Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

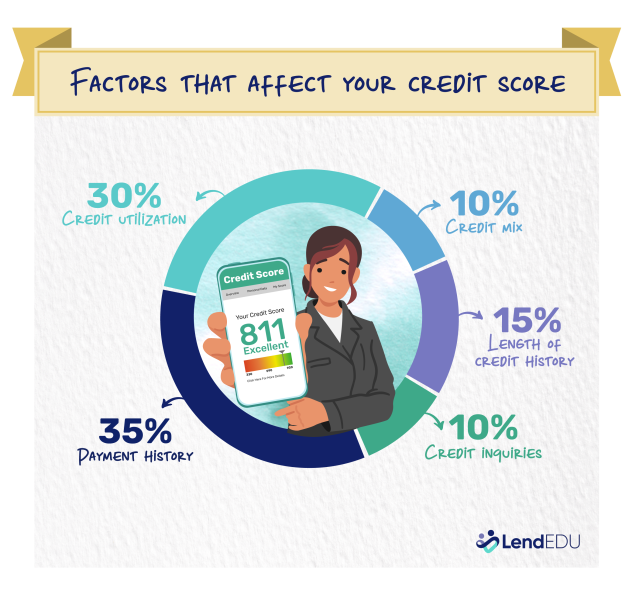

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

2025 Gold Investment Survey: 59% Show Higher Interest in Gold After Seeing the Numbers

If you’re seeking diversity and stability in your investments, you might be asking, “Is investing in gold a good idea?” Despite gold’s long history, there are quite a few misconceptions…

-

How to Protect Your Investments in 2026 and Beyond: 7 Strategies

If your 2025 has been anything like mine, you’re probably seeing headlines about trade disputes and impending recessions, all while trying to cut costs and afford your favorite snacks at…

-

What Is MoneyLion? What You Need to Know in 2026

MoneyLion is a legit all-in-one finance app offering cash advances up to $500, credit builder loans, personal loan offers, and fee-free banking through RoarMoney. We like that it doesn’t charge…

-

How Much Gold Should I Own? Experts Say 10% – 15% of Portfolio

Wondering how much gold you should actually own? Many financial experts say 10% to 15% of your portfolio is a smart starting point, but the right amount depends on your…

-

What Is a Merchant Cash Advance? How It Works

I know many entrepreneurs who have used business financing to keep the lights on, hire staff, manage cash flow, and fuel growth. A merchant cash advance (MCA) is one type…

-

Transactional Gold: Where and How Gold Works as Legal Tender in 2026

Gold has shaped financial systems across the world for thousands of years. Even after paper money emerged, most major currencies were gold-backed, providing stability and global trust. In the U.S.,…

-

MCA Debt Relief: 6 Strategies to Get Out of Merchant Cash Advance Faster

I’ve talked to business owners who felt relief when that merchant cash advance finally hit their account. But now, the pressure’s back. If you’re struggling to keep up with daily…

-

Why Is the U.S. Dollar’s Value Dropping? Our Analysis for 2026

Hearing that the U.S. dollar is dropping in value can be stressful, especially with sensational news coverage fueling public uncertainty. While the dollar has weakened since 2024, it remains one…

-

2026 Tax Challenges Survey: 39% Surveyed Facing IRS Fees, Penalties, Interest, or Collections

For some, tax season means the promise of a big tax return to help pay for bills, go on vacation, or fund home renovations. For others, it’s a source of…

-

JG Wentworth Debt Relief Review 2026: Good Reputation, Mixed Customer Reviews

Min. required debt $7,500 Standout feature 30-year track record Settlement fee 18% – 25% of enrolled debt Membership fees None How much can you save? Reduce monthly payments up to…