Our take: Reliant Home Funding has low rates and helpful customer service, a winning combination for homebuyers. You’ll need to start the application process to view rates, but the savings make it worth the hassle. Reliant is a solid lender, especially if you’re in New York, where the company can help you navigate a state program that lowers taxes. But you should still compare it to the best mortgage lenders.

Purchase Mortgage

- Helpful and responsive customer service

- Low rates

- Wide variety of loan types

- Strong CEMA program expertise

- Not available in every state (available states listed below)

- Can’t view rates without applying

- Not BBB-accredited

| Rates (APR)* | 5.625% – 6.500% |

| Loan amounts | Based on loan type and program limits |

| Repayment terms | 8 – 30 years, depending on loan type |

| Min. down payment | 0% (USDA, VA), 3.5% (FHA), 5% (Conventional) |

| Customer ratings | No reviews on Trustpilot, 4.9/5 Google |

Mortgage Refinance

| Rates (APR) | 5.625% – 6.500% (Refinance), 5.646% – 6.524% (Cash-out refinance) |

| Repayment terms | 10 – 30 years |

| Property type | Primary residence |

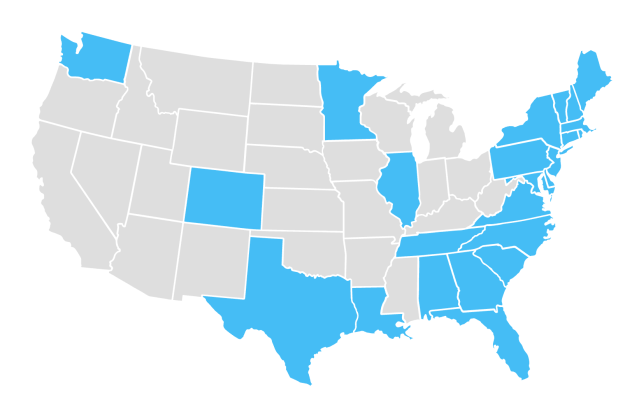

Reliant Home Funding is a Long Island mortgage lender serving customers in 26 states and Washington, D.C. The company stands out with a fully digital lending process, low rates, and expertise in the CEMA program for New York borrowers.

Here’s an in-depth look at how to decide whether Reliant Home Funding is the best lender for you.

States where Reliant is available

- Alabama

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- New Hampshire

- New Jersey

- New York

- North Carolina

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Vermont

- Virginia

- Washington

- Washington, D.C.

Company profile

Reliant Home Funding is an Equal Housing Lender and an FDIC member (NMLS #29273). Gregory Topal, Reliant co-founder and CEO, started the company in 2010.

His goal was to create a customer-centric mortgage process, and it seems to have worked. Reliant Home Funding reviews are overwhelmingly positive, and reviewers repeatedly mention that mortgage officers are helpful, responsive, and kind.

Mortgage purchase loan types

Reliant offers nearly every type of mortgage, including FHA, VA, conventional, and adjustable-rate (ARM).

You have to submit a form or call to get answers. It’s a bit of a hassle, especially when most lenders provide the information upfront, but the lender’s low rates might make the extra steps worth it.

Here’s an overview of how each option compares.

Unclear on what exactly a mortgage is? Check out our resources: How Do Mortgages Work? The Beginner’s Guide to Navigating 2025 Home Purchases, Mortgage Terms Glossary: 75 Words Every Borrower Should Know

FHA

FHA loans are government-insured and require a lower down payment of 3.5%. It’s a more accessible loan option for borrowers.

VA

VA loans have special perks like a 0% down payment requirement. You must meet military service requirements to qualify for the loan. Reliant’s VA loans offer the standard benefits, but nothing extra.

Conventional

Reliant’s conventional loans have competitive rates that range from 5.625% to 6.5% (in October 2025). The repayment terms range from 8 to 30 years. You need a credit score of 620 and a down payment of around 5%.

ARM

Reliant Home Funding Inc. offers adjustable-rate mortgages that start with a fixed rate and then fluctuate. You need a down payment of at least 5%, solid income, and a credit score of 700 or higher.

Jumbo

Reliant usually requires a down payment of 20%, excellent credit, and a low debt-to-income ratio for loans exceeding county limits on conforming loans.

Mortgage refinance loan types

If you already have a mortgage but are shopping for a better deal, Reliant Home Funding has three types of refinance loans: refinance, cash-out refinance, and FHA streamline refinance. Let’s take a look at how each one works.

- Cash-out refinance: These rates are slightly higher than other refinance options from Reliant, but not by much. You can replace your mortgage with a larger one, get the difference in cash, and use the money for nearly any expense, including renovations.

- Refinance: The rates for this loan are similar to the company’s purchase mortgage rates. It allows you to lower your rate or reduce your monthly payments.

- FHA streamline refinance: This refinance allows you to reduce your interest rate without adding to the balance. You must be able to verify your income, have a history of on-time payments, and complete an appraisal.

Tax Buster Program

The company specializes in Consolidation Extension Modification Agreements (CEMA) for New York buyers. This state-specific program can help sellers and buyers save thousands of dollars.

Here’s how it works: The document allows the seller to pay transfer tax only on the difference between the purchase price and the unpaid principal balance of the seller’s existing mortgage. The buyer gets to do the same and only has to pay mortgage tax on the “gap money.”

Both lenders work together to complete the process, and it goes more smoothly when the companies have experience.

Is Reliant Home Funding legit? Customer reviews and ratings

| Source | Rating | Number of reviews |

| Better Business Bureau | 1.0/5 | 1 |

| 4.9/5 | 596 |

Here’s the bottom line.

- What it does well: Reliant home mortgage earns top-notch reviews for customer experience. The mortgage officers are friendly, helpful, and available. Reviewers also report that the loan process, including closing, runs smoothly and often finishes ahead of schedule.

- Where to be cautious: Reliant Home Funding isn’t BBB-accredited, and you won’t find any reviews on Trustpilot. It’s a legitimate company with licensing, but online reviews are somewhat limited on every site except Google.

Pros and cons

Pros

-

Customer service is responsive and helpful.

-

The rates are lower than the national average.

-

Reliant offers almost every type of home loan.

-

New York buyers benefit from strong CEMA program expertise.

Cons

-

Loans are only available in 26 states and Washington, D.C.

-

You can’t view rates without applying or providing personal information.

-

The company isn’t BBB-accredited.

Reliant Home Funding alternatives

Here’s how Reliant stacks up against three of our choices for best mortgage lenders.

Reliant Home Funding vs. SoFi

SoFi is available in every state. The company also offers a close-on-time guarantee that includes a $10,000 payment if it doesn’t happen. The lowest rate at SoFi is a bit higher than what you’ll find at Reliant, but it’s smart to check what you qualify for with both, and take advantage of SoFi’s 45-day rate lock while you shop around.

Reliant Home Funding vs. Rocket Mortgage

Rocket Mortgage and Reliant have several similarities, including a wide variety of loans and refinance options, plus apps to guide you through the home-buying process. Both companies also require you to provide personal information to view rate estimates. But Reliant’s lowest rates win out here.

Reliant Home Funding vs. Quicken Loans

Quicken Loans (also part of the Rocket Mortgage company) offers customizable loan terms and extra flexibility that you can’t find with other lenders. It’s a solid option for experienced buyers with more complex needs. But Reliant could be the better pick if you’re a first-time homebuyer or need a mortgage with standard terms.

Looking for more options? Check out our list of reviewed mortgage companies.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Reliant Home Funding Customer Service, 877-937-6787

- Federal Reserve Bank of St. Louis, 30-Year Fixed Rate Mortgage Average in the United States

- Reliant Home Funding, About Us

- U.S. Department of Housing and Urban Development, How Can FHA Help Me Buy a Home?

- Reliant Home Funding, Find the Loan That Fits You

- SoFi, Current Mortgage Rates

- Rocket Mortgage, Monthly Payments in Your Comfort Zone

- Quicken Loans, Compare Loan Options

About our contributors

-

Written by Taylor Milam-Samuel

Written by Taylor Milam-SamuelTaylor Milam-Samuel is a personal finance writer and credentialed educator who is passionate about helping people take control of their finances and create a life they love. When she's not researching financial terms and conditions, she can be found in the classroom teaching.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.