No, you can’t unconsolidate a federal Direct Consolidation Loan or a refinanced private student loan. Once finalized, both are permanent. However, there may be limited exceptions and other ways to adjust your repayment plan if you regret the decision.

This guide walks through what to know and what to do instead.

Table of Contents

Is it possible to unconsolidate federal student loans?

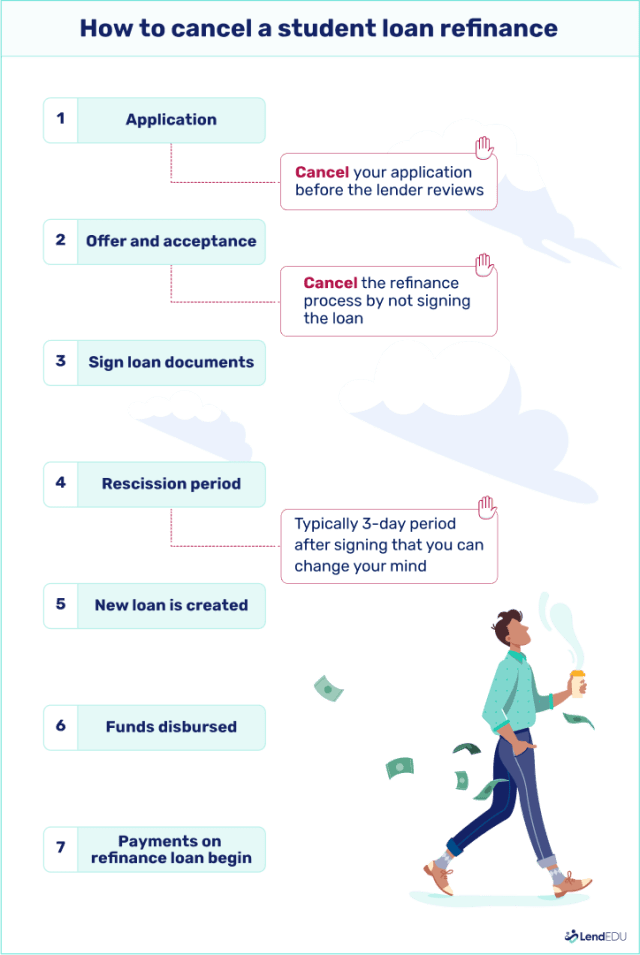

In most cases, no. Once your loans are consolidated through the Direct Consolidation Loan program, you can’t reverse it. Your original loans are paid off and replaced with a new one. But you can cancel before the loan is finalized.

You can cancel a federal consolidation if:

- You withdraw your application before it’s reviewed.

- You notify your servicer before your old loans are paid off.

Your servicer will send you a notice with the deadline for canceling. After that, the decision is locked in.

Exception: Joint FFEL consolidation

Borrowers who consolidated federal loans with their spouse under the FFEL program may be eligible to separate their loans under the Joint Consolidation Loan Separation Act (JCLSA). This allows married or divorced couples to split a joint loan into individual loans.

Can you reverse a private student loan refinance?

Once your refinanced loan is disbursed, it can’t be undone. The new lender has already paid off your old loans. But you do have a short window to cancel.

You can cancel a refinance if:

- You change your mind before signing the agreement.

- Your lender offers a short post-signing cancellation period (often up to three days).

After this window closes, your only option is to refinance again.

What to do if you consolidated or refinanced too soon

If you regret your decision, here are options to consider:

For federal loans:

- See whether you qualify for a different repayment plan, like an income-driven option.

- If you consolidated loans while working toward forgiveness, contact your servicer to confirm that your progress counts.

For private loans:

- Refinance again to switch terms, lenders, or interest types.

- Use autopay and rate discounts to lower costs.

Can you consolidate your federal loans more than once?

Possibly—especially if you’ve taken out new eligible federal loans or you’re pursuing IDR or PSLF under updated rules. But if you’re simply unhappy with the terms of your Direct Consolidation Loan, reconsolidation won’t usually help. Instead, contact your servicer to explore repayment options, forgiveness progress, or other federal programs that might better suit your needs.

Can I refinance a consolidated student loan?

You can refinance a Direct Consolidation Loan into a private loan if you’re unhappy with your consolidated terms, but know that you’ll lose federal repayment benefits by doing so. If you’ve already refinanced, you can do it again to secure more favorable terms. Learn more about how many times you can refinance and about refinancing more than once.

If you’re looking to refinance again with better terms or more flexible options, you might consider a marketplace—Credible is our favorite—to compare multiple lenders at once without affecting your credit, and with no obligation.

Questions to ask before consolidating or refinancing

Use these questions to help decide whether consolidation or refinancing is right for you:

- Am I giving up forgiveness or income-driven repayment by refinancing federal loans?

- Can I still afford the new monthly payment?

- Do I understand when the loan becomes permanent?

- Does the lender offer any cancellation window?

If you’re unsure, it may be best to wait. You can consolidate or refinance later, but you can’t undo it once it’s finalized.

Bottom line: You can’t unconsolidate student loans after the process is complete. But you can cancel during the early stages or refinance again to fix a mistake. Always weigh the trade-offs first, especially when giving up federal benefits or combining multiple loans into one.

About our contributors

-

Written by Megan Hanna, CFE, MBA, DBA

Written by Megan Hanna, CFE, MBA, DBADr. Megan Hanna is a finance writer with more than 20 years of experience in finance, accounting, and banking. She spent 13 years in commercial banking in roles of increasing responsibility related to lending. She also teaches college classes about finance and accounting.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.