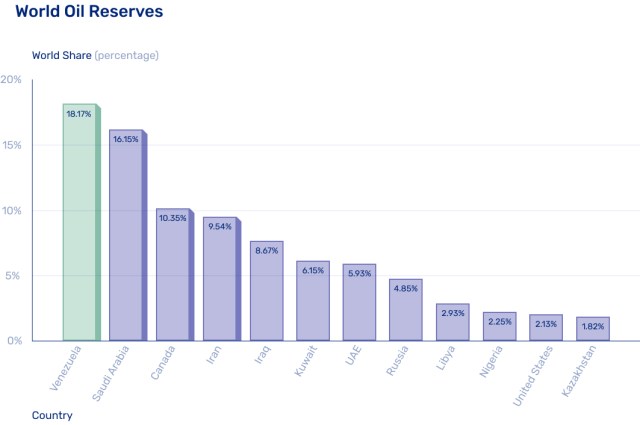

Venezuela sits on an estimated 303 billion barrels of proven oil reserves, making it the country with the largest known oil deposits in the world. To put that number in perspective, Venezuela’s reserves represent roughly 18% of the global total, dwarfing those of traditional oil powerhouses like Saudi Arabia, Iran, and Canada.

The United States, despite being one of the world’s largest oil producers, has only about 45 billion barrels in proven reserves. That’s less than one-sixth of Venezuela’s holdings. But the U.S. taking a hands-on approach to Venezuela’s oil sector doesn’t guarantee an economic windfall. The reality of tapping those reserves is far more complicated than the numbers suggest.

Table of Contents

The reality behind the numbers

While Venezuela’s reserve numbers are staggering, the country’s oil production tells a different story. Venezuela currently produces about 960,000 barrels of oil per day, ranking just 21st globally and representing less than 1% of total global production.

This stands in stark contrast to the country’s peak output in the 1970s, when Venezuela pumped as much as 3.5 million barrels per day and accounted for more than 7% of global oil production.

The dramatic decline stems from years of underinvestment, aging infrastructure, and the technical challenges of extracting Venezuela’s particular type of crude. Most of the country’s oil comes from the Orinoco Belt. The deposits there consist predominantly of heavy crude, a thick, tar-like substance that has been partially oxidized underground.

This heavy crude requires specialized equipment and processes to extract and refine. Unlike light crude, Venezuelan oil must be mixed with costly imported lighter oil or other diluents just to move through pipelines, adding to production costs. The oil also contains a high sulfur content, requiring complex refineries to process.

Recent political developments

In early January 2026, U.S. forces captured Venezuelan President Nicolás Maduro in a military operation in Caracas. Following the operation, President Donald Trump announced plans for American oil companies to invest billions of dollars to rebuild Venezuela’s deteriorated oil infrastructure.

Trump stated that U.S. oil companies would “go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country.”

The investment challenge

The scale of investment required to revive Venezuela’s oil sector is massive. Venezuela’s state-owned oil company, PDVSA, acknowledges that its pipelines haven’t been updated in 50 years and estimates that returning to peak production levels would require $58 billion in infrastructure investment.

Independent energy research firm Rystad Energy projects even higher costs, estimating that restoring Venezuelan oil production to 1990s levels would require $183 billion over more than a decade. The firm further estimates that $53 billion in investment would be needed just to maintain current production levels over the next 15 years.

Major U.S. oil companies also have a complicated history in Venezuela.

- Chevron is currently the only American oil company operating in the country.

- ExxonMobil and ConocoPhillips left after the Venezuelan government forcibly renegotiated contracts around 2007, costing the companies billions of dollars.

International courts have ordered Venezuela to reimburse these companies, but most of the debt remains unpaid.

The economics present another hurdle. Global oil markets currently face an oversupply, with some estimates suggesting excess production of approximately 2 million barrels per day. That’s about twice Venezuela’s total current output. Oil prices are hovering around $60 per barrel, well below the $80 per barrel that analysts estimate would be needed to make Venezuelan projects economically viable.

Energy analysts suggest that even with political stability, increasing Venezuelan production significantly would take years. Francisco Monaldi, director of the Latin America energy program at Rice University, estimates that returning Venezuela to production levels of 4 million barrels per day would require at least a decade and investments exceeding $100 billion.

Implications for the U.S. oil market

Despite the challenges, the situation presents potential benefits for the U.S. economy. Venezuelan heavy crude is particularly valuable to U.S. Gulf Coast refineries, which were originally designed to process this type of oil.

According to the American Fuel & Petrochemical Manufacturers trade group, 70% of U.S. refining capacity is optimized for heavy crude, while the vast majority of current U.S. production is light crude.

This means Venezuelan oil could help U.S. refineries operate more efficiently and produce products like diesel, asphalt, and heavy equipment fuels that are difficult to make from light crude.

According to research from Wood Mackenzie, some production increases could happen relatively quickly with improved management and financial support, though reaching historical production levels would require sustained investment over many years.

Global market impact

Before recent events, China was Venezuela’s largest oil customer, importing 144 million barrels in 2023, which represented 68% of all Venezuelan crude oil exports. Venezuela’s oil shipments to China averaged more than 600,000 barrels per day in December 2025, constituting about 4% of China’s total oil imports.

Any U.S. effort to control Venezuelan oil could affect this trading relationship and potentially influence broader geopolitical dynamics in the energy sector.

Near-term outlook

Energy market experts suggest that the immediate impact on global oil prices will likely be modest. Bob McNally, president of consulting firm Rapidan Energy Group, stated that he expects the impact to be limited, “unless we see signs of widespread social unrest.”

The current global oversupply of oil and relatively low prices mean Venezuelan production increases may not significantly move markets in the short term. Additionally, the technical challenges of reviving decades of neglected infrastructure mean any meaningful production increases are likely years away, even with substantial investment.

For now, Venezuela’s 303 billion barrels remain largely underground. The vast reserve represents enormous potential but faces equally enormous challenges in converting that potential into actual economic value.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Visual Capitalist, “How Venezuela’s Oil Reserves Compare to the Rest of the World“

- U.S. Energy Information Administration, “Venezuela“

- Council on Foreign Relations, “Increasing Venezuela’s Oil Output Will Take Several Years—and Billions of Dollars“

- NPR, “Trump Wants U.S. Oil Companies in Venezuela. Here’s What to Know.”

- NPR, “The World Has Too Much Oil Right Now. Will Companies Want Venezuela’s?“

- New York Center for Foreign Policy Affairs, “Why Is the United States Focused on Venezuela’s Oil Reserves?“

Recommended readings

- Retail Investors Now Make up 20.1% of the Market (And Why That Matters)

- Americans Spent a Record Amount on Black Friday, So Why Are Consumers Uneasy?

- Grocery Prices Up 30% Since 2020: What That Means for Your Thanksgiving Table

About our contributors

-

Written by Ben Luthi

Written by Ben LuthiBen Luthi is a Salt Lake City-based freelance writer who specializes in a variety of personal finance and travel topics. He worked in banking, auto financing, insurance, and financial planning before becoming a full-time writer.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.