A home equity line of credit, or HELOC, is a flexible tool that allows you to borrow against your home’s equity. But if you have a balance, paying it off early can substantially lower your total interest costs.

We’ll cover strategies you can use to pay off your HELOC faster. Learning how each method works can help you decide on the best way to pay off a HELOC.

Table of Contents

How does HELOC repayment work?

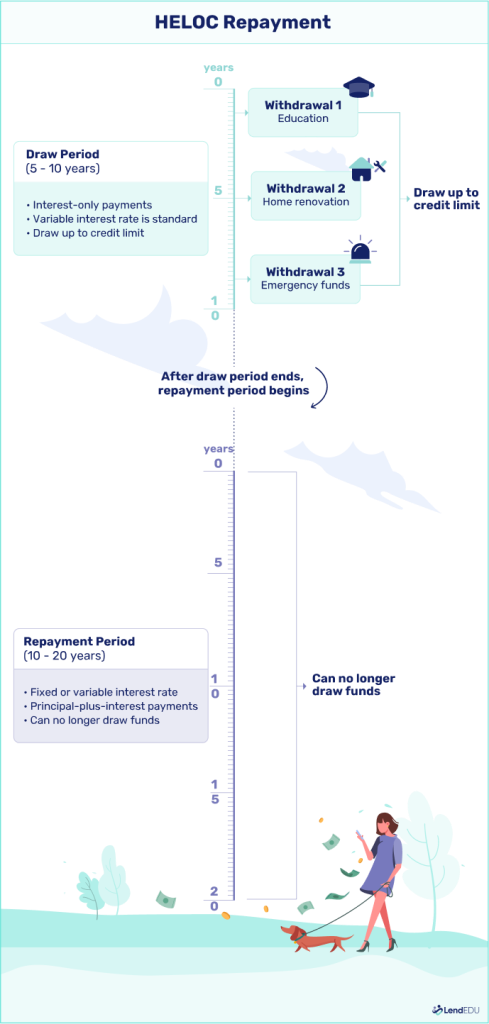

A HELOC comes with a draw period and a repayment period. During the draw period—which often lasts 10 years—you can borrow money up to your credit limit as needed. Many lenders allow you to make monthly interest-only payments during this phase. However, you can also pay down the original balance in addition to the interest payments.

After that phase ends, the repayment period begins, and you can no longer borrow against the HELOC. This period can last up to 20 years, and the lender requires you to pay your principal balance plus interest. But you can pay back your HELOC early to lower your total borrowing costs.

Check with your lender first to see whether it charges a fee for paying off your HELOC early. The cost of a prepayment penalty fee varies, but some lenders charge 2% of the amount you owe.

4 ways to pay off a HELOC

You can use several strategies to pay your HELOC off. Here are four options to consider.

| Method | Best for |

| Make a lump-sum payment | Individuals who can afford to pay their HELOC off at one time |

| Make extra principal payments | Borrowers who want to reduce their overall interest costs |

| Refinance | Changing the rate and terms of your current HELOC |

| Cash-out refinance | Switching to a fixed-rate loan |

Make a lump-sum payment

If you want to save the most interest and can afford to, pay your HELOC balance in full. Even if your lender charges a prepayment fee, the savings might outweigh the future borrowing costs.

Make extra principal payments

Making additional payments toward your principal balance can help you pay off your HELOC faster. Before you pay, contact your lender to tell it you want the extra money applied toward your original balance.

Refinance

Another way to repay your balance faster is to refinance your HELOC—take out a new HELOC to pay off your old one. If you qualify for a lower rate, you can save money and kick your HELOC debt to the curb sooner.

Cash-out refinance

A cash-out refinance might be ideal if you want to switch from a variable-rate mortgage to a fixed-rate one. It means taking out a new, larger primary mortgage with a fixed rate to pay off your current one. When you close on the loan, you receive the difference in cash—the “cash-out” part of this method.

You could use the cash for almost any purpose, including paying off your HELOC. Before you do this, make sure the benefits outweigh the costs.

You’ll have to pay closing costs like when you took out your original mortgage. Also, if you can’t qualify for a lower rate, consider an alternative method to avoid increased interest payments on your current home loan.

I suggest following these four steps: First, determine what type of payment options you prefer and what options remain open to you if you begin with interest-only and then want to move to principal or lump-sum payments before the required payment period begins. Next, determine whether the lender allows principal payments during the draw period. Third, determine whether you can afford the interest payments during the draw period, and ideally, factor in principal payments too. Last, make sure the payments are realistic—don’t draw more than you can pay back in interest and put yourself in a position that requires you to draw on more debt (i.e., credit cards and personal loans). The bottom line is to borrow what you can afford to borrow.

Erin Kinkade, CFP®

| Company | Best for… | Min credit score | Rating (0-5) |

|---|---|---|---|

|

|

Best Overall | 640 (720+ preferred) |

|

|

Best Customer Reviews | 640 (720+ preferred) |

|

|

Best Traditional HELOC | 670 |

|

|

Best Marketplace | Varies by lender |

|

What is the best way to pay off a HELOC?

The best method for paying off a HELOC depends on your financial circumstances and goals. The following table highlights options that are ideal for different scenarios.

| If… | Pay off your HELOC by… |

| You can afford to pay it off all at once | Making a one-time payment |

| You can’t afford a lump-sum payment | Making extra principal payments |

| You want to switch to a fixed-rate loan | Using a cash-out refinance |

If you can afford to pay it off all at once

If you can afford to pay off what you owe, a lump-sum payment might be the best option for you. Just remember to check with the lender to see whether it charges a prepayment fee.

If you can’t afford a lump-sum payment

Making extra principal payments could be your best strategy if you can’t afford to pay your balance in full but want to pay down your loan faster. Doing so helps lower your total interest costs.

If you want to switch to a fixed-rate loan

Applying for a cash-out refinance might be your best option if you want to swap out your HELOC’s variable rate with a fixed one.

About our contributors

-

Written by Jerry Brown, CFEI®

Written by Jerry Brown, CFEI®Jerry Brown is a freelance personal finance writer and Certified Financial Education Instructor℠ (CFEI®) who lives in New Orleans. He covers a range of personal finance topics, including credit, personal loans, and student loans.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.