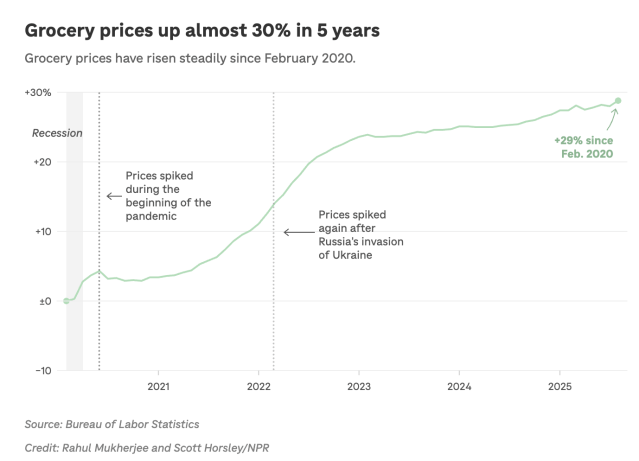

Grocery prices are now about 30% higher than before the pandemic, according to recent reporting from NPR and Axios, and you see it every time you shop.

This year, those higher-than-normal grocery prices collide with a Thanksgiving Price War, a shrinking turkey supply, and a wave of newly lifted tariffs that won’t influence November prices fast enough. It’s a complicated picture.

Here’s what rising prices mean for your real grocery bill this month.

Table of Contents

Why grocery prices are still 30% higher than pre-COVID

Most shoppers don’t need government data to know groceries cost more than they used to. The Consumer Price Index shows “food at home” is up 2.7% year over year, but this number disguises the cumulative reality: Every small increase since 2020 has stacked on top of the last one.

A few forces are behind today’s higher price floor:

Tariffs raised input costs

In 2025, President Donald Trump’s tariffs on everything from steel to fertilizers pushed up production costs across the food supply chain. Axios reports these price increases year over year due to tariffs or higher global costs:

- Coffee prices are up 20.9%

- Beef steaks are up 16.6%

- Bananas are up 6.6%

Labor and weather disruptions didn’t help

Another big thing feeding into higher food prices this year was farm worker shortages, packaging delays, rising transportation costs, and extreme weather events. These factors aren’t new issues, but they’ve compounded over time to keep prices elevated.

Overall inflation sits on top of all that

Even as monthly inflation improves, consumers still face the reality of a grocery bill that’s 30% higher than 2019. The level hasn’t come down because companies rarely reverse food prices once they climb. They may offer temporary discounts, but the base price sticks.

Thanksgiving is the rare exception because retailers compete so aggressively (and sometimes irrationally) to win your holiday trip.

What the Thanksgiving Price War means for your holiday meal

The Thanksgiving Price War refers to the lengths retailers will go to in order to slash turkey prices, curate meal bundles, and cut margins to retain cost-conscious shoppers. But behind the splashy ads, some important details explain why prices look lower (even though they haven’t felt lower at all this year).

Retail turkey prices are lower (but someone’s taking the hit)

The U.S. turkey flock is the smallest it’s been in 40 years, thanks in part to avian flu outbreaks. More than 1.3 million turkeys have been hit since October, mostly in Minnesota and nearby states. That’s pushed the wholesale price of frozen hens to $1.73 per pound, almost 40% higher than last year, according to Axios.

Despite higher wholesale prices, frozen turkeys are selling for about 25 cents per pound less than a year ago, according to the USDA.

How? Retailers are selling them at or below cost as loss leaders, hoping you’ll buy wine, pies, decorations, and higher-margin side dishes.

Meal bundles are cheaper but smaller

Walmart grabbed headlines with a Thanksgiving meal “25% cheaper than last year.” That’s technically true, but it’s because the 2025 bundle includes fewer items and swaps in cheaper brands.

A comparison of identical items shows the real savings are closer to 6.5%, according to fact-checking from PolitiFact and FactCheck.org.

Here’s what major grocery store chains are advertising for Thanksgiving:

- Walmart’s Thanksgiving meal costs about $40 to feed 10 people. The lower price comes from offering fewer items than last year and swapping in different brands and smaller portions.

- Aldi’s Thanksgiving meal also costs about $40 and feeds roughly 10 people. It includes a 14-pound turkey.

- Lidl’s Thanksgiving meal costs about $36 for 10 people, and shoppers can get a turkey for just $0.25 per pound through the store’s app.

- Kroger’s Freshgiving bundle costs less than $4.75 per person (its cheapest price in four years) and is built around private-label items to keep costs down.

- Target’s Thanksgiving meal costs less than $20 and feeds a family of four. The retailer swapped two items from last year’s bundle but kept turkey at $0.79 per pound.

Will the new tariff rollbacks change Thanksgiving prices?

In short, no.

In a major policy shift, Trump recently scrapped tariffs on beef, coffee, tropical fruits, tea, juice, cocoa, bananas, tomatoes, and more. But here’s the part that matters for your holiday budget:

Tariff rollbacks take months to show up in consumer prices

Even though importing beef or coffee may get cheaper, retailers still need to work through existing inventory, renegotiate contracts, and wait for wholesalers to adjust prices. Savings often trickle in later, not the same week or even the same month.

Most Thanksgiving items aren’t affected by tariffs

Turkey pricing has nothing to do with imported beef, and core Thanksgiving items like potatoes, rolls, pumpkin, and green beans aren’t meaningfully affected by the tariff changes.

What this means for your actual Thanksgiving grocery bill

The headline Thanksgiving deals may look generous, but the underlying grocery market hasn’t gotten noticeably cheaper. Here’s the actual picture:

- Your turkey is cheaper because retailers are eating the cost. If a frozen bird is less than $1 per pound this year, it could be a marketing strategy grocery stores are using to get you to shop.

- Side dishes are where you’ll feel the 30% inflation most. Butter, rolls, eggs, cream, vegetables, and desserts are still priced higher than last year. If you’ve felt the sting when buying everyday staples, you’ll likely feel the same as you shop for Thanksgiving.

- A “cheaper meal” doesn’t mean cheaper groceries overall. Grocery stores curate bundles to seem affordable. But they’re often not reflective of prices across the rest of the store.

How to save money on Thanksgiving dinner

Use these tips to save the most money at the grocery store this holiday season:

- Compare unit prices for every ingredient. Two boxes of stuffing might look identical on the shelf, but one could cost nearly twice as much per ounce once you check the fine print. The same goes for cranberries, canned vegetables, pie crust, or broth. Look at cost-per-ounce to spot the real deals.

- Buy frozen turkey. Fresh turkeys cost more this year and are more affected by avian flu supply issues. Frozen is cheaper, and the quality difference is negligible.

- Shop bundles strategically. Walmart’s bundle may be $40, but check what’s included. Buying sides individually could be cheaper if you’re willing to go with another brand or don’t need all the included items.

- Choose two or three “swap” items that save the most. Going with store-brand rolls, broth, and stuffing could save you more than expected, even if you go with your preferred brand for everything else.

- Consider a flexible menu. If green beans cost too much, pivot to a roasted carrot side. If pie crusts are pricey, make a crumble dessert instead.

- Avoid overbuying just because turkey is cheap. Stores want you to feel like you’re getting such a good deal on turkey that you overspend elsewhere. But make a budget for how much you want to spend on your meal, and work within those parameters. If you’re planning on a large gathering this year, it can be much more cost-efficient to shop at two or three stores to get the best deals in the week leading up to Thanksgiving.

Recommended readings

- When Safety Nets Fray: $411 Million in Shutdown Relief and the Future of Food Assistance

- Why Are Groceries So Expensive? 2025 Trends and Predictions

- Gen Z Credit Scores Drop to 676, Lowest of Any Generation in 2025

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- NPR, Grocery Prices Have Jumped Up, and There’s No Relief in Sight

- Axios, Grocery Inflation Highest Since 2022 as Trump Tariffs Pile Up

- Axios, Retailers Carve Into Profits to Win the Thanksgiving Table

- Factcheck.org, Trump Serves a Misleading Thanksgiving Meal Statistic

- Politifact, President Donald Trump Misleads about Walmart Thanksgiving Dinner Price Comparison

- AP News, Trump Scraps Tariffs on Beef, Coffee and Tropical Fruit in a Push to Lower Grocery Store Prices

- Bureau of Labor Statistics, Consumer Price Index Summary

- USDA, Confirmations of Highly Pathogenic Avian Influenza in Commercial and Backyard Flocks

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.