Owe back taxes? So do 11.3 million other Americans, to the tune of $158 billion and counting.

If you’re looking for solutions to your tax situation, the IRS Fresh Start program offers a way to get caught up. Fresh Start was the name given to a set of tax relief initiatives launched in 2011 to help individuals and businesses manage tax debt.

While the IRS doesn’t use that term anymore, the program’s benefits still exist. Eligibility is based on the amount of tax you owe and your financial situation. You can avoid collection actions, including levies and liens, but it can be difficult for some taxpayers to qualify. Let’s look at how IRS Fresh Start works and who it may help.

Table of Contents

What is the IRS Fresh Start program? Is it real?

IRS Fresh Start is a legitimate program that helps people who are struggling with tax debt. The IRS offers help in the form of:

- Payment plans. Short-term payment plans give you up to 180 days to pay your balance. Long-term payment plans, also called installment agreements, allow you to pay off tax debts over up to 72 months.

- Offer in Compromise. An Offer in Compromise allows you to settle your tax debt for less than you owe and get the remaining balance forgiven.

Plenty of people use these options to deal with federal tax debt. In 2023, just over 4 million Americans had an IRS payment plan in place. Nearly 215,000 taxpayers had an Offer in Compromise accepted.

If you’re applying for a payment plan or an Offer in Compromise, I recommend ensuring you are up to date with your tax return filings and getting a checklist to help organize necessary documents. This should include compiling personal and business financial data, such as financial statements, income records from all sources, and a comprehensive list of expenses. You should also prepare a balance sheet or net worth statement outlining your assets and liabilities, along with any supporting hardship documentation.

IRS Fresh Start program requirements: How to qualify

Eligibility for IRS Fresh Start depends on what kind of help you’re looking for. Here’s more on how qualification works.

Short-term payment plans

Short-term payment plans let you pay off tax debts in 180 days or less. You might qualify if you:

- Are an individual taxpayer

- Owe less than $100,000 in combined taxes, penalties, and interest

Businesses can’t request short-term payment plans. The only exception is that you run your business as a sole proprietor or independent contractor.

There’s no fee to apply for a short-term payment plan.

Long-term payment plans (installment agreements)

Installment agreements are designed for taxpayers who can’t pay their tax bill in full in the 180-day window. If you qualify, you can take up to 72 months to pay off your balance.

You might be eligible if you:

- Owe less than $50,000 in combined taxes, penalties, and interest

- Have filed all required tax returns

Long-term payment plans are for individual taxpayers, which include sole proprietors and independent contractors. Businesses can qualify if they owe less than $25,000.

If approved for a long-term payment plan, you’ll pay a setup fee. The fee ranges from $22 to $178, depending on how you apply and whether you enroll in automatic payments. You qualify for a fee waiver if your adjusted gross income is at or below 250% of the federal poverty level for your household size.

Offer in Compromise

An Offer in Compromise lets you settle your tax debt for less than you owe. This option is designed for people who would experience financial hardship if they had to pay their tax debt in full.

You’re eligible to apply if you:

- Have filed all required tax returns and made required estimate payments (if applicable)

- Aren’t in bankruptcy

- Have filed a tax extension for a current-year return

- Are self-employed, have employees, and have submitted all required tax deposits for the current year

If you’re approved, you’ll have two options to pay the agreed-upon amount:

- An initial payment of 20%, with the rest paid in five or fewer installments

- Initial payment, followed by a series of periodic payments

Applying doesn’t guarantee approval. The IRS doesn’t specify exactly what qualifies someone for an Offer in Compromise. Decisions are based on your income, expenses, assets, and ability to pay.

How to complete the IRS Fresh Start program application

How you apply for IRS Fresh Start depends on which type of relief you need. If you want to request a short- or long-term payment plan, you can apply online, by phone, by mail, or in person.

Applying for a short- or long-term payment plan online is the fastest way. Here’s what you’ll need to do.

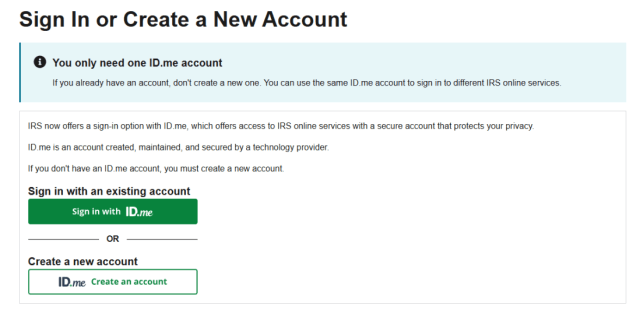

1. Log in to your ID.me account, or create one if needed.

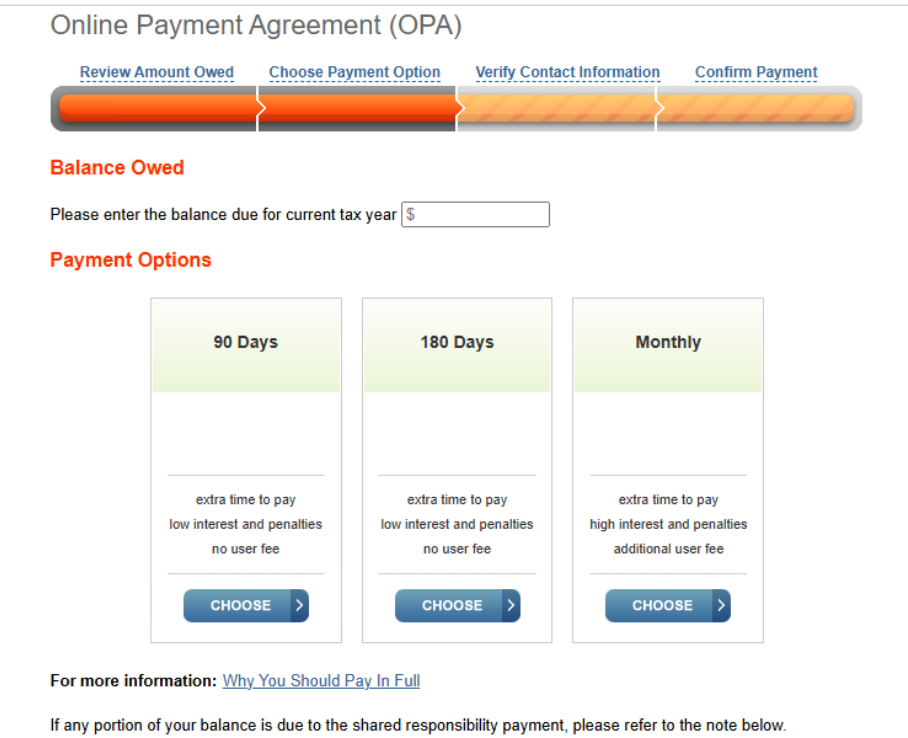

2. Once logged in, enter the balance owed in the box. At the top, choose your payment term.

3. Enter your proposed payment amount and preferred payment due date. Choose direct debit if you plan to make automatic payments; otherwise, choose the installment agreement.

4. Enter your bank account details if you plan to pay by direct debit, and then confirm your payment information to submit your application.

You’ll get an immediate notification letting you know whether your payment plan is approved.

If you want to make an Offer in Compromise, you’ll need to fill out a paper application package and mail it to an IRS office. You’ll include a check to cover the $205 application fee. You should get a notice letting you know whether you’re approved within 90 days of applying.

Alternatives if you don’t qualify for IRS Fresh Start tax forgiveness

IRS Fresh Start offers tax help when you can’t pay what you owe, but some people won’t qualify. You may be ineligible if you:

- Haven’t filed your returns

- Owe an excessive amount of debt

- Can’t get the IRS to agree to your Offer in Compromise

In those scenarios, you might look to a tax relief company for help.

Tax resolution services help people who are struggling with tax debt find the best solution for their situation.

You’ll pay a fee for services, but working with a tax relief expert can be reassuring if you’re not comfortable facing the IRS on your own. Learn more about the best tax relief companies and what they have to offer if you’re ready to tackle your IRS debt.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.