Can you get a HELOC with bad credit?

Honest answer? No.

Bad credit—defined as a FICO score below 580—is too low to qualify for a HELOC in almost every case. While some lenders claim to offer HELOCs to borrowers with fair or poor credit, our experience shows that most won’t approve applicants with scores below 620. In fact, the majority of approvals go to borrowers with scores of 720 or higher. If you find another answer elsewhere, take it with a grain of salt.

Here’s a closer look at why HELOC credit score requirements are what they are, and what your options might actually be if you have bad credit and want to access our home equity.

Note: If your credit score is below 720, it is unlikely that you will pass the prequalification stage for most HELOC lenders. If your score is higher than 580, see our highest-rated HELOCs for fair credit. Below 580, look into home equity agreements as an alternative.

Table of Contents

- Why can’t you get a HELOC with a score in the 500s?

- How does a low credit score affect your HELOC?

- HELOC approval odds by score

- How to improve your approval odds for a HELOC with bad credit

- Pros and cons of getting a HELOC with bad credit

- If I can’t get a HELOC with bad credit, what should I do instead?

- FAQ

Why can’t you get a HELOC with a score in the 500s?

HELOCs are riskier for lenders than other types of loans. They’re tied to your home, and since most have variable interest rates and flexible draw periods, there’s less predictability in how (and when) the money will be used or repaid. That’s why lenders set the bar high—they want to see that you have a proven track record of managing debt responsibly.

A credit score in the 500s tells a very different story. It often signals late payments, defaults, or high credit utilization, all of which make you a riskier borrower in the eyes of lenders. From their perspective, it’s simply too risky to offer a line of credit secured by your home without a stronger credit profile to back it up.

If you’re set on getting a HELOC, your first step should be improving your credit. Most lenders require a minimum credit score of 620 just to consider your application—and even then, approval isn’t guaranteed. We’ve observed most lenders don’t approve scores lower than 720. We’ve reviewed HELOCs for fair credit if you’re in the rebuilding phase and want to explore your options.

In general, lending has become tighter since 2021; interest rates have risen due to the Federal Reserve raising rates. In an effort to avoid an environment similar to the 2007 to 2009 Great Recession and housing crisis, lenders—particularly with first and second mortgages—want to ensure they’re loaning to reliable borrowers.

How does a low credit score affect your HELOC?

If you are able to boost your credit score enough to be approved a HELOC, it’s important to know how a lower score an affect the loan terms. Getting a HELOC for bad credit will likely mean paying a higher interest rate, making your credit line more expensive.

Interest rates for many HELOCs are variable and based on the federal prime interest rate. The lender takes the prime rate and adds a margin based on your perceived creditworthiness; the higher the risk, the higher the margin—and that equals more interest paid on the loan.

Here’s how it works:

- Anna has a good credit score of 780. The lender offers her a rate of prime plus 2%. At a prime of 8%, that equals a 10% interest rate. On a $50,000 HELOC with a draw period of five years, Anna will pay $25,000 in interest if she takes out the entire $50,000 at the beginning of the draw period (assuming no change in the prime interest rate).

- Brian has a fair credit score of 620. His lender offers a rate of prime plus 6% for a total of 14%. On the same $50,000 HELOC withdrawn at the beginning of the five-year draw period, Brian will pay $35,000 in interest—$10,000 more than Anna.

Bad credit can also affect the size of your HELOC credit limit. To help mitigate risk, lenders will likely offer you a smaller line of credit compared to someone with good credit. Here’s an example of how this could play out:

- Anna, with a 780 credit score, has $200,000 equity in her home. Her lender will likely agree to let her borrow the maximum of 85%, which is $170,000.

- Brian, with a 620 credit score, also has $200,000 equity in his home. To lower the risk, the lender may only let him borrow 70% of his equity, which equals $140,000. That’s a credit line $30,000 smaller than Anna’s.

Other terms, such as the length of your draw and repayment periods, could also be shortened because of bad credit. You might even pay an annual fee on the credit line to help compensate for the risk of lending.

HELOC approval odds by score

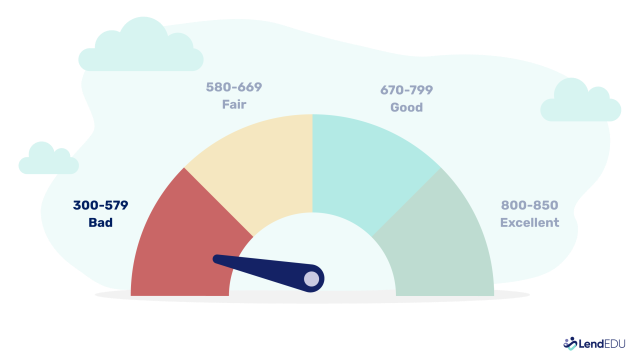

Bad credit typically refers to a credit score between 300 and 579. If you’re in this range, getting approved for a traditional HELOC is extremely unlikely—even if your home has substantial equity. Most lenders simply don’t approve HELOCs below a 640–680 credit score, and in practice, approvals usually go to borrowers with scores of 720 or higher.

Here’s how approval odds break down at the lower end of the credit spectrum:

| Credit score | Realistic approval odds | What to expect |

| 300–499 | Not possible | No legitimate HELOC lender will consider scores in this range. Focus on rebuilding your credit first. |

| 500 | Nearly impossible | You may find online claims of 500-score approvals, but no reputable HELOC lenders offer financing at this level. |

| 540 | Extremely unlikely | Technically closer to “fair,” but still far below lender cutoffs. You’d need perfect equity, income, and debt ratios—and even then, expect rejection. |

| 600 | Very unlikely | This creeps into “fair” territory, but you’re still below the minimum for almost all HELOC lenders. |

| 620 | Borderline | Often cited as the minimum, but real-world approvals at this level are rare unless you have strong compensating factors. |

| 640 | Low-to-moderate odds | While technically eligible with some lenders, actual approvals typically go to borrowers with 700+. |

Are there any HELOC lenders for bad credit? Some websites or lenders may suggest you can get a HELOC with a 500 or 540 credit score, but this is highly misleading. These scores fall below even the most flexible lender minimums.

How to improve your approval odds for a HELOC with bad credit

Again, 620 is truly the absolute lowest score you can have to apply for a HELOC. If you choose to proceed, consider the following to make yourself a more attractive candidate for a HELOC:

- Pay down debt. Reducing your outstanding debt could add points to your credit score if you lower your credit utilization ratio. Paying off debts would also reduce your DTI, making you a more attractive prospect to lenders.

- Increase home equity. Paying off more of your mortgage increases your home equity. More equity equals more collateral, which reduces lenders’ risk and improves your chances of getting approved for a HELOC.

- Check credit report for errors. Credit report errors could cause harm to your score. Reviewing your reports for errors and disputing them with the credit bureau reporting the information could help make a positive difference to your score if the error is corrected or removed.

- Consider a cosigner. A cosigner is someone who applies for a HELOC alongside you and assumes equal legal responsibility for the debt. A cosigner could bolster your application and help you qualify for better terms if they have a solid credit score.

Along with these tips, follow the usual best practices for improving a credit score. That includes paying bills on time, keeping older accounts open, and not applying for new credit that isn’t a necessity.

You could possibly renegotiate for a better HELOC rate down the road if you and a cosigner can prove that a past hardship caused your credit rating to decline and reflect poorly on your credit report. Examples could include divorce, unexpectedly needing to care for a family member (and using your savings or credit cards), filing for Chapter 7 bankruptcy, or you or your spouse losing your job, resulting in reduced overall income.

But keep in mind: You must prove you have recovered from this and have a reliable source of income. It’s worth a shot to negotiate—or wait to apply for a HELOC if it isn’t a critical need. In the meantime, you could build up savings and work on improving your credit score and credit report. You can also ask the lender what it recommends and wants to see improved on your credit report to approve your loan request.

Pros and cons of getting a HELOC with bad credit

Consider the advantages and disadvantages before trying to get a HELOC if you have bad credit.

Pros

-

Borrow as needed

You don’t need to withdraw the entire amount at once; you only take out funds when you need them.

-

Flexible use of funds

You can use a HELOC for almost anything.

-

Interest-only payments during draw period

You don’t need to pay the principal balance during the draw period, which makes the debt easier to manage early.

-

Potential for lower interest rates

Because most HELOCs offer variable interest, your rates could come down if the prime interest rate is lowered.

Cons

-

Higher interest rates

Borrowers with bad credit are more likely to pay higher interest rates, making your loan more expensive over time.

-

Smaller credit limit

Lenders compensate for the high risk of lending by reducing the size of your home equity line of credit.

-

Risk of losing your home

Because your home is being used as collateral, you may lose it if you fail to make payments on your HELOC.

If I can’t get a HELOC with bad credit, what should I do instead?

If a HELOC isn’t in the cards due to bad credit, you still have options to tap into your home equity or access the cash you need.

Home equity agreement

A home equity agreement (HEA) lets you turn your equity into cash without taking on monthly payments or interest. Instead of borrowing money, you’re selling a share of your home’s future value in exchange for a lump sum today.

These agreements often have more flexible credit requirements than traditional loans, making them a potential fit for homeowners with lower scores.

👉 See the best home equity sharing agreements

Personal loan

Some lenders offer personal loans to borrowers with poor credit, though rates may be higher. If you don’t have enough home equity or prefer an unsecured option, a personal loan could help cover your expenses.

👉 Compare the best personal loans

Cash-out refinance

If you’ve built substantial equity and your credit isn’t severely damaged, a cash-out refinance could be another route. This replaces your existing mortgage with a new, larger loan—and gives you the difference in cash.

👉 Explore the best cash-out refinance options

Loan from a family member or friend

If none of the above are workable, consider asking someone you trust for a private loan. It may not be ideal, but it could buy you time to improve your credit and qualify for better financing in the future.

No matter which option you choose, the key is to avoid predatory lenders and high-cost products that can trap you in a cycle of debt. Focus on rebuilding your credit so that more favorable options—like a HELOC—become available down the line.

FAQ

What disqualifies you for a HELOC?

Several factors can disqualify you from getting a HELOC, including a low credit score (e.g., below 600 for most lenders), high debt-to-income ratio (DTI), insufficient home equity, inconsistent income, or a history of late payments, foreclosures, or bankruptcies.

What would cause a HELOC to be denied?

A HELOC could be denied if you have insufficient home equity, high DTI, a poor credit history with recent delinquencies, unstable income, or if your property has significant issues that affect its value. The application could be rejected if you don’t meet a lender’s specific requirements, such as minimum income levels.

Does a HELOC damage your credit?

Applying for a HELOC results in a hard credit inquiry, which can lower your credit score by a few points. Once approved, responsibly managing the HELOC, such as making on-time payments, can help improve your credit over time. However, missing payments or overextending your credit can damage your score.

How we selected the best HELOCs for bad credit

Since 2018, LendEDU has evaluated home equity companies to help readers find the best home equity loans and HELOCs. Our latest analysis reviewed 850 data points from 34 lenders and financial institutions, with 25 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.