Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Whether it’s a surprise bill or a tight spot between paychecks, a small cash boost can make all the difference.

Cash advance apps offer quick, no-credit-check loans, often within minutes. They’re a faster, cheaper option than most personal loans or credit cards.

We tested nine popular apps and found the best for first-time users. EarnIn stood out as the only app offering a free $100 transfer, with standard transfers always free. Here’s how the rest stack up.

Table of Contents

EarnIn

Why we picked it

EarnIn is hands-down the best choice for borrowing $100 instantly—especially if it’s your first time using a cash advance app. It’s the only app we tested that lets you get your first $100 Lightning Speed transfer completely free, with no monthly fee, subscription, or hidden charges.

After that, instant transfer fees start at $3.99, but standard transfers (which take 1 – 3 days) remain free forever.

Beyond the low cost, EarnIn stands out for being transparent, easy to use, and packed with helpful features. You can qualify with just a regular direct deposit and a steady paycheck.

Plus, you can borrow up to $300 per day—or even up to $1,000 per pay period—once you’ve built up a history. Fast, flexible, and truly fee-free if you’re patient, EarnIn is our top pick.

- First instant $100 transfer is completely free

- No subscription or hidden fees

- Up to $1,000 per pay period available

- 24/7 customer support and excellent app reviews

- Instant transfers after your first free one cost $3.99 – $5.99

- Requires regular direct deposit and a consistent pay schedule

| Instant transfer fee | First $100 free; $3.99 – $5.99 thereafter |

| Other fees | None |

| No-fee funding time | 1 – 3 days |

| Advance amounts | Up to $300/day; Up to $1,000/ pay period |

LendEDU test run results: Our best experience was with Earnin—the tester was able to advance themselves $100, with no fees, within 8 minutes after downloading the app. (First instant transfer is free for new users.) They were then eligible to advance an additional $150 at a time, and up to $500 total per pay period.

Tilt

Why we picked it

Tilt (formerly Empower) offers a 14-day free trial, during which you can get an instant $100 transfer for just $5, with no monthly fee until the trial ends. After the trial, Tilt charges $8 per month, which is on the higher side. But you get more features in return, like overdraft fee reimbursement and the ability to adjust your repayment date.

The app provides access to up to $300 and consistently ranks high in user satisfaction. If you’re looking for something with a bit more flexibility and support, Tilt is a solid option—especially if you only need it for a short time.

| Instant transfer fee | $5.00 (for $100 transfer) |

| Other fees | $8.00 monthly subscription after 14-day trial |

| No-fee funding time | Within 5 business days |

| Loan amounts | $10 – $300 |

LendEDU test run results: We were able to advance $300 from Tilt within the first 11 minutes after download. It was close to instant, but it cost $9.00. Avoided paying the $8 per month subscription while on free trial. Next time they logged in (after paying for the subscription), it allowed our team member to advance $350.

Dave

Why we picked it

Dave offers up to $500 in advances and reports payments to all three credit bureaus, which may help users build credit. To access ExtraCash™, you must pay a $1 monthly membership fee. Standard transfers are free and take two to three business days.

However, instant transfers cost extra—anywhere from $1.99 to $13.99. The actual fee depends on how much you borrow and how fast you need it, but Dave doesn’t provide exact pricing upfront.

- Access up to $500

- Reports to all 3 credit bureaus

- $1 monthly subscription is among the lowest we’ve seen

- $1.99 – $13.99 instant transfer fee (Dave’s fee schedule is not clear)

- Not compatible with PayPal

- No fee calculator

| Instant transfer fee | $1.99 – $13.99 |

| Other fees | $1 monthly subscription |

| No-fee funding time | 2 – 3 business days |

| Loan amounts | Up to $500 |

LendEDU test run results: Our team member was eligible for an instant $400 advance with Dave after signup.

Brigit

Why we picked it

Brigit offers up to $500 in cash advances and includes access to budgeting tools, credit monitoring, and credit-builder loans. However, you must enroll in its $9.99 monthly subscription to use the advance feature, even for a one-time $100 loan. Standard transfers are free, but if you want your money faster, you’ll pay an additional $0.99 fee for instant delivery.

- Access up to $500

- No credit check and no late fees

- $0.99 instant transfer fee is low compared to many competitors

- $9.99 monthly subscription required

- Not compatible with PayPal

| Instant transfer fee | $0.99 |

| Other fees | $9.99 monthly subscription |

| No-fee funding time | 1 – 3 business days |

| Loan amounts | $25 to $500 |

LendEDU test run results: Brigit had trouble verifying personal information, but our team member was approved for a $200 cash advance after connecting their bank account.

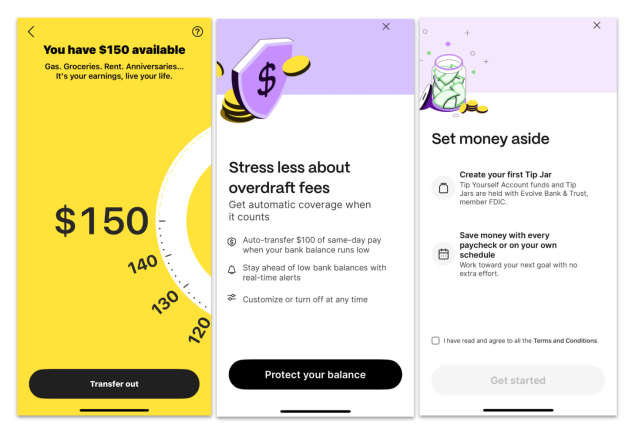

Cleo

Why we picked it

Cleo provides interest-free cash advances up to $250, along with budgeting tools and a funny AI assistant. To access advances, you’ll need a paid subscription: either $5.99 or $14.99 per month.

Instant funding is $8.99 for $100. (The fee depends on the amount you request.) Since advance amounts are small, the cost of borrowing $100 can vary and add up if you need it fast.

- Access up to $250

- Offers money management tools with personality

- Subscription required for advances

- Instant transfer of $100 adds $8.99

- Funding can take 3 – 4 days without instant delivery

| Instant transfer fee | $8.99 (for $100) |

| Other fees | $5.99 or $14.99 monthly subscription |

| No-fee funding time | 3 – 4 days |

| Loan amounts | Up to $250 |

FAQ

What is my best option for an instant $100 cash advance?

If you’re looking for the fastest and most affordable way to borrow $100 right now, EarnIn is the best option. It’s the only app we tested that offers a completely free instant $100 transfer your first time, with no subscription or hidden fees. And if you’re OK waiting a day or two, standard transfers are always free.

What are the risks of using an app to get $100 right now?

While cash advance apps can be a lifesaver in a pinch, they’re not risk-free. The biggest concern is falling into a cycle of dependency—borrowing from one paycheck to cover the last. Some apps also charge fees that can add up fast if you use them often or don’t repay on time.

Another risk is overdrawing your bank account. Many apps automatically withdraw repayment on your next payday. If your balance is too low, you could get hit with overdraft fees. Always read the fine print so you understand when repayment is scheduled and what happens if there’s not enough money in your account.

How do you repay a $100 instant loan from an app?

Most apps automatically deduct the advance from your bank account on your next payday or a scheduled date you choose. You don’t usually need to do anything manually—just make sure the funds are available to avoid overdraft fees.

Some apps also let you reschedule your repayment date or repay early without penalty. That flexibility can help if your payday shifts or you’re dealing with irregular income. Just be sure to stay on top of your balance and notifications so you’re not caught off guard when repayment hits.

Where else can I borrow $100 instantly?

Cash advance apps are usually the best bet for speed, convenience, and low cost—but there are a few other ways to get $100 quickly.

Some banks offer early access to your paycheck, and buy now, pay later (BNPL) services can help with purchases at specific retailers. Credit card advances and payday loans also provide fast cash, but we don’t recommend them due to high fees, steep interest rates, and the risk of debt cycles.

If you don’t need the money immediately, you might also consider safer alternatives like:

- Payday alternative loans from credit unions

- 0% interest rate credit cards (for larger expenses)

- Personal loans (but most require borrowing more than $100)

- Borrowing from a friend or family member

Cash advance apps still offer the most accessible way to borrow a small amount fast—with fewer strings attached.

Generally speaking, the better someone plans, the better their options will be. I suggest understanding your costs and fees before embarking on any of these methods.

Recap of the 5 best cash advance apps when you need $100 right now

About our contributors

-

Written by Rebecca Safier

Written by Rebecca SafierRebecca Safier is a personal finance writer with years of experience writing about student loans, personal loans, budgeting, and related topics. She is certified as a student loan counselor through the National Association of Certified Credit Counselors.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.