A home equity investment (HEI) gives you cash today in exchange for a share of your home’s future value. You don’t make monthly payments—but the tradeoff is that your eventual repayment depends on how your property value performs.

If your home appreciates, you could owe far more than you received; if it depreciates, you may end up paying less.

Because of that, HEIs can be both flexible and risky. In this guide, we’ll explain how they work, walk through real repayment examples under different market conditions, and compare HEIs to other home-backed financing options, like home equity loans and HELOCs, so you can see if the convenience is worth the cost.

If you’re ready to explore the best HEI companies, see our recommendations below.

We didn’t find any matches from our top picks based on your filters. However, we’ve found other products that could be a great fit. Compare these options or adjust the filters.

Table of Contents

What is home equity investment (HEI)?

A home equity investment, or an HEI, is a financial product that turns your home’s equity into cash.

While the investor will take claim to the portion of equity you’ve exchanged, it won’t hold any ownership stake, nor will it be added to your home’s title. You’ll eventually buy the investor out in cash after a certain period or when you sell the home or refinance.

Home equity investments (HEIs) go by several names—home equity agreements (HEAs), home equity contracts, or home equity sharing agreements (HESAs). They all refer to the same product: you receive cash based on your home equity today in exchange for giving the company a share of your home’s future appreciation. You can learn more about these terms and how they work in our complete guide.

HEI loans vs. home equity loans and HELOCs

The major benefit of a home equity investment is that you don’t have to make monthly payments during the contract, unlike home equity loans (HEL) and home equity lines of credit (HELOCs). These investments also tend to have less stringent credit and income standards than other home equity products.

Here’s how these three home equity products measure up:

| HEI | HEL | HELOC | |

| Min. credit score | 500 | 620 | Mid-600s |

| Min. income | None | Yes, varies | Yes, varies |

| Monthly payments | None | Yes | Yes |

| Terms | 10 – 30 years | 5 – 30 years | 10 – 20 years |

See more in our guide: HEI vs. HELOC.

Is a home equity investment a loan?

A home equity investment isn’t structured like a traditional loan, but it’s still a form of financing. Instead of borrowing money and making monthly payments, you get a lump sum upfront in exchange for sharing a portion of your home’s future value.

When the term ends or you sell your home, you repay the company based on how your home’s value has changed. If your home appreciates, you’ll likely owe more. If it declines, you could owe less.

It’s a different way to tap into your home equity, but you’re still agreeing to repay later based on your home’s future value.

How does a home equity investment work?

The basic premise of a home equity investment is simple: An investor gives you a set amount of cash today—say $30,000—in exchange for a percentage of your home’s equity in a set number of years—say 20%.

This typically means paying a higher premium for quick access to cash in the long run because you’ll likely pay more than $30,000 back once your home appreciates.

Essentially, a home equity investment limits how much money you stand to gain from your equity, which increases as your home’s value rises and as you pay off your mortgage loan.

Here’s a general look at the home equity investment process:

1. Determine current home value

To start, the HEI company sends a third-party appraiser to determine the current value of your home.

Typically, the investment company will make a valuation adjustment (i.e., lower the appraised value of your home) to protect themselves in the event of depreciation.

In some cases, they may also cap the amount you would owe if the home appreciates significantly.

2. HEI company makes offer

The company’s offer includes the amount of cash you qualify for upfront, the percentage of your equity that will be shared, and the repayment terms.

You can typically expect to buy out the investor within 10 to 30 years.

3. Enter the agreement and pay closing costs

You will typically need to cover the costs of the appraisal, an origination fee, and various third-party expenses.

For example, Hometap charges a 4.5% origination fee, plus appraisal, escrow, and other third-party costs that are deducted from your funding amount.

On a $50,000 investment, that means you’d lose about $2,250 to the origination fee, plus another $500–$1,000 for the appraisal and a few hundred dollars for other services—leaving you with closer to $46,000 in usable cash.

4. Get the lump-sum cash payment

You’re free to spend this money however you like.

5. Repay

At the end of your term (or earlier if you choose), you will pay the investor their share of your equity, based on the home’s current value at that time.

This effectively buys out the investor and returns all your home equity to you.

How do home improvements affect repayment?

Most HEI companies exclude the value of major home improvements you’ve paid for from the calculation.

For example, if an appraiser determines your $25,000 kitchen remodel added $20,000 in value, that $20,000 would be subtracted from the home’s valuation before the investor’s share is calculated.

That way, the investor isn’t profiting off of upgrades you funded yourself—but you still cover the cost of the renovation out of pocket.

Can you repay early?

Yes. Homeowners can buy out the investor before the end of the term, though this typically requires a new appraisal and repayment based on the home’s current value at that time.

Some companies (like Unlock) also allow partial payments during the term to reduce the final bill.

Read More: 11 Ways to Lower Your Mortgage Payment

Pros of a home equity investment loan

Home equity investments can offer flexibility and accessibility that traditional loans don’t. Here are some of the key benefits:

✅ Lower credit score requirements

You don’t need excellent credit to qualify—these products are more accessible than traditional home equity loans or HELOCs.

✅ No monthly payments

There are no ongoing payments to worry about, which can free up monthly cash flow.

✅ No minimum income requirements

Many investors don’t require proof of income, which is helpful for self-employed or variable-income individuals.

✅ Upfront lump sum

You receive a cash payment upfront that you can use for any purpose—home improvements, debt consolidation, or other expenses.

✅ Shared downside risk

If your home loses value, the investor shares in the depreciation, potentially reducing what you owe.

Cons of a home equity investment loan

While these agreements offer some appealing features, they also come with major drawbacks; for most homeowners, these cons will outweigh the pros. Here are the biggest disadvantages to consider:

❌ Lost opportunity for future home appreciation

If your home’s value increases significantly, you may owe the investor a much larger repayment than the original cash received.

You can manage this drawback in a couple of ways:

- Choose a home equity investment company that allows partial payments during the term (Unlock) so your final payment is more manageable.

- Choose a home equity investment company that implements protection caps that limit how much you owe.

Even with these options, the risk is real: You will likely lose out on a lot of money when you sell your home.

❌ High equity requirements

You usually need a substantial amount of equity in your home to qualify for an investment.

Point doesn’t publicly share its home equity requirements; of the other two key players, Hometap has the lower equity requirements at 25%. However, this is still higher than what’s required by a traditional home equity loan or HELOC.

❌ Closing costs and fees

Upfront fees, including appraisal and origination charges, can add to your out-of-pocket costs.

However, these might simply be deducted from your funding amount. That means you don’t have to worry about having the cash on hand to close, but it does cut into how much money you receive after signing.

❌ Limited availability

These products aren’t yet offered in every state, which may limit your eligibility depending on where you live.

Research each of the three home equity invest companies featured above to determine if you’re eligible for any of the programs. If not, you’ll need to consider traditional loan products or a source of funding that doesn’t rely on your home equity.

❌ Forced house sale

If you don’t have the cash on hand to pay what you owe at the end of the sale, you’ll likely have to sell your home or get a cash-out refinance. If you aren’t ready to move because the home has sentimental value or you’re not in a good financial position to do so, this can be a major problem.

❌ Higher long-term costs compared to other home equity products

According to the Consumer Financial Protection Bureau, home equity investments are more expensive than home equity loans and HELOCs in the long run. Data shows that settlement amounts grow at a rate of 19.5% to 22% in the earliest years; these rates are much higher than typical home equity loan and line of credit interest rates.

Read more about the pros and cons of home equity investments

Home equity investment loan examples

Home equity investment contracts can be tricky to decipher, and because they’re much less common than a traditional home equity loan, it’s challenging to visualize how much you’ll pay in the long run.

Let’s look at a few examples to better understand how much you could really pay.

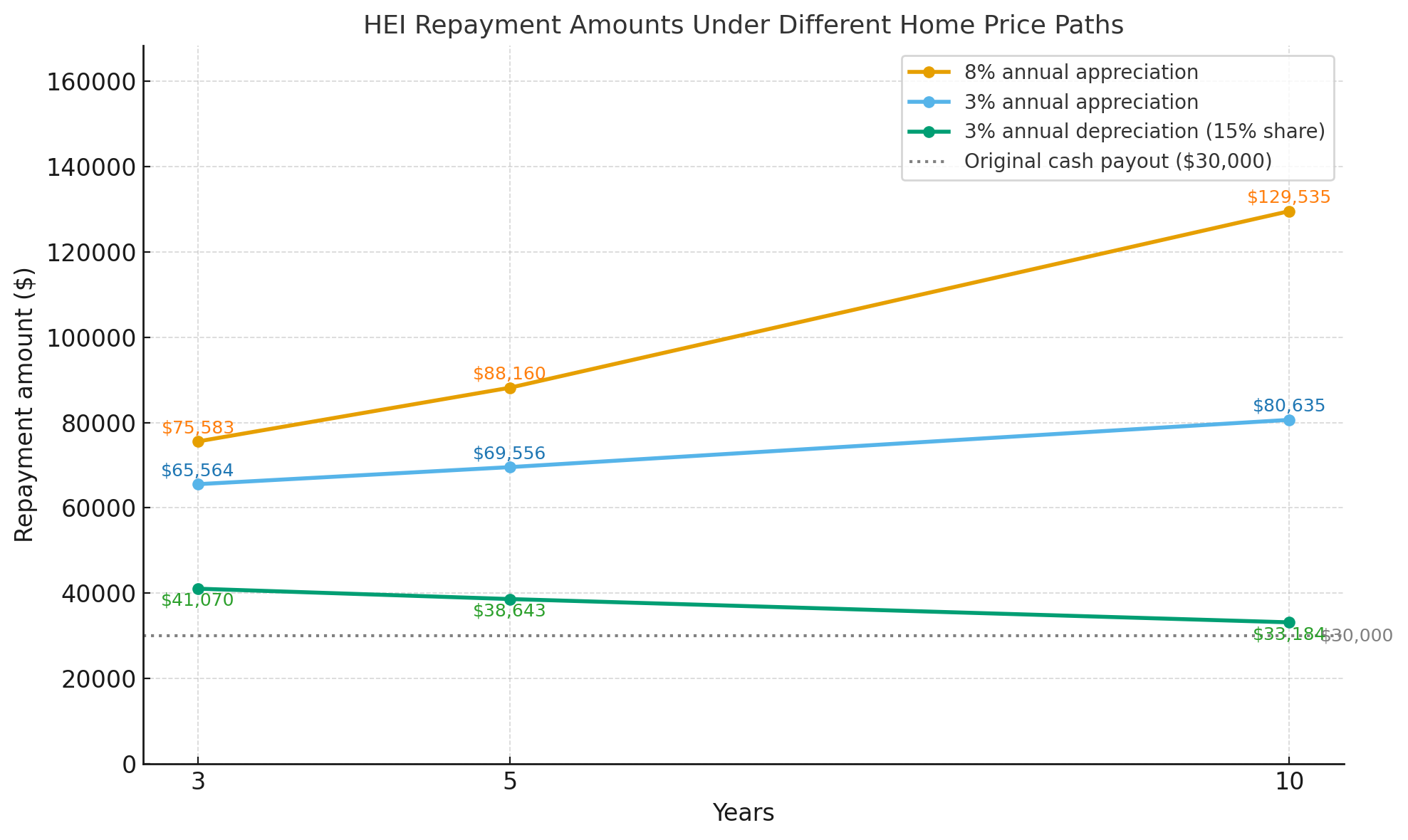

For each example, we’ll see what you would owe to the home investment company at the end of the term and if you bought out the company at an earlier stage. For simplicity, we assume:

- A steady appreciation or depreciation. In real-world scenarios, this won’t be consistent.

- A strict 20% share of value when the home appreciates in value. Home investment companies may have more complicated formulas to calculate their share of value.

- A 15% share of value when the home depreciates in value. This can vary by company, but it is often the case that the company takes less of a share in the case of home depreciation.

- A 10-year term. One of the three main home equity investment companies has term lengths of 30 years, which can get considerably more expensive.

- Full property value considered: When determining the share of value, we assume the home equity investment company gets a percentage of the full value of the home, rather than only a share of the appreciated value.

- All fees are deducted from your upfront payment. Thus, we do not consider those costs when calculating what you owe.

We’ll use a standard home equity agreement contract for all three scenarios:

- Home value: $300,000

- Amount funded: $30,000

- Term length: 10 years

All that changes across the examples is the amount by which the property appreciates. By understanding this change, you can see how your HEI payments can differ as shown in the graph here. We’ll dig into the details of each example below.

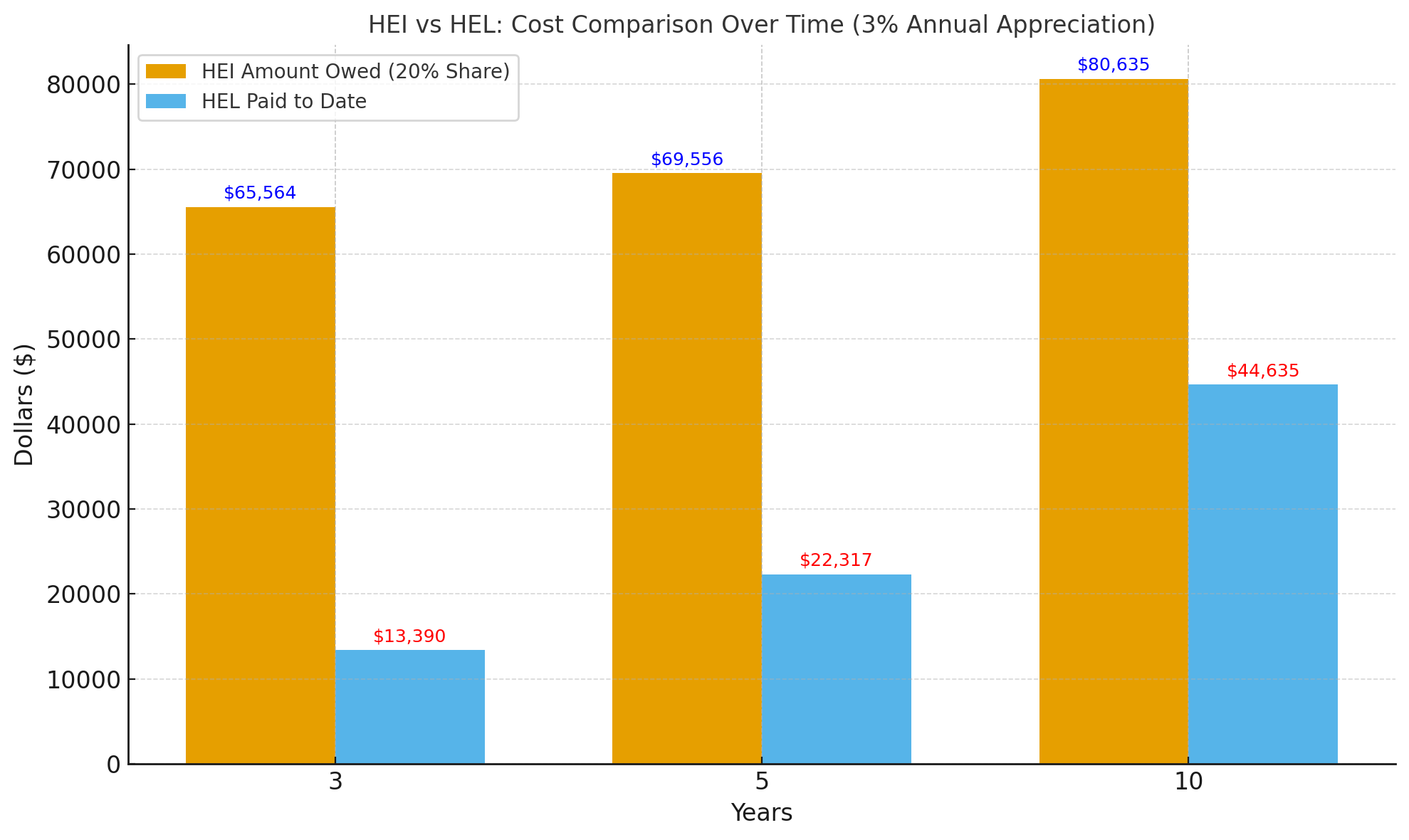

Example 1: Average appreciation (3% a year)

In a scenario where the home appreciates by 3% a year and the home equity investment company gets a 20% share of value, here’s what you would owe in three, five, and 10 years.

HEI cost

| Number of years | Home’s value | Amount owed |

| 3 | $327,818.10 | $65,563.62 |

| 5 | $347,782.21 | $69,556.44 |

| 10 | $403,174.88 | $80,634.98 |

For the full 10-year term, you’d owe $80,634.98, which is 2.69 times greater than the upfront funds.

HEI cost vs. home equity loan cost

| Product | Loan amount | Owed after 10 years | Total cost |

| Home equity investment (HEI) | $30,000 | $80,634.98 | $50,634.98 |

| Home equity loan (8.5% interest rate) | $30,000 | $44,634.85 | $14,634.85 |

In comparison, a home equity loan for $30,000, with an interest rate of 8.5%, would cost you $44,634.85. That’s 1.49 times more than the borrowed amount, meaning a home equity loan would be $36,000.13 less expensive.

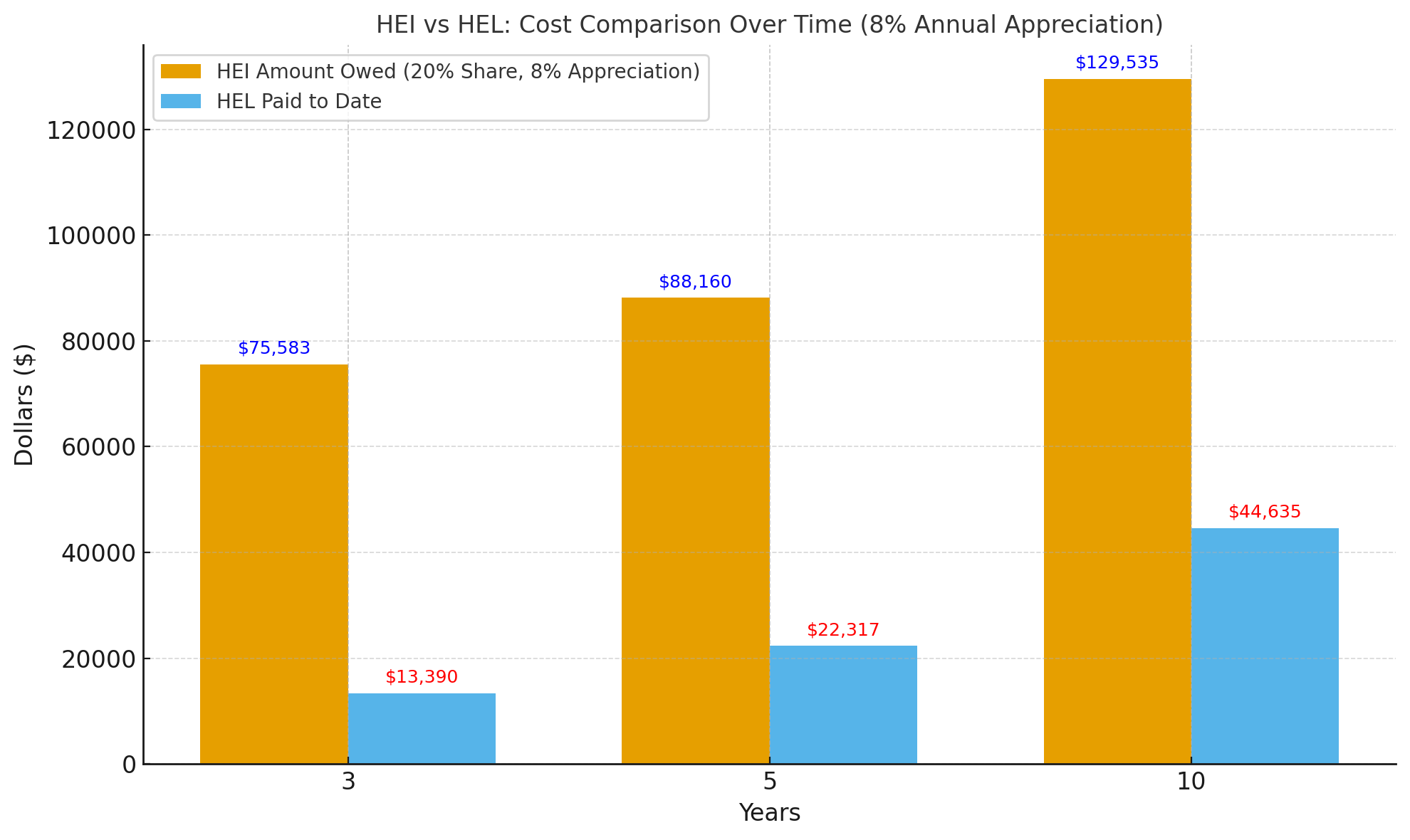

Example 2: High appreciation (8% a year)

In a scenario where the home appreciates by 8% a year and the home equity investment company gets a 20% share of value, here’s what you would owe in three, five, and 10 years.

HEI cost

| Number of years | Home’s value | Amount owed |

| 3 | $377,913.60 | $75,582.72 |

| 5 | $440,798.41 | $88,159.68 |

| 10 | $647,677.46 | $129,535.49 |

For the full 10-year term, you’d owe $129,535.49, which is 4.32 times greater than the upfront funds.

HEI vs. home equity loan

| Product | Loan amount | Owed after 10 years | Total cost |

| Home equity investment (HEI) | $30,000 | $129,535.49 | $99,535.49 |

| Home equity loan (8.5% interest rate) | $30,000 | $44,634.85 | $14,634.85 |

In comparison, a home equity loan for $30,000, with an interest rate of 8.5%, would cost you $44,634.85. That’s 1.49 times more than the borrowed amount, and $84,900.64 less expensive.

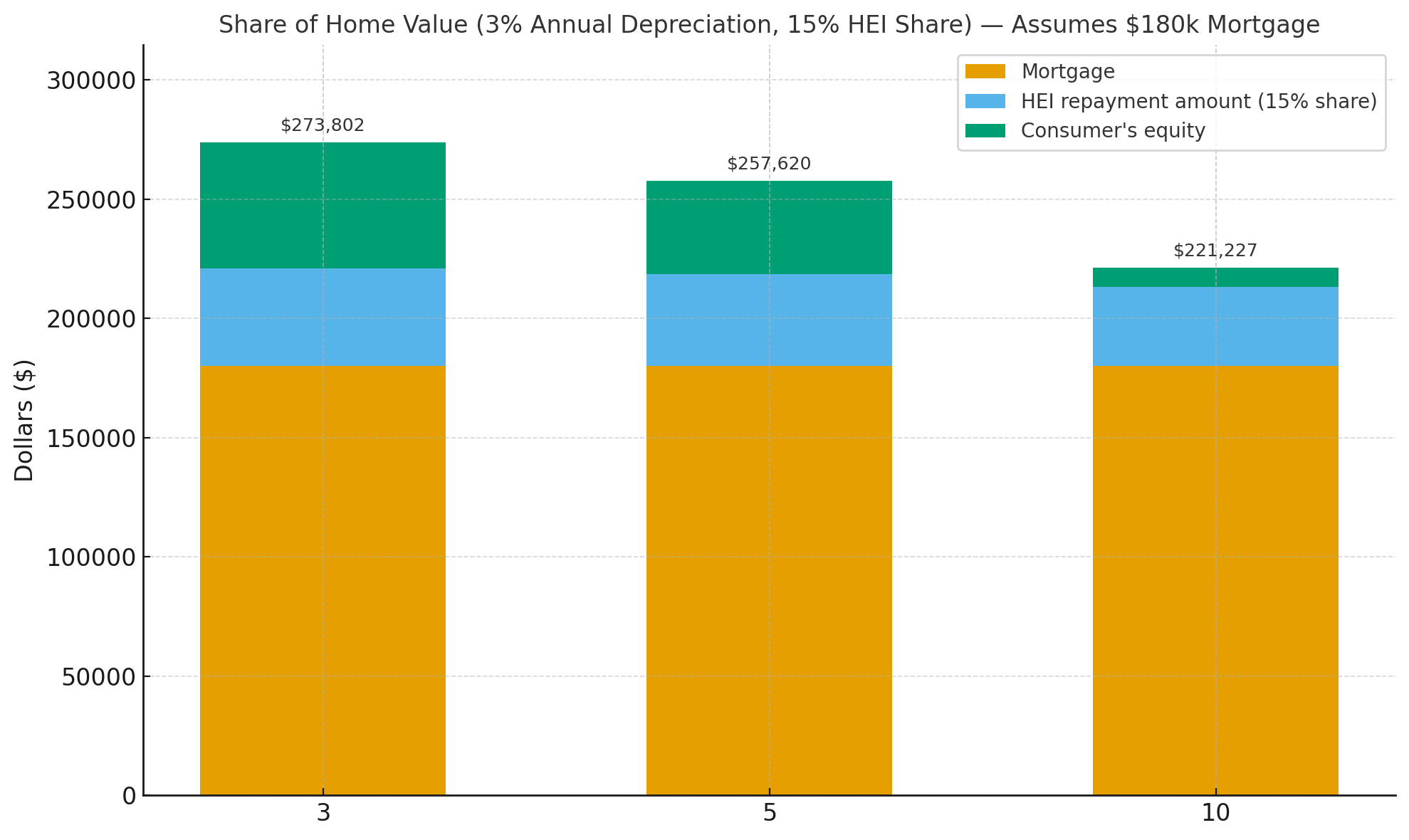

Example 3: Depreciation (3% a year)

In a scenario where the home depreciates by 3% a year and the home equity investment company gets a 15% share of value, here’s what you would owe in three, five, and 10 years. (We assume a fixed $180,000 mortgage balance.)

HEI cost

| Number of years | Home’s value | Amount owed |

| 3 | $273,801.90 | $41,070.29 |

| 5 | $257,620.20 | $38,643.03 |

| 10 | $221,227.22 | $33,184.08 |

For the full 10-year term, you’d repay $33,184.08. While that’s a smaller bill than in appreciation scenarios, it doesn’t mean you saved money—you still paid back more than the $30,000 you received upfront.

The only reason the repayment looks “cheaper” is that your home lost nearly $80,000 in value. That’s not an outcome any homeowner should root for.

About the HEI loan market

Home equity investments are relatively new in the world of finance. The first company to offer this product was Unison in 2006. Three additional players entered the space more recently: Point (2015), Hometap (2017), and Unlock (2019).

Despite the high potential expenses, these companies all have strong ratings on consumer review sites such as Trustpilot.

That said, only the earliest customers for most of these companies have just hit the 10-year mark, when the money is due and customer opinions may become less favorable.

Unison is not currently operating its equity sharing agreement program. That said, you can join the waitlist to know when it will resume accepting applications.

Is a home equity investment a good idea?

There’s no hard-and-fast answer to this question. While a home equity investment can be a wise move for some homeowners, it may not be the best choice for others. The right strategy really depends on your finances, goals, property, and long-term plan as a homeowner.

A home equity investment might be smart if you:

- Need cash but can’t handle the monthly payments that come with a home equity loan

- Or, your credit score won’t qualify you for a HELOC.

On the other hand, it might not be the wisest move if:

- You’re in a particularly high-value housing market. Should your home appreciate significantly, you may pay the investor much more than you’d spend on other financial products—particularly low-interest options like home equity loans or cash-out refinances.

A good candidate for a home equity investment might be an elderly homeowner who needs cash and would compare an HEI to a reverse mortgage. Another person who could be a good candidate is someone riddled with credit card debt and a low credit score. An HEI could help them begin to save and invest.

How to get a home equity investment loan

There are many home equity investors to choose from, so shop around before deciding who to sign your agreement with. You should consider customer ratings, fees, eligibility requirements, repayment terms, and geographic eligibility.

Requirements vary by company, but generally, homeowners need:

- A strong equity position: Many providers require at least 25%–30% equity.

- Owner-occupied, single-family homes: Most programs exclude rental or vacation properties.

- Fair or better credit: While lower than for a HELOC, credit score minimums often fall between 500–640.

- Stable property value and location: The home should be in a market with reliable appreciation trends, and availability is limited to certain states.

Unlike other types of loans, income requirements tend to be relaxed, making these investments more accessible for self-employed or retired homeowners.

Our team compared several of these companies based on these factors to determine which were the best for different homeowners. Check out the best home equity investment companies based on our research.

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Michael Menninger, CFP®

Reviewed by Michael Menninger, CFP®Michael Menninger, CFP®, is the founder and president of Menninger & Associates Financial Planning. He provides his clients with financial products and services, always keeping their individual needs foremost in mind.