Mortgage rates hit historic lows in the early days of the COVID-19 pandemic, with some homeowners signing loans below 3%. While today’s average mortgage rates (around 6.5%) are more than double those pandemic-era rates, they’re nowhere near the 18% (or higher) rates of the early 1980s.

Still, today’s rates, combined with increasing housing costs amid stagnant wages, high inflation, and economic uncertainty, have made homeownership feel out of reach for many, and borrowing any type of loan a source of angst for most.

Many friends and family members, who know I write about finance as a Certified Financial Education Instructor, regularly ask me when interest rates will go down. The unfortunate answer: They might go down a bit in the near future, but don’t expect a return to <5% rates anytime soon.

🏦 On December 10, 2025, the Fed cut its benchmark rate to 3.50% – 3.75%, its third cut of the year. Average 30-year mortgage rates have dipped to 6.15%, the lowest in 12 months.

Below, I’ll share my thoughts on today’s rates, expert predictions about where they’re headed, and how to navigate buying a house or making other lending decisions while interest rates remain high.

Table of Contents

- What is the fed funds rate?

- Are mortgage rates going down?

- Will mortgage rates go down this year?

- How are mortgage rates calculated?

- Should you wait for rates to drop before buying a house?

- How to get a lower interest rate on a new house

- Will other interest rates drop this year?

- How to navigate short-term loans in a high-rate environment

What is the federal funds rate?

You may have heard politicians, news anchors, financial advisors, and journalists talking about the”fed rate” or “fed funds rate.” This refers to the federal funds rate, the interest rate banks can charge for overnight loans to one another. It’s set by the Federal Open Market Committee (FOMC), a branch of the Federal Reserve that meets eight times a year to make decisions aimed at managing inflation and maintaining economic stability.

While this rate doesn’t directly dictate the interest rates consumers pay, it acts as a baseline for borrowing costs across the economy. When the Fed raises or lowers the federal funds rate, it influences how expensive it is for banks to lend money, which in turn affects the rates they offer consumers on everything from credit cards and personal loans to auto loans, home equity loans and lines of credit (HELOCs), and mortgages.

Even though mortgage rates are more closely tied to the 10-year Treasury yield (more on that later), they’re still shaped by the overall economic climate the Fed is managing. For example, if the Fed keeps rates high to fight inflation, lenders may remain cautious and continue pricing mortgages conservatively. Conversely, signs of economic softening and Fed rate cuts can ease pressure on mortgage rates, though not always right away.

At its most recent meeting, in July 2025, the Fed voted to hold the rate steady at 4.25% to 4.50%. However, the market sees a 100% probability that the Fed will lower rates at its September 17 meeting, according to CME Group projections, so borrowing costs may get a bit lower soon.

I monitor interest rate trends by closely following Federal Reserve announcements, as well as key economic indicators such as inflation, unemployment rates, gross domestic product (GDP) growth, and consumer sentiment.

When advising clients, I start by reviewing and prioritizing their goals, distinguishing between needs and wants. For essential purchases that require financing, we discuss the possibility of refinancing in the future if interest rates decline. If the purchase is a discretionary want and the client is comfortable waiting, we explore the implications of delaying the purchase—including the potential risk of rising prices over time.

Are mortgage rates going down?

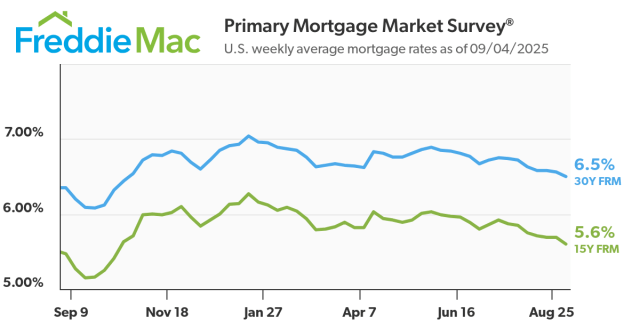

Yes, mortgage rates are going down, though perhaps not as fast as many would like. According to Freddie Mac, fixed rates for a 30-year mortgage are 6.50% in September 2025. That’s down from their 2025 high of 7.04% in mid-January. Plus, within the last year, rates dropped as low as 6.08%.

This reflects a modest downward trend from the 2025 peak, though rates continue to hover between 6% and 7%. As the chart shows, mortgage rates have gradually declined:

The table below shows mortgage rate averages for each month from September 2024 through August 2025:

| Month | Average mortgage rate (30-year fixed) |

| September 2024 | 6.18% |

| October 2024 | 6.43% |

| November 2024 | 6.81% |

| December 2024 | 6.72% |

| January 2025 | 6.96% |

| February 2025 | 6.84% |

| March 2025 | 6.65% |

| April 2025 | 6.73% |

| May 2025 | 6.81% |

| June 2025 | 6.82% |

| July 2025 | 6.72% |

| August 2025 | 6.59% |

Will mortgage rates go down this year?

We’ve seen some ups and downs in mortgage rates over the past year, but not a dramatic shift. The average 30-year fixed rate in August 2025 (6.59%) was higher than where it was a year ago in September 2024 (6.18%), and still hovering in the same 6% to 7% range we’ve seen all year.

So will mortgage rates go down this year?

Probably not, at least not meaningfully. Most experts expect rates to stay in the 6% to 7% range through the end of 2025, though a gradual decline is possible if economic conditions soften further.

Some forecasts, including from Fannie Mae, suggest rates may drift lower into 2026, potentially reaching 6% or slightly below, but don’t expect a sudden drop anytime soon.

Freddie Mac: “Higher for longer”

Mortgage rates remained higher than expected in 2024. Unlike last year when many were anticipating that mortgage rates would decline, in early 2025 the prevailing sentiment is that rates will stay higher for longer. This may impact prospective buyers and sellers as we get into spring.

– “Economic, Housing and Mortgage Market Outlook – January 2025,” Freddie Mac

Fannie Mae: “Lower rate outlook”

Mortgage rates are expected to end 2025 and 2026 at 6.4 percent and 6.0 percent, respectively, downward revisions compared with last month’s forecast of 6.5 percent and 6.1 percent, according to the July 2025 Economic and Housing Outlook from the Fannie Mae (FNMA/OTCQB) Economic and Strategic Research (ESR) Group.

– “Mortgage Rate and Home Price Growth Forecasts Revised Lower,” Fannie Mae

Zillow: “Rate cuts expected but baked into pricing”

On the heels of weak jobs numbers, the 30-year fixed mortgage rate declined to 6.67 in early August. Mortgage applications jumped on the news, largely driven by refinance activity, but new purchase applications initially jumped only 1% above the previous week.

“We’re hearing buyers say they want to wait for the Fed to cut interest rates in September,” says Zillow Home Loans Senior Regional Manager Jack Christie. “Agents can remind buyers that those anticipated Fed cuts are already baked into pricing. If you wait until September, and they don’t cut, you can expect rates to jump back up.”

National Association of Home Builders: “Path ahead may be bumpy”

NAHB expects two 25-basis-point cuts in the second half of the year. Mortgage rates have also edged higher alongside inflation … Compared to a year ago, rates have remained around the same level.

While the path ahead may be bumpy, NAHB expects the 30-year mortgage rate to average around 6.6% by the end of 2025 and fall just below 6% by the end of 2027.

J.P. Morgan: “Ease only slightly”

[W]e aren’t forecasting mortgage rates to breach 6% in 2025 — they should ease only slightly to 6.7% by the year end.

How are mortgage rates calculated?

Mortgage rates are complex; several key factors can affect current rates. Chief among them is the 10-year Treasury yield.

10-year Treasury yield

The 10-year Treasury yield is the interest rate the federal government pays to borrow money for 10 years. Who are they borrowing from? People like you and me.

In addition to putting money in a savings account or certificate of deposit, or investing it in stocks, we can purchase low-risk Treasury notes from the government. These pay out interest every six months until they mature (after 10 years).

How is this related to mortgages? The 10-year Treasury bond yield rate is a benchmark for long-term loans, including mortgages. Usually, when the Treasury yield changes, mortgage rates shift similarly. Right now, the 10-year Treasury rate is around 4.0%.

It’s all about the spread

OK, so if the 10-year Treasury rate is hovering around 4%, why aren’t mortgage rates lower?

Lenders use what’s called a spread. Essentially, it’s a little wiggle room, expressed as a percentage, above the current Treasury rate, that helps mortgage lenders cover the cost and risks of lending.

Think of it as how mortgage lenders make a profit: their version of markup. When you go to the store and buy a gallon of milk or a new T-shirt, the store charges you more than it paid for the product, to cover expenses and risks. Mortgage lenders do the same by setting a mortgage rate above the current Treasury rate.

Federal funds rate

While mortgage rates are primarily tied to long-term trends like the 10-year Treasury yield, the federal funds rate still plays an important indirect role. When the Federal Reserve raises this rate, it signals that borrowing across the economy is getting more expensive. That can influence investor behavior, slow consumer spending, and shift the way banks price loans, including mortgages.

Higher federal funds rates often push short-term rates higher (like those for credit cards and personal loans), but they also affect the broader lending environment. When the Fed keeps rates elevated to fight inflation, mortgage lenders may maintain larger spreads above the Treasury yield to account for added uncertainty or reduced demand. In contrast, a cut in the federal funds rate can ease some of that pressure, encouraging banks to offer more competitive mortgage rates, especially if inflation cools at the same time.

It’s not a one-to-one relationship, but the Fed’s decisions ripple through the economy, shaping the conditions under which mortgage lenders operate. If the federal funds rate stays high, mortgage rates are unlikely to drop meaningfully, even if Treasury yields move a bit lower.

Other mortgage rate factors

Of course, mortgage rates aren’t solely based on the Treasury rate and the federal funds rate Beyond those, lenders set rates based on factors such as:

- Financial markets

- Inflation rates

- Economic conditions

- Your own finances (credit score, income, etc.)

For instance, uncertainty around President Trumps’ tariff policy and the U.S. credit rating downgrade from Moody’s in May have affected current mortgage rates.

Should you wait for rates to drop before buying a house?

If you’re waiting to get a mortgage at pandemic-level rates, you’ll be waiting a long time. Sure, they may drop to around 6% by the end of next year, but there’s not a meaningful difference between today’s rates and those projected rates.

And in the meantime? Housing prices will likely continue to rise. For instance, J.P. Morgan expects housing prices to rise by 3% this year. As Zillow pointed out, anticipated rate hikes are already showing up in home prices. So any minor savings you’d get by waiting for a small rate drop over the next year could be obliterated by rising housing prices.

I feel that pain personally: My husband and I bought a house in the late summer of 2020 with a 2.75% rate. Last year, we almost bought a house at a near-7% rate. Despite financing $50,000 less than we did with our current mortgage, our monthly payment would have been about $500 more than the payment for our current home. We ultimately pulled out because of a bad inspection, but we recognize that we’ll need to get comfortable with a higher payment if we ever intend to move.

Having trouble navigating today’s financial markets, from saving for a down payment to securing a mortgage with a manageable interest rate? Financial experts can never have all the answers, either—but talking through the possibilities with one can help. Services like Money Pickle let you connect with a real financial advisor (a Certified Financial Planner) to discuss major financial decisions like when to buy a house and how to invest in today’s confusing market.

How to get a lower interest rate on a new house

The average 30-year fixed mortgage rate isn’t likely to drop meaningfully in the next year or so. But there are still ways to lock in a lower rate on a new mortgage:

15-year mortgage

A 15-year mortgage means you’d pay off your house twice as fast. Monthly payments are understandably much larger, but current rates for these shorter loans are more competitive. Right now, the average 15-year fixed mortgage rate is 5.6%.

Mortgage buydown

A mortgage buydown lets you “buy down” your interest rate by buying discount points. A point typically represents a 0.25% decrease in your mortgage rate and usually costs 1% of the mortgage.

For instance, if you have a 6.75% mortgage rate on a $300,000 mortgage, you could lower the rate to 6.50% by paying $3,000. This would save you about $18,000 over the life of the loan. Use a mortgage calculator to find out just how much the purchase of a mortgage point could save you.

This does, of course, require more money at closing. You can theoretically finance mortgage points, but this has less of an impact on how much you save.

Assumable mortgage

An assumable mortgage allows you, as a buyer, to take over a seller’s mortgage. Rather than get an all-new mortgage, you essentially take over (assume) the seller’s mortgage in its current form—interest rate, repayment period, and remaining balance—though you’ll still owe the seller money, in cash, to compensate them for what they’ve already paid on the house.

The reason to do so? If the seller got their mortgage when rates were significantly lower, you can assume their low interest rate, rather than get a new, higher rate.

Assumable mortgages are complex, and they carry a number of risks. Not every mortgage can be assumed, either. You’ll definitely want to talk with an advisor before going this route.

Will other interest rates drop this year?

In answering, “When will interest rates go down?” I’ve focused mostly on mortgage rates—but the federal funds rate plays a much bigger role when it comes to short-term loans and savings products. So even if you’re not buying a home, rate changes could affect your wallet.

Savings accounts

Interest rates on savings accounts tend to rise and fall with the federal funds rate. When the Fed hikes rates, banks can offer more attractive APYs to compete for deposits. But when the Fed lowers rates, as it seems likely to do later this month, those APYs often drop. If rate cuts come, expect to see those high-yield accounts get a little less exciting.

Credit cards and personal loans

Most credit cards have variable interest rates tied to the prime rate, which moves in lockstep with the federal funds rate. That means when the Fed raises rates, your credit card APR goes up, too—usually within a billing cycle or two.

The same goes for many personal loans offered by traditional banks and lenders. So if the Fed lowers rates, it could offer some modest relief for borrowers carrying balances or shopping for a new personal loan. Just don’t expect anything dramatic unless the Fed makes larger cuts than are currently expected.

Student loans

Federal student loan rates are recalculated each year in early summer, based on a formula that includes the 10-year Treasury yield. So while changes to the federal funds rate don’t directly affect your federal student loans, the broader market trends driven by Fed policy can still influence future loan rates. If you have private student loans with variable rates, though, you’re more exposed: Those rates can adjust up or down in response to changes in the federal funds rate.

Car loans

Car loans are a bit of an outlier. They’re more closely tied to the five-year Treasury note than the federal funds rate. That said, when the Fed raises or lowers rates, it still shapes the lending environment in a broader sense. And like most financing products, your final car loan rate depends heavily on personal factors: your credit score, the vehicle, your down payment, and the loan term all play a role.

When a client has revolving debt, such as credit cards, we prioritize paying down or eliminating those balances when interest rates are high—particularly for debt tied to variable interest rates, like a HELOC. To protect cash flow, certain financial goals may be postponed until interest rates become more favorable. We also place a strong emphasis on emergency savings, recommending funds be held in high-yield savings accounts or structured into a CD ladder to optimize interest earned.

How to navigate short-term loans in a high-rate environment

High interest rates don’t just make mortgages more expensive; they can hit you hard on credit cards, personal loans, and other short-term borrowing, too. When the federal funds rate is elevated (as it is now), lenders pass that cost along to consumers. That means higher monthly payments, more expensive financing, and less room for error if you’re carrying a balance. But there are a few ways to navigate this environment more wisely.

- If you’re using credit cards, prioritize paying down your balance as fast as possible. The average credit card APR is more than 20%. We might see a modest decrease if the Fed lowers rates next week, but it won’t be significant with the expected 25-to-50-basis-point cut.

- Consider a balance transfer credit card with a 0% intro APR offer if you’re carrying a balance. Just be sure you can pay it off before the promotional period ends, or the rate could become much higher.

- If you’re shopping for a personal loan, focus on your credit score. Lenders tend to reserve their best offers for the most creditworthy borrowers. If you can, try improving your credit profile before applying, or use a lender that lets you prequalify with a soft credit check to see your rate upfront. You can also compare multiple lenders. Even a small difference in the rate can add up over the life of the loan.

- Borrow only what you need. It’s tempting to borrow more “just in case,” but the cost of borrowing is higher than it’s been in decades. The less debt you take on while rates are elevated, the less interest you’ll pay overall, and the better positioned you’ll be if rates drop meaningfully.

When interest rates are high, in light of potential risks like job loss or early retirement due to corporate downsizing, I typically advise clients to maintain an emergency fund covering six to 12 months of essential expenses, when feasible.

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.