Advance America is a legitimate company with lending licenses in various states. As a BBB-accredited lender with nearly 20 years of experience, it offers strong customer service and same-day loans.

But scammers have been impersonating Advance America with advance-fee loans. It’s a confusing situation because the company is legitimate and doesn’t scam customers. Scammers pretend to be the company to steal money from unsuspecting borrowers.

Here’s an in-depth look at how the scam works and the exact steps you can take to avoid it. Plus, we share our take on the company’s financial products.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

| Company | Best for… | Advance Limits | Rating (0-5) |

|---|---|---|---|

|

Best overall | Up to $300 per day; $1,000 per pay period |

|

|

Best credit-building tools | Up to $400 per advance |

|

|

Best for large advances (up to $500) | Up to $500 per advance |

|

|

Best theft protection | Up to $500 per advance |

|

Table of Contents

Is Advance America a scam?

Advance America isn’t a scam. It’s a licensed lender with genuine loan offers that follow legal guidelines. But some scammers are pretending to work for Advance America as part of an advance-fee scam:

Once you know what to expect with a scam, it’s easier to avoid it. Here’s what happens.

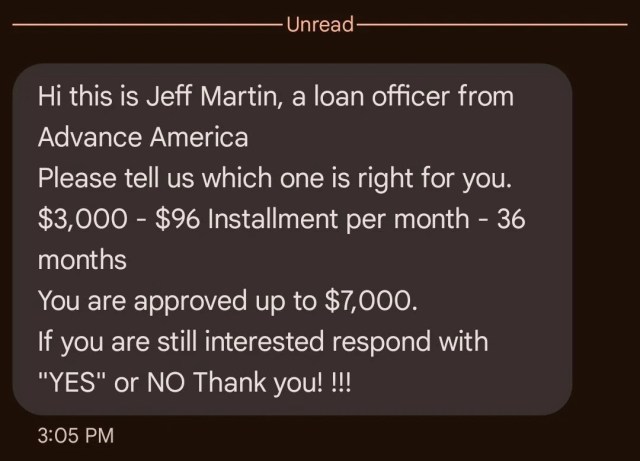

- Unsolicited text: A person pretending to be Advance America contacts you, usually by sending a text. The person offers you a loan or says the company has approved your application. The only issue? You’ve never applied for a loan or been in contact with “Advance America.”

- Payment request: After replying to the text, the scammer asks for a payment before you can receive the loan amount. They might request that you pay with a prepaid debit card, wire transfer, or mobile payment app. Some people report that the scammer asks to deposit money into their bank account and then asks for it back, making it similar to a money mule scam. Either way, it’s a scam.

- No response or additional requests: After you send the money, the scammer never provides the loan and disappears, or they might make further requests and threaten you for not responding.

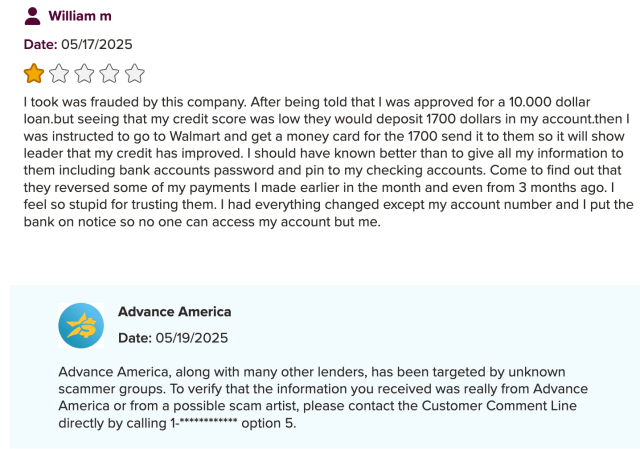

Advance America is aware of the scams and is taking steps to stop them.

The best way to avoid a scam is never to send money to a loan company as part of the application process. Some lenders charge an origination fee, but it’s never an upfront cost. Instead, the lender adds the fee to your total loan balance, and you pay it off over time.

How Advance America helps customers avoid scams

Advance America is aware that scammers are posing as company employees to steal money from people. The company is taking steps to educate potential customers and report the fraud.

According to Advance America, everyone should take the following steps to avoid scams.

- Never give personal information: Don’t share your full name, address, Social Security number, or bank account details. Legitimate companies collect that information through a secure platform during the application process. Remember, you need to apply for a loan. Lenders can’t randomly offer you a loan without reviewing an application and completing a credit check.

- Call the company to verify: If you suspect you’re dealing with a scammer, hang up the phone or stop texting, and call the company directly. Use the official phone number from the company’s webpage, not the number the person used to contact you. For example, you can call Advance America at 1-844-562-6480 to confirm whether a text or call is legitimate.

- Check for licenses: You can use a state-specific government database to check for company licenses. For example, you can confirm licensing at https://dol.wa.gov/ if you live in Washington state. Every state offers a similar tool.

- Look out for aggressive language: You’re likely dealing with a scammer if the person is using aggressive, intimidating, or foul language. The Fair Debt Collections Practice Act clearly states that lenders aren’t allowed to speak to customers in that way.

What to do if you suspect a scam

Report the phone number, email address, and any other information you have about the scammer to the Federal Trade Commission.

Even if you fell for the scam and lost money, it’s important to file a complaint so law enforcement can collect information and help others avoid it.

How Advance America works

Advance America offers different loans, including payday and title loans. These types of loans have higher fees and interest rates. The trade-off is that you can access the money much faster, and it’s easier to qualify.

But you can easily get caught in a debt cycle trap if you’re not careful. Some people prefer same-day cash advances from reputable companies like EarnIn to avoid the cycle.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Here’s a brief overview of the financial products Advance America offers.

| Feature | |

| Products | Personal loans, title loans, line of credit, payday loans, cash advances |

| Speed of advance | As soon as same-day |

| Loan amounts | $100 – $25,000, depending on loan type and state |

Advance America pros and cons

Advance America isn’t a scam, but that doesn’t necessarily mean the company is right for you. You might want to consider the following pros and cons as you research personal finance companies.

Pros

-

Many in-person locations

With more than 800 stores, it’s easy to find an Advance America near you.

-

Accessible application

You can apply for a loan or cash advance online or at a store, making it easier to get funding.

-

Several types of loans

Advance America offers personal loans, title loans, lines of credit, payday loans, and cash advances.

Cons

-

Not available in every state

Advance America is only available in Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nevada, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, Wisconsin, and Wyoming.

-

Limited information online

We found it challenging to get details about terms and rates without completing an application or speaking with a representative, making it harder to compare offers from other lenders.

-

Inaccurate support hours

Although Advance America says customer service representatives are available from 8 a.m. to 9 p.m. Eastern during the week, we had trouble reaching someone.

Advance America reviews

| Source | Customer rating | Number of reviews |

| Better Business Bureau | 1.47/5 | 151 |

| Trustpilot | 4.9/5 | 116K |

| 5/5 | 1,044 |

Advance America earns impressive customer ratings on Trustpilot and Google. With more than 100,000 reviews on Trustpilot, it’s clear that the company has a long history of providing a solid customer experience. Google reviews are also quite positive, with most store locations earning four or more stars.

Reviews on the Better Business Bureau (BBB) are the exception. Advance America earns low ratings on the site, primarily because customers report it as a scam. Most reviews on the BBB suggest that the scammers are Advance America employees attempting to scam them. The truth is that the scammers aren’t associated with Advance America at all, and the company replies to reviews to let customers know.

FAQ

Does Advance America send you text messages?

Advance America doesn’t send text messages unless you provide the company with your cell phone number and opt in to the service. If you haven’t taken those steps, texts from anyone claiming to be Advance America are likely from scammers.

How do I contact Advance America customer service?

You can contact Advance America customer service by sending a chat message, direct messaging on Facebook, or calling 844–562-6480. You can also talk with a representative at a local store.

What is the Advance America approval code?

Advance America doesn’t use an approval code. However, the company makes an approval decision when you apply for a loan or other financial product. The decision determines whether you can move forward and get the funding.

What is the Advance America lawsuit email?

Some scammers who pretend to work for Advance America send threatening emails about lawsuits as a scare tactic. Report it to the Federal Trade Commission if you get an email from a company you don’t use and the person is threatening legal action.

Does Advance America hurt your credit?

It doesn’t hurt your credit to apply for a loan with Advance America. Most loans require a soft credit check, which doesn’t impact your score. But the lender doesn’t require credit checks for some loans, like the payday loan.

| Company | Best for… | Advance Limits | Rating (0-5) |

|---|---|---|---|

|

Best overall | Up to $300 per day; $1,000 per pay period |

|

|

Best credit-building tools | Up to $400 per advance |

|

|

Best for large advances (up to $500) | Up to $500 per advance |

|

|

Best theft protection | Up to $500 per advance |

|

About our contributors

-

Written by Taylor Milam-Samuel

Written by Taylor Milam-SamuelTaylor Milam-Samuel is a personal finance writer and credentialed educator who is passionate about helping people take control of their finances and create a life they love. When she's not researching financial terms and conditions, she can be found in the classroom teaching.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.