If your credit score could use a boost, a credit building app might be the easiest place to start. These apps offer tools like secured credit cards, credit builder loans, rent reporting, and score monitoring right from your phone.

In 2026, they’re more popular than ever. That’s partly because they’re easier to access than traditional credit cards, and partly because more people are focused on financial health. Some apps even combine multiple tools in one place, so you can build credit and budget better at the same time.

- Improve your credit score +45 to +86 1

- Plans starting at $15 per month

- No minimum credit score required

- No hard credit check

Table of Contents

What are credit building apps, and how do they work?

A credit-building app is a simple, effective way to improve your credit score—especially if you’re just getting started or working to rebuild.

These apps help by turning small, consistent payments into positive credit activity that gets reported to the three major credit bureaus: Experian, Equifax, and TransUnion.

You can usually choose a monthly payment plan that fits your budget, often between $10 and $50. Many apps don’t require a hard credit check to get started, and some even help you build savings at the same time.

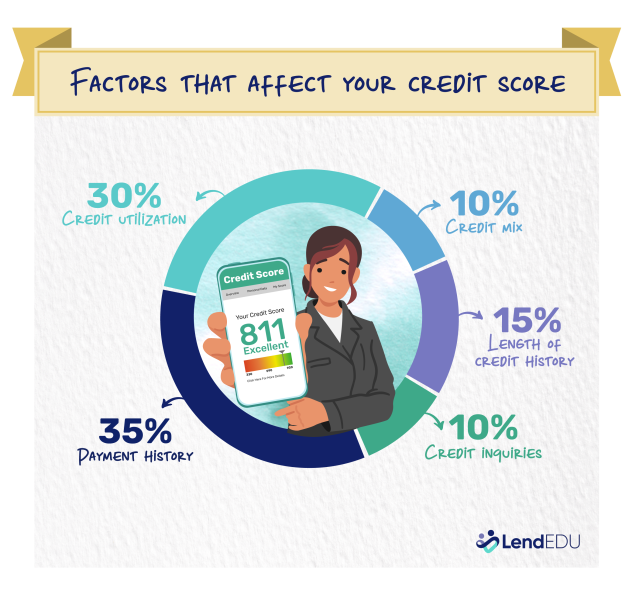

Most work by offering a credit-builder loan, giving you a secured card to use, or by reporting on-time payments that you already make, such as rent, subscriptions, or utilities. Over time, these actions help build a payment history, which is one of the biggest factors in your credit score.

A good credit-building app is transparent about its costs, reports to all three credit bureaus, and includes features like credit score tracking, alerts, and financial tips.

We downloaded and tested the best credit building apps of 2025 to see how they stack up. Here’s what we found.

| App | Great for | No credit check | Reports to all 3 bureaus | Has savings feature | Secured card | Rent reporting | Credit monitoring | Subscription and utility credit | Debit-based card |

|---|---|---|---|---|---|---|---|---|---|

Read more Read more | Benefits beyond building credit | ✅ | ✅ | ✅ | ✅ | ✅ | ➖ | ➖ | ➖ |

Read more | Building credit with a secured card | ✅ | ✅ | ➖ | ✅ | ➖ | ➖ | ➖ | ✅ |

Read more | Bundling credit building with banking | ✅ | ✅ | ✅ | ➖ | ➖ | ✅ | ➖ | ➖ |

Read more | Building credit with small monthly payments | ✅ | ✅ | ➖ | ➖ | ➖ | ✅ | ➖ | ➖ |

Read more¹ | Budget-friendly credit building with all 3 bureaus | ✅ | ✅ | ➖ | ✅ | ✅ | ✅ | ➖ | ➖ |

Read more | Building credit through subscriptions | ✅ | ✅ | ➖ | ➖ | ➖ | ➖ | ✅ | ➖ |

Read more² | Boosting your Experian score with bills you already pay | ✅ | ➖ | ➖ | ➖ | ✅ | ✅ | ✅ | ➖ |

Read more³ | Understanding what’s affecting your credit | ✅ | ➖ | ➖ | ➖ | ➖ | ✅ | ➖ | ➖ |

Read more | Building credit with a debit card | ✅ | ✅ | ➖ | ➖ | ➖ | ✅ | ➖ | ✅ |

Read more⁴ | Building credit without a credit check | ✅ | ➖ | ➖ | ➖ | ➖ | ➖ | ➖ | ✅ |

² Reports only to Experian, not to Equifax or TransUnion.

³ Offers credit monitoring but does not report user behavior to any bureau.

⁴ Reports only to Experian and Equifax, not TransUnion.

1. Self

Why it’s one of the best

Self is one of the best credit building apps for a reason. It works by letting you “repay” a small installment loan to yourself. You make fixed monthly payments starting at $25, and Self reports each one to all three major credit bureaus. Once you finish your plan, you unlock your savings, minus interest and fees. You can also qualify for a secured credit card through the app, and Self now offers rent reporting, too.

- No credit check required

- Reports to Equifax, Experian, and TransUnion

- Plans start at $25/month with savings back at the end

- Optional secured credit card and rent reporting

Our experience

We liked that Self makes credit building feel low-pressure. Everything is laid out clearly, from how much you’ll pay each month to what you’ll get back. It’s a great fit if you want to start small and don’t want to rely on credit cards. Bonus: You’ll end up with a little savings cushion.

2. Chime

Why it’s one of the best

The Chime Card is a secured credit card that helps you build credit without interest, annual fees, or a credit check. There’s no minimum deposit required—just move money into your Credit Builder account and use the card like you would any debit card. Chime reports your payment activity to all three major credit bureaus.

- No annual fees, interest, or credit check

- No minimum security deposit

- Reports to Experian, Equifax, and TransUnion

Our experience

We love how easy Chime makes it to get started. If you already use Chime for banking, adding the card takes just a few taps. You’re in control of your spending limit, and there are no hidden fees or complicated rules. It’s one of the lowest-stress ways to start building credit, especially if you’ve had trouble qualifying for other cards.

3. MoneyLion

Why it’s one of the best

MoneyLion is more than one of the best credit builder apps—it’s a full-fledged mobile bank. Its Credit Builder Plus program gives you access to a small installment loan while reporting payments to all three credit bureaus. It also includes credit monitoring, cash advances, and a RoarMoney banking account.

- Credit builder loan with upfront cash access

- Reports to TransUnion, Equifax, and Experian

- Cash advances, banking, and rewards all in one app

Our experience

We found MoneyLion to be a one-stop shop, but it can feel a little overwhelming if you’re only here to build credit. It could be a good option if you want to do your banking and credit building all in one place.

4. Kovo

Why it’s one of the best

Kovo helps you build credit by reporting $10 monthly payments to all four major credit bureaus without charging interest or requiring a credit check. Over time, you can unlock access to additional credit-building products and identity protection tools, all while building positive payment history.

- No interest, fees, or credit checks

- Reports to TransUnion, Equifax, Experian, and Innovis

- Optional credit boosts and up to $1,225 in cash rewards

Our experience

We like that Kovo reports payments to more bureaus than most competitors. The app includes tools to track your progress and offers clear tips to keep moving forward.

5. Kikoff

Why it’s one of the best

Kikoff offers one of the lowest-barrier ways to build credit in 2026. For as little as $5 per month, you can open a $750 tradeline with no credit check or interest. Kikoff reports your on-time payments to Equifax, Experian, and TransUnion to help you establish a payment history and improve your score.

- Reports to all 3 major credit bureaus

- Tradelines starting at $750 (up to $3,500 on higher tiers)

- Rent reporting and secured card options available on premium plans

Our experience

Kikoff feels almost too simple, which is kind of the point. There’s no card to use. Instead, you pay a monthly fee to keep the account active, which is reported as a positive tradeline. It’s a great entry point for anyone starting from scratch or rebuilding credit on a budget.

6. GrowCredit

Why it’s one of the best

Grow Credit lets you build credit just by paying for services you already use—like Netflix, Spotify, or Amazon Prime. Once approved, you’ll get a virtual Mastercard that can only be used for eligible subscriptions. Grow reports your on-time payments to all three major credit bureaus.

- Free plan covers up to $17/month in subscriptions

- Reports to Equifax, Experian, and TransUnion

- Paid memberships available for higher monthly spending limits

Our experience

GrowCredit is one of the best credit building apps for anyone with recurring subscriptions. It’s one of the only apps that turns everyday spending into a credit-building opportunity, without adding more debt. Setup takes under five minutes, and we appreciate that even the free plan packs value.

7. Experian Boost

Why it’s one of the best

Experian offers a free way to check your Experian credit report and FICO Score, along with an optional tool called Experian Boost. Boost lets you get credit for on-time payments like phone bills, utilities, streaming services, and even rent. As a result, you could potentially increase your score without taking on new debt.

- Free access to your Experian credit score and report

- Boosts your score using eligible bill payments

- Credit monitoring and spending insights included

Our experience

We liked how easy it was to create an account and instantly see our Experian FICO Score. You can also cancel old subscriptions in the app, set up a budget, and use Boost to potentially raise your score. Just note: if you want to see your Equifax or TransUnion scores, or use the FICO Score Simulator, you’ll need to pay for a premium plan. Experian Boost is free, though.

8. Credit Karma

Why it’s one of the best

Credit Karma isn’t a credit builder app in the traditional sense—it doesn’t offer a loan or credit line. But it does help you monitor your score and find credit-building products you might qualify for. It’s best for folks who want to understand what’s helping (or hurting) their credit in real time.

- Free credit scores from TransUnion and Equifax

- Personalized credit card and loan recommendations

- Credit score simulators and report insights

Our experience

We’ve used Credit Karma for years to stay on top of score changes. The score tracking and report breakdowns are incredibly useful, and the app surfaces relevant products (though sometimes a bit aggressively). Still, it’s one of the best credit building apps out there for a reason.

9. Credit Sesame

Why it’s one of the best

Credit Sesame offers a virtual debit account called Sesame Cash, which now includes a credit builder feature that helps you build credit with your everyday purchases. There’s no credit check, no security deposit, and no interest—you just use your Sesame Cash Mastercard for gas, groceries, or bills, and Credit Sesame reports your on-time activity.

- No credit check or security deposit required

- Credit building tied to everyday debit purchases

- Early direct deposit and cash back perks on some plans

Our experience

We like that Credit Sesame works just like a regular debit card but helps build credit in the background. The app also includes a helpful dashboard showing your credit score, Sesame Grade, and tips to improve it. Just note: Some features may come with monthly fees unless you meet usage requirements.

10. Extra

Why it’s one of the best

Extra is a credit-building debit card that links to your bank account. You spend as you normally would, and Extra fronts the money, then pulls it back via ACH a few business days later. Your purchases are reported to Experian and Equifax to help build your credit. There’s no credit check or security deposit required to use Extra.

- Builds credit without using a credit card

- Reports purchases, not just payments

- Works with 10,000+ banks

Our experience

We were impressed with how seamlessly Extra connects to your bank and how fast it started tracking purchases. (You connect your account using Plaid.) The card feels like using a debit card, but with the added benefit of reporting activity like a credit card. One downside? It doesn’t report to TransUnion, and plans cost $20 to $25 per month (unless you get an annual plan). But it’s still one of the best credit building apps if you want to avoid a credit check.

If you’re just beginning to build or repair your credit history, I recommend considering a secured credit card, which requires a refundable deposit and helps build credit through on-time payments. It’s a low-risk, practical first step. I also suggest using an app that reports rent and utility payments to credit bureaus, especially for renters, so those consistent payments can help your credit score.

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.