In most places across the U.S., having a car is essential. We need them to get to work and school, run errands, go to the doctor, and visit friends and family. But cars are expensive, which is why more than 80% of new cars and more than a third of used cars are financed, instead of purchased with cash.

As a Certified Financial Education Instructor who spent half a decade in marketing for car dealerships, I can assure you it’s possible to finance a car, even if you have poor credit—but there are some serious downsides to doing so. Below, we’ll cover the best auto loans for bad credit, but also the risks involved with such financing.

| Company | Best for… | Loan amounts | Rating (0-5) |

|---|---|---|---|

|

Best for Bad Credit | $2,500 – $100,000 |

|

Finding the best auto loans for bad credit (also called deep subprime) can be complicated. First, check with local banks and credit unions. If they offer a loan with a moderate annual percentage rate (APR), I advise going that route.

If you come up short, the next step is often online loan marketplaces. The companies below aren’t actually lenders, but they work with a network of lenders to find financing regardless of your credit.

Autopay

Why we picked it

Autopay is our top choice for car loans with bad credit. You can get prequalified online in a matter of minutes, and loan amounts start as low as $2,500. Loan terms range from two to eight years. While there’s no fee to apply, expect a hard pull on your credit report, which will have a minor impact on your credit score.

My favorite part of Autopay is that there are no payments for 45 days. If you’re on a tight budget and strained your finances to come up with a down payment for a car, the 45-day grace period can be tremendously helpful.

| Loan amounts | $2,500 – $100,000 |

| Loan terms | 24 – 96 months |

| Rates (APR) | 4.67% – 17.99% |

What about myAutoLoan?

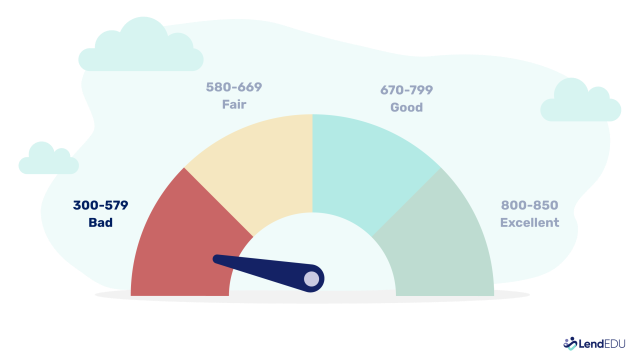

You might see other auto financing experts recommending myAutoLoan for bad credit. However, don’t waste your time if you have truly bad credit by FICO’s standards (580 or less).

MyAutoLoan clearly states that its minimum credit score requirements are 600. While trying to get prequalified won’t hurt your credit score, I recommend setting your sights on car loan marketplaces that will work with your credit score.

Can I get a car loan with bad credit?

You can typically get a car loan with bad credit; many young drivers can finance a car with no credit at all.

There may be special parameters around financing. For instance, you might:

- Need to compile a list of character references

- Be restricted to cars from a specific dealership

- Be limited in how much you can finance

Getting an auto loan with bad credit carries plenty of risks, too:

❗Higher interest rates

As with any loan, poor credit scores result in higher auto loan rates. This raises your monthly payment and means you’ll spend more money on the vehicle in the long run.

The average APR for a deep subprime (FICO Score between 300 and 500) borrower is 21.81%, compared to just 7.67% for borrowers with excellent credit. On average, bad-credit borrowers get stuck with interest rates that are 14.14% (used) and 10.98% (new) higher than borrowers with excellent credit.

| New car APR | Used car APR | |

| Deep subprime credit (300 to 500) | 15.75% | 21.81% |

| Superprime credit | 4.77% | 7.67% |

❗Limited car options

If you get approved for a car loan with bad credit, it likely comes with stipulations. Lenders may restrict how much you can borrow and limit you to specific dealerships.

❗Higher monthly payments

A higher interest rate means a higher monthly payment. That’s more money out of your budget each month to cover the cost of your car. And because lenders view borrowers with bad credit as higher risk, they often only offer shorter loan terms—meaning payments are spread out over fewer months, which makes them even higher.

You can use our car loan calculator to determine your only monthly payment based on how much you plan to borrow and what interest rate you’re offered.

❗Upside-down loans

When you finance a car with bad credit, you’re more likely to end up “upside down” on your loan—meaning you owe more than the car is worth. This can happen fast due to high interest rates and rapid depreciation. If you need to sell or trade in your car before paying off the loan, you could be stuck covering the difference out of pocket.

❗Risk of repossession

Borrowers with a credit score below 620 are 52 times more likely to be delinquent on car payments than those with very good or excellent credit, according to data from the Federal Reserve Bank of New York. By extension, borrowers with poor credit are also more likely to go into default.

If you default on your car loan, the lender can repossess your vehicle. Not only will you lose your car, but your credit score will take a serious hit.

Where to get an auto loan with bad credit

The best place to get an auto loan with bad credit is your bank or credit union. If possible, visit a branch in person and speak with a loan specialist about your options.

If you can’t get approved, your next step is:

- An online lender

- An online loan marketplace

- Financing through online car sale companies

Many dealerships have finance departments with a network of lenders, so you can technically visit the dealer without financing secured. However, I generally recommend going to a dealer armed with loan approval—so you have a good idea of how much your monthly payment will be before shopping.

Otherwise, salespeople can use high-pressure tactics that convince you to buy a car outside what you can realistically afford. Plus, financing could help with negotiating; the dealer’s finance office may be willing to offer a lower rate than the loan offer you have.

Should you consider “buy here, pay here” dealerships?

Some dealerships advertise “no credit check” or “buy here, pay here” loans. This differs from finance departments that work with a network of lenders; the dealership is the lender. This is usually the most expensive way to finance a car because of astronomical interest rates and higher-priced vehicles. Avoid it at all costs.

Tips for getting the best auto loan for bad credit

Even if your credit isn’t in great shape, there are still ways to lower your auto loan costs. With a little planning, you can improve your approval odds and avoid getting stuck with a sky-high interest rate.

Save up and pay cash

The easiest way to avoid a bad-credit auto loan is to skip the loan altogether. If you can save up and pay cash for a reliable used car, you won’t need to worry about loan approval, high interest, or monthly payments. It may not be your dream vehicle, but owning a car outright can help you rebuild your finances and avoid the risk of default or repossession.

Improve your credit score

If you can wait to buy a car for six months to a year, look for ways to improve your credit score.

Technically speaking, most auto lenders don’t use your credit score—at least, not the one you’re used to. Instead of your main FICO Score, they use a FICO Auto Score, which ranges from 250 to 900. These scores are weighted a little differently, with a larger emphasis on past auto loans.

However, a bad regular FICO Score usually means you also have a bad FICO Auto Score—and the actions you can take to boost the regular score will also help improve your auto score.

If my client has bad credit and is deciding whether to buy a car with financing or wait to improve their credit, first, we assess their immediate transportation needs and the available options in their community. If reliable transportation is scarce or nonexistent and they urgently need a vehicle, I recommend securing the best possible loan terms for a reasonably priced car within their budget. However, if the need is not urgent, I advise waiting until their credit improves to secure better financing options.

Buy a more affordable vehicle

The less you borrow, the easier it is to qualify, especially if you have bad credit. Focus on reliable, budget-friendly cars that fit your needs rather than your wish list. A lower loan amount also means smaller monthly payments and less interest paid over time, which can help protect your budget and credit score.

Get a cosigner

If your credit is holding you back, asking a trusted family member or friend with good credit to cosign your loan can help. A cosigner reduces the lender’s risk, which can improve your chances of approval and help you qualify for a lower interest rate. Just make sure your cosigner understands the responsibility: If you miss payments, they’re on the hook.

Don’t be tempted by leases

While it’s possible to get a lease with bad credit through certain dealerships (at a higher interest rate), I advise against it. Leasing a vehicle means you’re potentially driving a car otherwise out of your price range—and that’s a bad habit to form if you’re already struggling to manage debt.

Leasing is also a more temporary solution. You’ll need to lease another car or purchase one in three years. And if you continue to lease repeatedly, you’ll never be free of a car payment. With financing, you’ll have no monthly payment once the loan is paid off—and you can start allocating that money to other debts and continue to improve your credit score.

Buy at the right time

I spent five years in marketing for car dealerships, so I became familiar with the best time to buy a car, and whether you’re buying new or used makes a difference.

The best time to buy a new car is when the model years change. For instance, if the new 2026 vehicle model has reached dealer lots, salespeople are motivated to move the remaining 2025 models off the lot. You can use that to your advantage to get a lower price—and when you’re financing less, you’re more likely to get approved with bad credit.

However, most borrowers with bad credit shop for older used vehicles to stay within their budget. In that case, pay attention to holiday sales at used car dealerships, including:

- End-of-the-year blowouts (end of December into early January)

- Martin Luther King Jr. Day (a weekend in January)

- Presidents Day (a weekend in February)

- Around the end of tax season (April 15)

- Memorial Day (a weekend in May)

- Labor Day (a weekend in September)

- Black Friday

Salespeople trying to hit quotas at the end of a month, quarter, or year may also be more incentivized to offer you a lower price and find you a better deal on financing, even with a lower credit score.

FAQ

Can I get approved for an auto loan with a 500 credit score?

Yes, it’s possible to get an auto loan with a 500 credit score, but your options will be limited. Most traditional lenders, such as banks and credit unions, have higher credit score requirements, so you might need to work with subprime lenders, online lenders, or in-house financing at dealerships. The ones we listed above are an excellent place to start. Expect higher interest rates, larger required down payments, and stricter loan terms.

To improve your chances, consider making a larger down payment, getting a cosigner, or improving your credit score before applying. Some lenders also offer prequalification, which lets you check potential rates without affecting your credit score.

What is the lowest credit score you can get a car loan with?

There’s no universal minimum credit score for auto loans, but many lenders prefer a score of at least 600. However, some subprime lenders and buy-here, pay-here dealerships may approve borrowers with scores as low as 300 to 500—though these loans typically come with high interest rates and strict terms.

Does Carvana work with a 500 credit score?

Carvana doesn’t have a set minimum credit score requirement, so you may qualify even with a 500 credit score. Carvana considers multiple factors beyond credit, including income, loan amount, and debt-to-income ratio. Borrowers with lower credit scores might pay higher interest rates or need to provide a larger down payment.

Since Carvana offers prequalification with a soft credit check, it’s worth checking your potential loan terms before committing. If the rates are too high, you may want to explore improving your credit or finding a cosigner before financing a car.

Does CarMax approve everyone?

No, CarMax doesn’t approve everyone, but it offers financing options for a wide range of credit scores, including borrowers with bad or no credit. CarMax works with multiple lenders, including subprime auto lenders, which may improve approval chances for those with lower credit scores.

Approval depends on your income, credit history, debt-to-income ratio, and down payment. You may qualify with bad credit, but with higher interest rates and stricter terms. It’s best to get prequalified through CarMax or compare offers from other lenders to secure the best deal.

Recap of the best auto loans for bad credit

| Company | Best for… | Loan amounts | Rating (0-5) |

|---|---|---|---|

|

Best for Bad Credit | $2,500 – $100,000 |

|

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.