If you have a home equity line of credit (HELOC), you might receive a freeze letter from your lender notifying you that your account has been temporarily suspended, stopping future withdrawals. This typically happens when there’s a change in your financial situation or property value.

On the other hand, you can also send a freeze letter to your lender if you need to voluntarily pause access to your HELOC, such as when preparing to sell your home. Understanding how HELOC freeze letters work and what steps to take next is key to managing your account effectively.

Table of Contents

What is a HELOC freeze letter?

A HELOC freeze letter is a notice sent by your lender to inform you that your home equity line of credit (HELOC) has been temporarily suspended. This can happen if your lender determines that market conditions, your property value, or your financial situation no longer meet their lending requirements. The letter typically explains the reason for the freeze and outlines the steps needed to reinstate your HELOC.

Borrowers can also send a HELOC freeze letter to their lender. For example, you might request to freeze your HELOC if you’re planning to sell your home or want to limit access to the account for budgeting purposes. In this case, you’ll need to provide any forms or documentation required by your lender.

Why would I receive a HELOC freeze letter?

Your lender will regularly review your account and status. Based on these reviews, it could freeze your HELOC and stop you from making future withdrawals.

It might do this if its review reflects:

- A loss in home value: If your home loses significant value, you could owe more than it’s worth. This would make it impossible to sell your home and settle your HELOC balance with the proceeds. Your lender wants to prevent this, or at least prevent the problem from worsening, so it may freeze your account to keep you from borrowing more.

- A job loss or financial change: If you lose your job, divorce, or make some other financial change, you might find it challenging to make your HELOC payments. If your lender finds out about one of these events, it may freeze your account to stave off future payment challenges.

- A drop in credit score: Sudden drops in your credit score can indicate a financial hardship and may mean you’re less likely to stay on top of payments. If that happens, your lender might freeze your HELOC to ensure you don’t withdraw more than you can pay back.

If you receive a freeze letter, it should indicate the reason. Call your lender and talk to a representative if you need more details.

What’s in a HELOC freeze letter?

HELOC freeze letters vary by lender, but they all include similar information. If you receive a HELOC freeze letter, expect to see:

- Your account number

- Why your HELOC is being frozen or reduced

- The date your HELOC freeze takes effect

- Who to contact with questions

If you disagree with the reasons for your HELOC freeze, call the number listed on your freeze letter. Your lender should be able to provide further details regarding the freeze, as well as explain the appeals process.

Your lender can legally freeze or reduce your HELOC up to three days before sending you a written notice. If you experience issues drawing from your HELOC but haven’t received a freeze letter, contact your lender to see if a freeze letter is forthcoming.

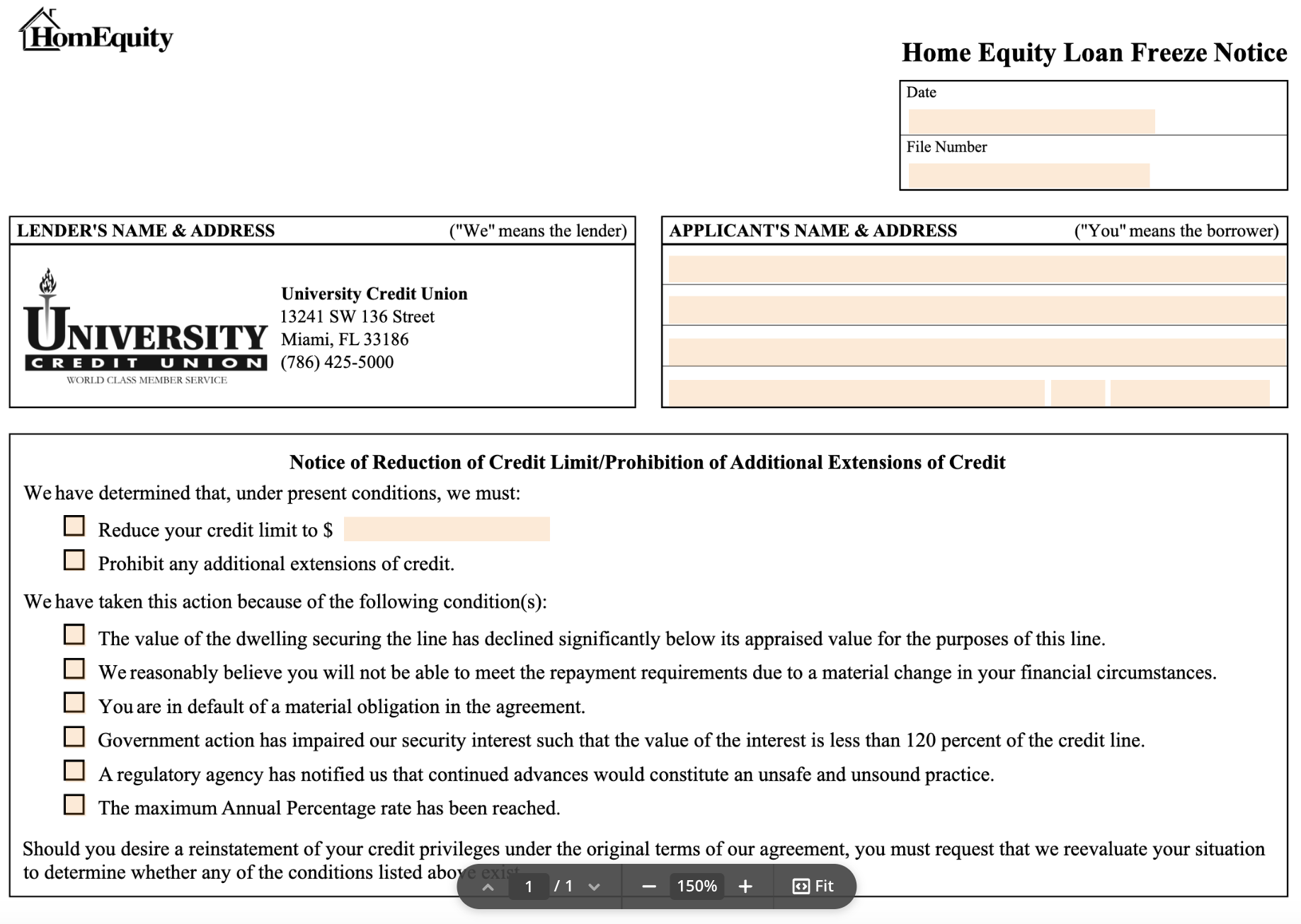

HELOC freeze letter example

Here is an example of how a HELOC freeze letter may look. Note that this sample freeze letter applies to home equity loans, but you’ll find similar language and reasons for the freeze on a HELOC freeze letter.

Source: USLegalForms.com

How does a HELOC freeze affect repayment?

While a HELOC freeze prevents you from making additional withdrawals, it doesn’t let you off the hook when making payments. You’re still obligated to repay your HELOC as agreed, even if it’s frozen.

If you stop paying toward your HELOC while it’s frozen, you may have a more challenging time getting the freeze lifted later on. You also risk losing your home—and that’s not a chance worth taking.

The good news is you don’t have to worry about your payments going up. The amount you pay each month won’t change, and you won’t have to pay back more than you withdrew before the freeze.

What should I do if my lender sends me a HELOC freeze letter?

If your lender sends you a HELOC freeze letter, you can take the following steps:

- Make sure you understand the reason for the freeze. If you need to, call your lender for more information.

- Be sure to stay on top of your payments. Despite the freeze, your payment terms won’t change, so you’ll need to keep repaying your lender as agreed. If you don’t, the lender could foreclose on your property.

- Consider filing an appeal. If you believe the freeze is based on incorrect information—for example, the lender claims your home’s value has dropped, but you’ve made valuable improvements since you took out the HELOC—you can appeal the decision to get the HELOC unfrozen.

You can also request reinstatement of your credit line later if conditions change. Just keep in mind: If the freeze is due to a drop in home value, your lender will likely require a new appraisal before it reinstates your line.

How to unfreeze your HELOC

HELOC freezes are meant to be temporary, not permanent. When the issue that precipitated the freeze is resolved, your lender is required to reinstate your HELOC. Your lender may lift the freeze automatically, or you might have to request reinstatement in writing.

Your HELOC freeze letter should tell you your lender’s reinstatement procedures. If you’re required to make a written request, here’s how the process usually works:

- Write to your lender at the address listed on your freeze letter. Include evidence that the conditions for the freeze no longer apply. For example, if you’ve started a higher-paying job, you could provide a copy of your offer letter or recent pay stubs. If home values in your neighborhood are on the rise, you might include a copy of a third-party appraisal or recent sales data from similar homes nearby.

- Give your lender time to investigate. Your letter may compel your lender to reconsider the freeze, but it still has to do its research. Your lender will likely evaluate market conditions, order an appraisal, check your credit, or a combination of the three.

- Pay for the appraisal or credit check. You may need to foot the bill for your lender’s investigation. Be prepared for that possibility, and ask your lender about applicable costs ahead of time.

- Schedule the appraisal, if applicable. Work with your lender to coordinate the appraisal. The sooner you complete this step, the sooner you could regain access to your HELOC.

- Authorize a credit check, if applicable. You may need to give your lender permission to re-run your credit. Like with an appraisal, you’ll want to read and sign any necessary disclosures quickly to avoid delays.

- Wait for a final decision. After reviewing the appraisal, your updated credit report, or both, your lender will determine whether it can unfreeze your HELOC. Timelines vary, but expect this process to take several days.

If your lender agrees to lift the freeze on your HELOC, you can draw against your line of credit just as before. If your lender cannot reinstate your HELOC, it’ll send you a notice listing why.

Don’t despair if your reinstatement request is unsuccessful. You may need to wait out the market or take additional steps to improve your finances. Work with your lender to determine next steps, and try again when ready.

Can I send my lender a HELOC freeze letter?

You can freeze or terminate your HELOC yourself. This might be necessary in certain situations, such as before selling your house. A HELOC is a lien against the property, so you must settle it before transferring the title.

Before taking this step, check with your lender to see if there are any fees or penalties for early termination. Some HELOCs include early closure fees if you close the account within a certain time frame, typically within the first few years of opening it.

However, not all lenders impose these fees—Aven and Figure, for example, don’t charge prepayment penalties, making them standout options on our list of the best HELOCs without prepayment penalties, shown below.

| Company | Best for… | Pre-payment penalty? | Rating (0-5) |

|---|---|---|---|

|

|

Best overall | No |

|

|

Best customer reviews | No |

|

|

Best credit union | No |

|

|

Best marketplace | May vary by lender |

|

To initiate the process, you can obtain a form authorizing the lender to freeze or terminate the account online or from a local branch. Make sure to clarify with your lender whether this action will incur any additional costs.

Learn more about HELOC close-out letters, including a sample letter to reference.

How is a HELOC freeze letter sent?

From your lender to you

By law, your lender must provide written notice within three days of freezing your HELOC account. This should arrive via mail at the address on the home that secures your HELOC.

The letter should include the reason for the freeze and directions to reinstate your credit line should conditions change. It should also contain your lender’s contact information in case you have questions or concerns.

From you to your lender

Title companies and real estate attorneys often recommend sending a letter to your lender that includes the following information to request a freeze or termination:

- Your account number

- Borrowers’ names

- Property address

- County in which the home’s deed is recorded

You can also request a specific form to do this from your lender. Once it receives your request, your lender should send a letter indicating your line of credit is “suspended,” “frozen,” or “blocked to prevent future advances.”

Find out more about how HELOC repayment works.

About our contributors

-

Written by Sarah Sheehan, MAT

Written by Sarah Sheehan, MATSarah Sheehan is a writer, educator, and analyst who focuses on the impact of health, gender, and geography on financial equity. Her ultimate goal? To live beyond the confines of chasing the next dollar—and to teach everyone else how to do the same.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Gail Urban, CFP®

Reviewed by Gail Urban, CFP®Gail Urban, CFP®, AAMS®, has been a licensed financial advisor since 2009, specializing in helping individuals. Before personal financial advising, she worked as a business financial manager in several industries for about 25 years.