From coins and cash to credit and debit cards, just how dirty is our money, literally?

When you think about all the places your cash has been and how many times it has changed hands, you realize that bills become germ-transporting vessels. And even as we progress towards a cashless society, those debit and credit cards are still getting swiped or inserted, changing hands, or sitting on bar tops.

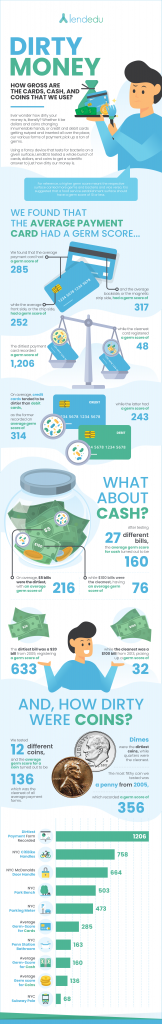

To get some concrete evidence behind how dirty our various forms of payment are, LendEDU used a scientific device that tests for bacteria on a given surface; in this case, the tested surfaces were credit and debit cards and various bill and coin denominations.

The device returns a germ score that is quite easy to understand: the higher the number, the dirtier the surface and vice versa. For reference, food establishment surfaces should have a germ score of 10 or less to be considered sanitary.

Continue on to find out how just how filthy your money is. But be forewarned, the results may disturb you, and they could get you to start using Apple Pay or Google Pay a bit more.

The Results

On Average, What’s the Dirtiest: Cash, Cards, or Coins?

After testing the front and back of 41 different debit and credit cards, 27 different bills, and 12 different coins, and calculating the average germ scores for each payment based on the results, debit and credit cards turned out to be the dirtiest payment method.

This comes as a bit of a surprise as one might expect cash to be the filthiest since cash stays in circulation a lot longer and can travel across the country by changing hands. However, debit and credit card usage numbers have quickly caught up to cash’s figures; in fact, debit cards are actually the most commonly used payment method today.

Not to mention, imagine how many germs a card can accumulate every time a consumer puts it on a bar top to pay for drinks or a table top to take care of a restaurant bill.

Sean Perry, the Founder and Director of Neat Services, a cleaning company, offered some of his thoughts on this topic.

According to research from Mastercard and the University of Oxford, the average bank note is home to 26,000 types of bacteria including E. Coli. And the average coin has more germs than on a toilet seat! It’s perhaps not surprising given the number of people that exchange money on any given day, many of whom do not wash their hands before or after handling it.

Sean Perry, Founder & Director of Neat Services

How Can You Combat Dirty Money?

Since you pretty much cannot avoid using money, what is considered best practice when it comes to preserving your hygiene against germ threats from our various forms of payment?

Perry had a few simple tips:

Keeping money clean is going to be difficult particularly when you’re using it day-to-day. With cards, it is, however, worth wiping them semi-regularly.

But the best advice is just to make sure you wash your hands regularly throughout the day, and particularly before and after eating. And, washing your hands after eating will mean a reduced chance of any food debris going back onto the money once you finish.

Sean Perry, Founder & Director of Neat Services

Another expert on the subject matter is Bart Wolbers, a researcher at Nature Builds Health, that holds a degree in clinical health science. Wolbers had a more simple solution when it comes to fending off germs from our money:

“Switch to digital payments as much as possible.”

Bart Wolbers, Research at Nature Builds Health

How Dirty Are Payment Methods Compared to Known Filthy Things?

So, compared to some other things that are known to be quite dirty, like subway poles in Manhattan or bathrooms in Penn Station, our payment methods are essentially just as germ-ridden, on average.

In the case of debit and credit cards, they are actually dirtier, on average, than those two things, while cash and coins are both dirtier than a subway pole and slightly cleaner than a bathroom in Penn Station, which sees more than 650,000 people on an average workday.

However, it was pretty fascinating to find that the dirtiest payment card we tested was filthier than any other infamously dirty thing we tested around New York City, such as a CitiBike, McDonald’s door handle, or park bench.

A Complete Look at the Germ Score Data

The table above encapsulates all of the data was collected as part of this research project. It is broken into four different tabs, each one displaying a different ranking.

Comparing Debit & Credit Cards and Fronts & Backs of Cards

Based on the data that we collected through this project, credit cards carried a lot more germs than debit cards did. On both the front side and backside, credit cards were dirtier than debit cards.

Another interesting trend was that the average front sides of both debit and credit cards were cleaner than the backsides. While it was a temporary pain when merchants across the country began switching to card payment via chip insertion instead of swiping the strip, perhaps they were unintentionally onto something.

One could argue that it would make sense that using the chip instead of the magnetic strip to pay for things with a card is a cleaner process. While only a small portion of the card is used when paying via chip, the entire length of the card is swiped when using the magnetic strip found on the backside.

Comparing Various Bill Denominations

After averaging together the individual germ scores for each bill denomination, we found that $5 bills, with an average germ score of 216, were the most germ-ridden.

Posting an average germ score of 40, the cleanest bill denomination was the $100. When you think about the usage of $5 bills compared to $100 bills, it is not a big surprise to see that commonly-used fives are much dirtier than hundreds, which change hands sparingly.

Comparing Different Coins

Of all the various types of coins, quarters, with an average germ score of 239, actually were found to be the dirtiest on average. Meanwhile, dimes posted an average germ score of 75, which made them the cleanest coin.

If you are ever out of cash and rounding up some spare change to pay for something quick, quarters are usually the first coins you look to grab as you just need a few to get to a dollar. Because they are so often utilized, especially at tolls, it is reasonable to see them end up as the dirtiest coin type on average.

Credit Card Alternatives

It’s possible this data scared you into not wanting to use a credit card anymore, even if you currently have one of the best credit cards available.

If this is the case, we have listed out a few credit card alternatives that you can read more about below.

Personal Loan

A personal loan could be used instead of a credit card if you are looking for alternative forms of financing. Personal loans can be used for a variety of purposes, and consumers can sometimes access $100,000 personal loans if they are looking to finance large projects like home renovations.

Getting a personal loan is not a complicated process, and LendEDU lays out the steps of getting a personal loan here.

Home Equity Line of Credit (HELOC)

If you are a homeowner, a home equity line of credit can be a great way to access financing by tapping into the equity you’ve built in your house.

A HELOC will typically come with a variable interest rate, although some lenders offer fixed-rate HELOCs. Additionally, the interest rates on HELOCs will typically be smaller than credit card interest rates.

Be sure to do your research on HELOCs because, like with any financial product, there are pros and cons to using a home equity line of credit.

Virtual or Mobile Payment Options

There are a variety of virtual or mobile payment options that allow you to pay for things with just a touch of a button on your smartphone. This way, you don’t have to worry about taking out your credit card or cash and having germs stick to either.

Some financial institutions offer virtual credit cards, while mobile payment options include Apple Pay, PayPal, Square Cash, Google Pay, Venmo, and Zelle.

Methodology

All data in this report comes from a research project completed by LendEDU on May 3rd, 2019. On that date, all forms of payment were tested for their surface bacteria. Specifically, we individually tested both the front and backside of 41 different debit and credit cards, 27 different bills of varying denominations, and 12 different coins of varying denominations. The germ score results for the known dirty objects that are featured in the second bar chart derive from an earlier report completed by LendEDU in 2019.

The LendEDU germ score derives from relative light unit (RLU) readings from Hygiena’s SystemSURE Plus handheld testing device. The device tests for adenosine triphosphate (ATP) on a given surface and gives the user an RLU reading within 15 seconds. For each surface tested, a Hygiena cotton swab was used to wipe the respective surface; that cotton swab was then dropped into the SystemSURE Plus device, which gives an RLU reading back in 15 seconds. That RLU reading is a number that LendEDU simply called the “germ score.” A higher RLU, or germ score, reading meant the surface was more dirty and covered in more bacteria and vice versa.

The Hygiena SystemSURE Plus is “the world’s best selling ATP Sanitation Monitoring System,” and has been used for over 10 years. The Centers for Disease Control and Prevention recommends monitoring cleanliness with an objective measurement tool, such as an ATP Cleaning Verification System like the SystemSURE Plus.

To calculate the average scores for each type of payment, the individual germ scores for each payment form were added together and divided by the total number of payment forms tested. To do the overall scores for each individual card, the front side and backside germ scores were averaged together.

See more of LendEDU’s Research