The One Big Beautiful Bill Act eliminated the SAVE plan when it was signed into law on July 4, 2025. If you were on the SAVE plan or applied for it, read our guide to learn what to do about your student loan repayment plan.

In 2023, the Department of Education introduced a new income-driven repayment plan for federal student loan borrowers. The Saving on a Valuable Education, or SAVE Repayment Plan, replaced the Revised Pay As You Earn (REPAYE) payment plan.

Under SAVE, eligible borrowers can get lower monthly payments and an interest benefit that can keep loan balances from growing. The SAVE plan also simplifies IDR enrollment for married couples, with more benefits scheduled to roll out in mid-2024.

If you were on the REPAYE plan previously, or you’re wondering whether you might qualify for the SAVE repayment plan, it helps to know how it works.

Table of Contents

What is the SAVE repayment plan?

The Saving on a Valuable Education (SAVE) plan is an income-driven repayment plan for federal student loan borrowers. An estimated 20 million Americans who took out federal student loans are expected to benefit from the plan.

It aims to make student debt more affordable by changing how payments are calculated and making it easier to get loan forgiveness.

With the SAVE plan, your monthly payment is based on your discretionary income—the difference between your annual income and 225% of the poverty guideline for your family size and state of residence.

Here’s an example of how the SAVE plan works:

- Assume you earn $70,000 annually and are married with one child.

- You owe $60,000 in federal undergraduate and graduate loans.

- If you qualify for SAVE, your monthly payments would start at $171. You would pay an estimated total of $7,663, with an estimated forgiveness amount of $60,000.

That’s a simplistic overview of what a SAVE plan might be able to do for you. Here’s a deeper dive into the plan’s main features.

Features of the SAVE plan

The SAVE repayment plan aims to make federal student loans more affordable in multiple ways. Eligible borrowers can benefit from the following:

- $0 payments for some borrowers. Some borrowers will see their monthly payments drop to $0 under the plan. If your discretionary income is $0, based on household size and federal poverty guidelines, then your payment will be $0 as well.

- Interest benefit. Borrowers won’t have to worry about their loan balances growing because of interest as long as they pay on time. If you make your monthly payments as scheduled, the Department of Education will not tack on unpaid interest accrued since your last payment.

- Easier qualification for married borrowers. Under the SAVE plan, spousal income is excluded for married couples who file separate returns. That means your spouse’s income wouldn’t affect your ability to qualify. Spouses are not required to cosign your IDR application under the new plan rules.

Borrowers also enjoy an extended grace period from October 1, 2023, to September 30, 2024, although interest accrues during this time.

These benefits are available now. The following benefits are set to take effect in 2024.

- Lower payments. Undergraduate borrowers who qualify for SAVE will have their monthly payments reduced from 10% to 5% of their discretionary income. Borrowers with undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income based on their original principal balance.

- Early forgiveness for certain borrowers. The SAVE plan requires you to pay 20 years for undergraduate loans or 25 years for graduate loans before any remaining loan balance can be forgiven. However, an exception allows borrowers with original principal balances of $12,000 or less to receive forgiveness after 120 payments instead. The period before forgiveness increases for 1 year for each additional $1,000 in loan balance. So for instance, if you have $14,000 in loans, your balance can be forgiven in 12 years.

- Credit despite consolidation. Consolidating your federal loans won’t impede your progress toward loan forgiveness. Borrowers will get credit for a weighted average of payments made that count toward forgiveness for any loans being consolidated.

- Credit during deferment and forbearance. The Department of Education will offer SAVE borrowers credit toward forgiveness for deferment and forgiveness periods that occur before July 1, 2024. Borrowers can also make “buyback” payments for other deferment and forbearance periods.

- Automatic enrollment for certain borrowers. Borrowers in the older REPAYE IDR program will automatically enroll in the new SAVE program. Borrowers who are 75 days or more late on monthly payments will also be automatically enrolled in an IDR plan if they’ve given the Department of Education secure access to their tax information.

How much would a SAVE repayment plan be worth? It’s estimated that a typical undergrad attending a four-year public university should save nearly $2,000 a year under the plan.

If you are a recent graduate, it might make sense to enroll in the SAVE IDR program. But you should be careful if you are a high earner. Since your payment under SAVE is tied to your income, high earners might find that their payment rises above that under the normal 10-year repayment plan. You can use the loan simulator on the studentaid.gov website to ensure that you will benefit from the SAVE program.

David Haas, CFP®

Who is eligible for the SAVE repayment plan?

There are two ways to qualify for the SAVE repayment plan. You can either be automatically enrolled if you were previously enrolled in the REPAYE plan. Or, you can submit an application to the Department of Education.

If you were not on REPAYE before, you can apply through your My Aid dashboard on the StudentAid.gov website. You’ll need to have eligible loans to apply. Here’s a breakdown of which loans are eligible and which are not.

| Eligible | Eligible if consolidated into a Direct Loan | Ineligible |

| Direct Subsidized Loans Direct Unsubsidized Loans Direct PLUS Loans made to graduate or professional students Direct Consolidation Loans that did not repay any PLUS loans made to parents | Subsidized Federal Stafford Loans (from the FFEL Program) Unsubsidized Federal Stafford Loans (from the FFEL Program) FFEL PLUS Loans made to graduate or professional students FFEL Consolidation LoansFederal Perkins Loans | Direct PLUS Loans made to parents Direct Consolidation Loans that repaid PLUS loans made to parents FFEL Program Loans (some types can become eligible if consolidated) Federal Perkins Loans (can become eligible if consolidated) Any loan that is currently in default |

The Department of Education does not specify any minimum or maximum loan amounts needed to qualify. There are no restrictions on income or the age of your loans either.

If you’re in default on one or more federal student loans, you’ll need to bring them back into good standing to be eligible for a SAVE repayment plan. Signing up for the Fresh Start initiative can help you do that. You’ll need to contact your loan holder to apply for Fresh Start benefits to bring your loans current.

Pros and cons

The SAVE repayment plan can offer some advantages to borrowers, but there are some potential drawbacks to consider. Here’s a list of how the pros and cons compare.

Pros

-

The plan is designed to make monthly payments more affordable for people who might be struggling to keep up with their loan obligations.

-

Some borrowers may see their monthly loan payments reduced to $0, which could ease financial strain.

-

REPAYE borrowers are automatically enrolled, so they don’t have to worry about missing out on benefits.

-

Certain borrowers may be able to get loan forgiveness in a shorter time frame.

-

The interest cap can prevent your balance from ballooning while you’re making reduced monthly payments.

-

Married borrowers who file separately can qualify on their income alone without their spouse’s income being factored in.

Cons

-

Parents who owe federal PLUS loans won’t qualify for the SAVE repayment plan.

-

Your monthly payments are tied to your income and household size; any changes to either could mean a larger payment.

-

There’s no monthly payment cap, which means some borrowers could pay more than they would under the 10-year Standard Repayment plan.

-

The amount of savings realized from the plan can vary greatly from one borrower to the next.

-

Unless you meet the low-balance exception, you must be enrolled in the SAVE plan for 20 or 25 years before qualifying for loan forgiveness.

Many student loan borrowers can live paycheck to paycheck and have difficulties building an emergency fund or saving for a home purchase. If the SAVE plan does benefit you by lowering your monthly student loan payment, you should consider applying your savings toward building an emergency fund. Your emergency fund is vital to keep you from financial disaster in case of job loss or unexpected medical or repair bills.

David Haas, CFP®

If you already have an emergency fund, then consider your retirement savings. If you are eligible for a retirement plan at work, are you missing out on a company match because you have been unable to contribute? Saving for retirement early in your working life is vital to creating an adequate retirement nest egg.

How to apply

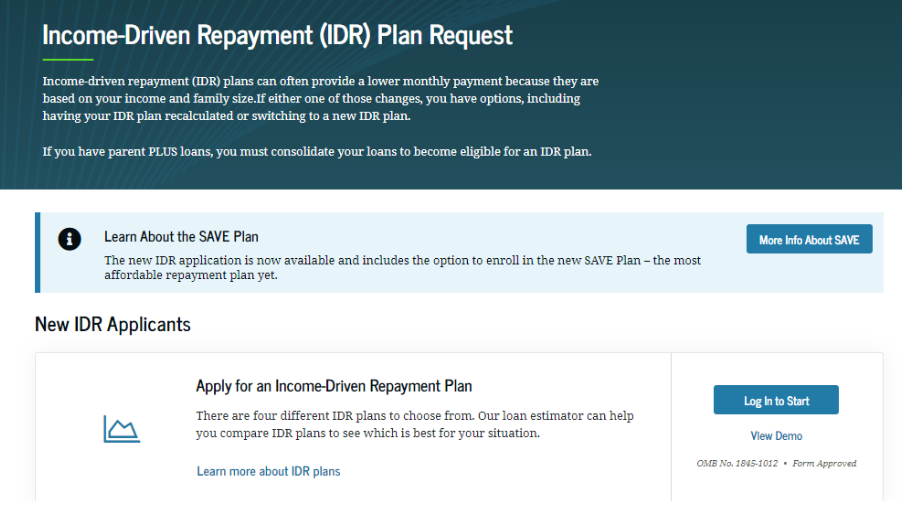

You can apply for a SAVE repayment plan online through the StudentAid.gov website. You’ll need to navigate to the Income-Driven Repayment Plan Request page, then click the button that says “Log In to Start.”

Once you’re logged in, here’s what you’ll need to do next.

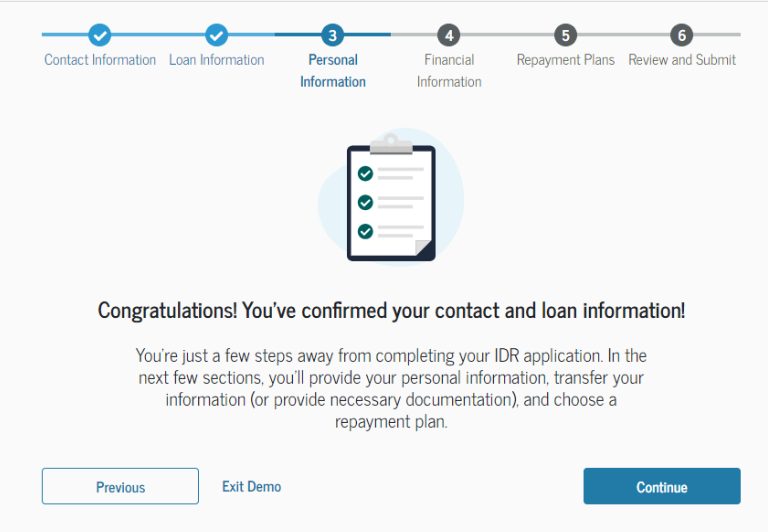

1. Verify your information.

First, you’ll need to check your borrower information to ensure everything is correct.

You’ll need to verify your:

- Name

- Date of birth

- Social Security number

- Address and phone number

- Loan information

Once you confirm that everything is correct, you should see this message.

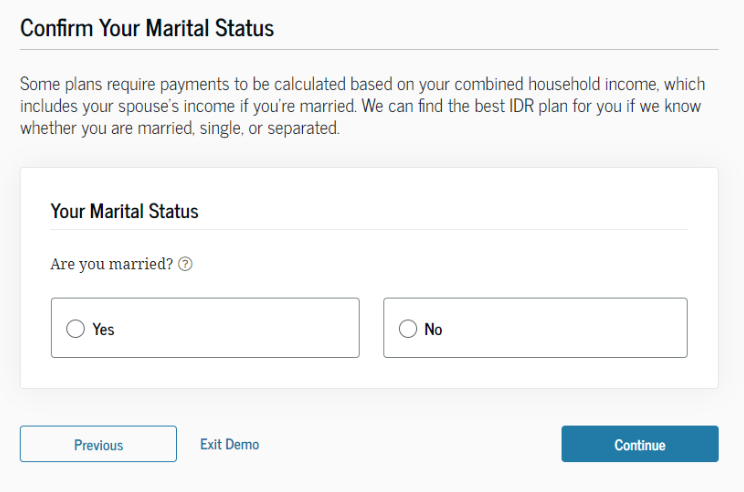

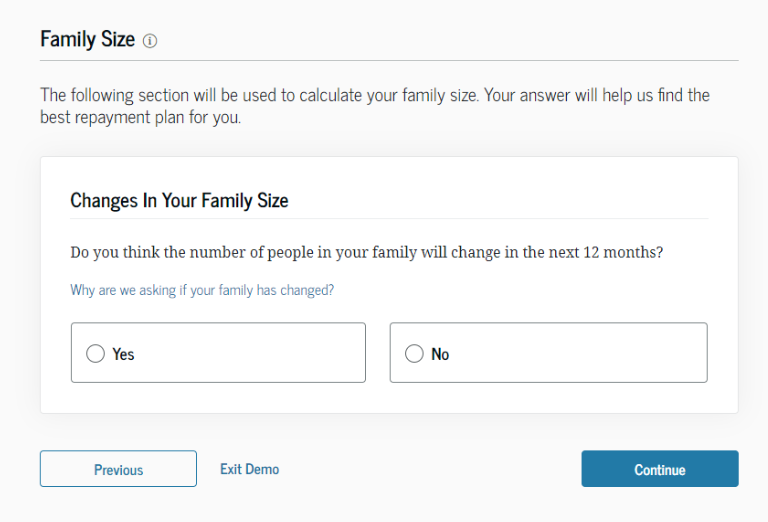

2. Confirm your marital status and household size

Next, you’ll need to verify your marital status and the number of people in your household.

The Department of Education uses this information and details about your income to calculate your monthly payments.

3. Enter information about your income

You’ll need to tell the Department of Education about your income, starting with any income changes since filing your last tax return.

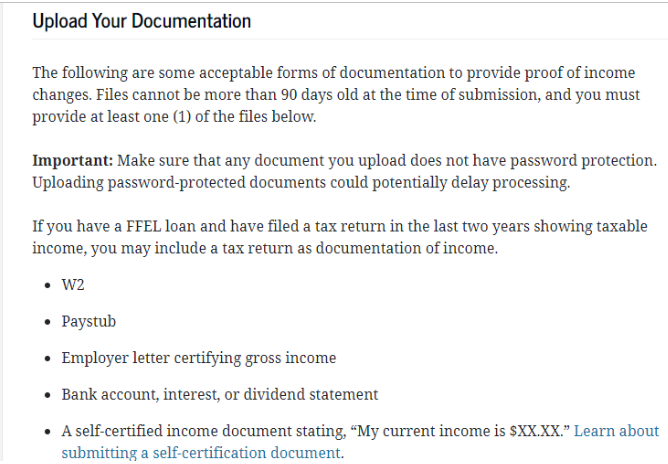

Once you’ve reported any income changes, you can upload documentation of your income. The Department of Education has an approved list of acceptable documents.

4. Estimate your payments

Before submitting your application, you’ll have a chance to review your estimated payments under the SAVE repayment plan.

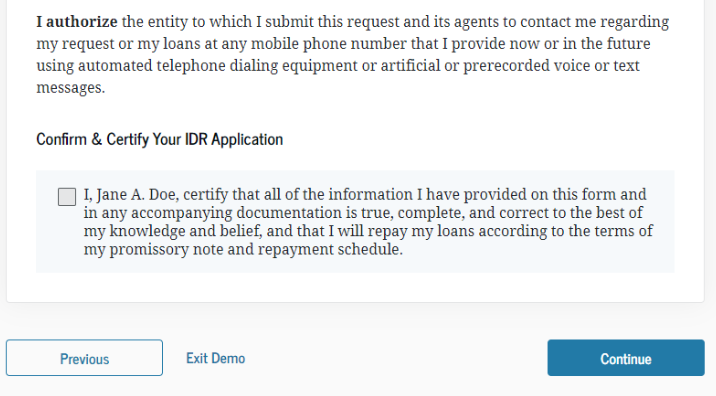

5. Confirm your application and submit it.

The final step is reviewing your application to make sure everything is correct. If it is, you can go ahead and submit it. Once you submit your application, you should get a confirmation message letting you know that it’s been received.

The whole process takes about 10 minutes or less if you have all your income documents organized and ready to go. You can contact your loan servicer for assistance if you have any questions or need help.

How does the SAVE plan compare to other repayment plans?

SAVE offers some advantages that other income-driven repayment plans don’t. Here are some of the key differences between SAVE and other IDR options.

- SAVE uses 225% of the federal poverty guideline to establish monthly payments. Other IDR plans use 100% or 150% instead.

- Most IDR plans set your monthly payments at 10% to 20% of discretionary income. SAVE reduces this number to 5% or 10%.

- Certain borrowers may qualify for loan forgiveness under SAVE in as little as 10 years, while other plans may require 20 to 25 years of payments first.

- The interest cap is permanent with SAVE, whereas with other plans it’s only temporary or not offered at all.

What about the Standard Repayment plan? Under the Standard plan, you must pay your loans off in 10 years. Your monthly payments may be higher, and there’s no option for loan forgiveness. Your loan balance and interest rate—not your income—determine your monthly payments.

If you’re wondering whether the SAVE repayment plan might be right for you, it’s helpful to consider how much you owe, what you’re currently paying, and your goals. The SAVE plan could be a good fit for anyone who’s looking for the lowest monthly payment possible without having to worry about unpaid interest piling up.

Comparing different income-driven repayment options can help you choose the best one for your situation.

College debt can be a significant financial overhang for graduates over many years. It interferes with building an emergency fund, saving for retirement, and purchasing a home—not to mention saving for your own children’s college education. By reducing the monthly payment and allowing earlier loan forgiveness, the SAVE plan can help graduates pay off their loans earlier and also can provide a little more monthly budget relief that could be used for other savings goals.

David Haas, CFP®

FAQ

What documents do I need to apply for the SAVE repayment plan?

The main documents you’ll need to apply for the SAVE plan are W-2s, tax forms, bank statements, and pay stubs. The Department of Education needs this documentation to verify your income.

How fast can I expect approval after applying?

Applying for a SAVE repayment plan can take as little as 10 minutes. From there, your application may take up to four weeks to be processed and approved. You’ll need to continue making payments to your loans as scheduled in the meantime.

Can I switch to SAVE from another repayment plan?

The Department of Education allows borrowers to switch from other IDR plans to the SAVE plan. Remember that if you were previously enrolled in the REPAYE program, you’ll automatically be switched to the SAVE plan.

Does the SAVE repayment plan offer any loan forgiveness?

Standard loan forgiveness is available with the SAVE plan after 20 or 25 years. However, certain low-balance borrowers may be able to get their loans forgiven after making 120 payments, or 10 years.

Is there a grace period for payments?

The SAVE repayment plan offers an extended grace period for borrowers. The grace period extends from October 1, 2023, to September 30, 2024, although interest continues to accrue.

Can I pause payments if I face financial hardship?

If you’re temporarily unable to pay your federal loans, you may qualify for a forbearance or deferment. You can log in to StudentAid.gov or contact your loan servicer to discuss your options.

How does the SAVE repayment plan affect my taxes?

Loans forgiven through the SAVE repayment plan or any other IDR plan are typically treated as taxable income, so that’s a potential downside. However, married borrowers who file separate returns would not have to factor in their spouse’s income to calculate their SAVE plan payments.

I have a Parent PLUS loan. Am I eligible for the SAVE Repayment Plan?

Unfortunately, Parent PLUS loans and any direct consolidation loans that were used to repay Parent PLUS loans are not eligible.

However, a double consolidation technique for Parent PLUS loans will allow you to use the SAVE Repayment plan for these loan balances, but this technique must be completed by July 1, 2025. Using it is complex, and you should get the help of an experienced financial advisor.

The SAVE Repayment plan has significant benefits over the income-contingent (ICR) plan, which is the only one available for Parent PLUS loans.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by David Haas, CFP®

Reviewed by David Haas, CFP®David Haas, CFP®, advises families, professionals, executives, and business owners on how to build better financial futures. His expertise includes financial planning, investment management, and insurance. David is a board member of the Financial Planning Association of New Jersey.