapping a photo from your phone. Make sure you delete this picture in case anyone else happens across your phone.

- Smartphone security: If you’re doing your taxes on your phone, consider security options like passcodes to prevent others from accessing your Cash App account.

How Cash App Taxes works

Judging by Cash App Taxes reviews and ratings from customers, one of its best features is how easy it is to use. Here’s how to get started:

- Download the app: If you don’t already have it, download the app on the Google Play or App Store.

- Verify your account: You’ll need a U.S.-based phone number where you can receive a confirmation code from Cash App Taxes.

- Enter last year’s tax return info: It’ll pre-load if you used Cash App Taxes last year. You can also import tax returns filed through TurboTax, H&R Block, and TaxAct. Otherwise, you can enter this information manually.

- Fill out new information: Cash App Taxes will guide you through the process of filling out your taxes. It’ll automatically save your progress so you can simply close the app and restart it on your mobile device or via a web browser at any time.

- File your taxes: When you’re done, you’ll get the option to print and mail in your tax return yourself, or Cash App Taxes can e-file it for you right from within the program. It’ll notify you whether you owe any tax payment or if you’ll be receiving a refund.

Alternatives to Cash App Taxes

Cash App Taxes is a unique program, but it’s not your only option. Here’s how it compares to a few similar services:

- IRS Free File service partners: If you earn below a certain threshold ($84,000 in 2024), you can choose from a few higher-end software options to file your federal (and some state) taxes for free.

- Chime Taxes: Chime is the only other fintech provider we know of that offers free tax filing. It covers a similar range of situations as Cash App Taxes and relies on partner companies to do the actual filing, instead of handling it in-house like Cash App.

- FreeTaxUSA: This platform lets anyone file federal taxes for free, and charges $14.99 for state tax returns. Crucially, it offers paid support options ranging from $7.99 to $49.99 if you need more help, which is still much cheaper than a typical tax preparer.

Is Cash App Taxes a good choice for you?

Let’s be clear: Cash App Taxes isn’t a replacement for a live human who can offer one-on-one advice and guidance. But that’s not always necessary. And Cash App Taxes can be a fantastic option for everyone else, particularly if:

- You’re comfortable using mobile apps.

- You want a clean, simple, and fast way to do your taxes.

- You don’t mind opening a new Cash App account, if you don’t already have one.

- You’re certain that you can troubleshoot tax-related issues on your own if needed.

- You don’t have an overly complex tax situation, like owing taxes in multiple states or countries.

- You’re not looking for tax planning advice, like estimating next year’s self-employment tax payments.

| Company | Product | |

|---|---|---|

|

Tax Prep Service |

|

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Internal Revenue Service, 1040 (and 1040-SR) Instructions, Tax Year 2024

- Block, Inc., Q2 2025 Block Investor Presentation

- Block, Inc., Expanding Access & Financial Inclusion

- Cash App, Control Your Cash

- Cash App Taxes, About our Accurate Calculations Guarantee

- Cash App Taxes, Audit Defense When You File With Cash App Taxes

- Cash App Taxes, Getting Started With Cash App Taxes

- Square, Inc., Cash App Announces Definitive Agreement to Acquire Credit Karma Tax

- FreeTaxUSA, Upfront Pricing

- Chime, Tax Season, Unlocked

About our contributors

-

Written by Lindsay VanSomeren

Written by Lindsay VanSomerenLindsay VanSomeren is a personal finance writer living in Suquamish, Washington. She's passionate about helping people manage their money better so that they can live the life they want. In her spare time, she enjoys outdoor adventures, reading, and learning new languages and hobbies.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.