A HELOC statement is a written document that includes critical information about your HELOC account. If you take out a HELOC, your lender should send you a statement each month, either by mail or electronic delivery.

A HELOC statement gives you a convenient way to review your account activity month to month. In that sense, it’s similar to a credit card statement.

Table of Contents

Why is a HELOC statement important?

A HELOC statement contains important details about your line of credit. Reading through your HELOC statement is an opportunity to review how much of your credit line you’ve used and how much available credit you have. It’s also a chance to check for errors or inaccuracies.

Your lender should send a HELOC statement every month. The timing for receipt of your first statement can depend on the lender. For example, it might send a statement within two weeks of closing to ensure you have enough time to prepare for your first payment.

Once you receive it, your options for making a payment might include:

- Phone banking

- Online or mobile banking

- Autopay

- Paper check

- In-person payments at a branch

In effect, your HELOC statement serves as an important reminder to pay your bill on time.

What does a HELOC statement look like?

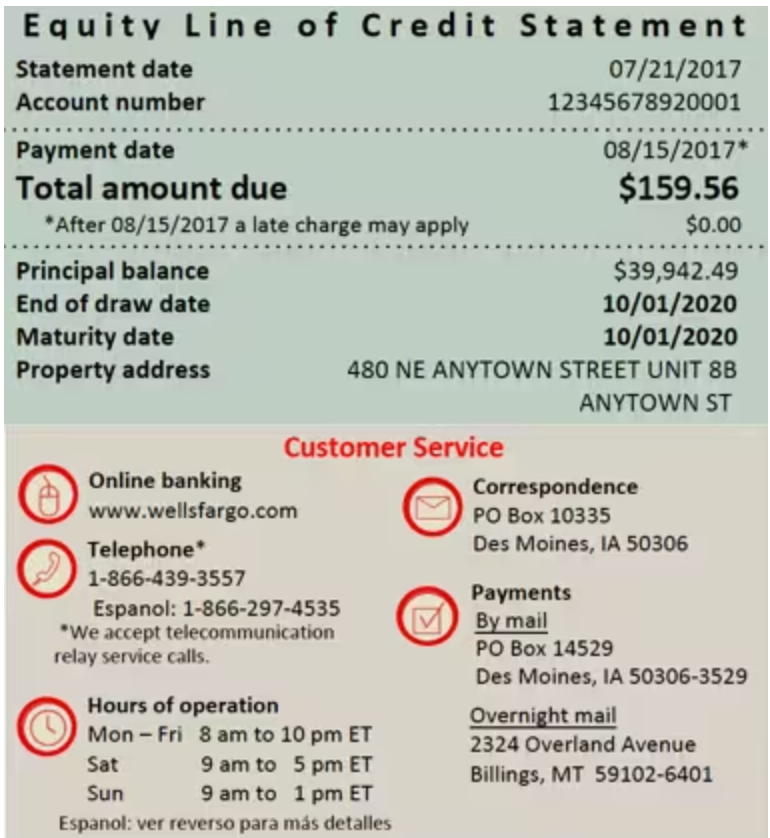

Here’s an example HELOC statement from Wells Fargo:

A HELOC statement looks similar to a bank, credit card, or loan statement. The statement may be one or two pages and include multiple sections with information relevant to your line of credit, such as:

- Transaction history

- Payment activity

- Interest rates

The bottom of the statement should include a payment coupon in case you want to mail in payment or pay your HELOC at a branch.

How you receive your HELOC statement will depend on the lender. If you opt in to paperless statements, you might receive an email reminder to view your statement each month. You may also be able to log in to your HELOC account dashboard for statements.

Important sections of a HELOC statement

HELOC statements don’t follow a uniform design, but they include much of the same information. As you go through your HELOC statement, it’s helpful to understand what it tells you about your credit line.

Your HELOC statement might include the following sections.

| Section | What it is |

| Account information | Basic information about the HELOC (balances, due dates, property info, etc.) |

| Payment summary | Current payment info |

| Activity summary | Info about your available credit and spending |

| Finance charges | APR info |

| Balance summary | What you owe |

| Messages | General or specific info from lender |

| Payment coupon | What to send with a paper check |

| Activity since last statement | How lender applied your most recent payment |

Account information

Your HELOC statement should include basic account information. The location and exact wording may depend on the lender.

In general, here’s what you can expect to see.

- Payment due date: The date your payment is due.

- Amount due: The minimum amount you must pay by the due date.

- Total balance: The amount you owe toward your credit line.

- Credit limit: The total amount your lender approved you to borrow when you took out the HELOC.

- Available credit: The difference between your credit limit and the balance you owe on your HELOC—how much more of your credit line you can access.

- Principal balance: What you owe toward the principal only (doesn’t include interest or finance charges).

- End of draw date: When the draw period ends and the repayment period begins.

- Maturity date: When your outstanding loan balance, along with interest and fees, becomes due. It’s often the same as the end of the draw date.

- Property address: The property location (could differ from the mailing address).

This information may be grouped in the same place on your statement or in different spots based on your lender.

Payment summary

If you have a HELOC, it’s crucial to know what you’ll have to pay toward it and when. The payment summary breaks down several pieces of information, including:

- When your payment is due

- Your current payment amount

- How much of that payment goes toward the principal on the line of credit

- How much of the payment goes toward finance charges and interest

Your payment summary may show information for multiple draws if you borrowed them at different interest rates. Most HELOCs have variable rates, so if your rate has adjusted up or down, that will affect your amount due. Likewise, you might see different draws if you converted your variable rate to fixed.

Activity summary

The activity section of your HELOC statement shows the difference in your available credit since your last billing statement.

You might see the following here:

- Approved credit limit: The amount your lender approved you for when you took out the HELOC.

- Credit in use: The balance you owe on your line of credit.

- Available credit: How much of your approved credit limit is left to use.

- Beginning balance: Your balance at the start of the billing cycle.

- Ending balance: Your balance at the end of the billing cycle, factoring in new draws and payments.

If your interest rate changed, this might be presented in sections for different draws. You might also see a different draw section if the lender reduced your line of credit.

Finance charges

Lenders calculate HELOC finance charges based on your annual percentage rate (APR), periodic rate, and the number of days rates are effective. The APR on a HELOC is the interest rate plus any fees you’ll pay, annualized over a year. The periodic rate is the interest your lender charges for each period.

You should see a section on your HELOC statement explaining the applicable finance charges for the billing period, including the APR, periodic rate, and number of days in the interest period. If you have multiple segments or draws at different APRs, those should be separate so you can see each finance charge.

Balance summary

Your balance summary is an overview of what you owe. This section might include details for your:

- Outstanding principal balance: How much you owe, without finance charges or interest factored in. You may see multiple balances if the rate on your HELOC changed.

- Finance charges: As we mentioned, finance charges reflect the interest assessed against your balance (or balances) for the billing period.

- Other charges: These can include late payment fees or a monthly maintenance fee if your lender charges one.

Your balance summary may also include a dollar amount for any new transactions since your last statement.

Messages

The messages section of your HELOC statement may show general or specific messages from your lender, such as a reminder that paying late can trigger a late fee or a notice about a change to your interest rate.

Payment coupon

The payment coupon is often at the bottom of your HELOC statement, and you’ll need it if you plan to pay using a paper check. The coupon may include:

- Your name and address

- Your HELOC account number

- The lender’s name and address

- The payment amount due

- Boxes to enter how much you’re paying

Your lender may include this on your statement even if you opt in to autopay. It can be wise to keep a paper payment coupon as a backup just in case you run into a snag scheduling an online payment.

Activity since last statement

This section breaks down how your lender applied your most recent payment to the principal on your HELOC and to the finance charges. Here, you might also see any fees you’ve been charged.

Your lender may include specific details about your transaction history. For example, if you took out a HELOC to fund home improvements, you might wonder if purchases you made with your linked debit card will show up.

A paper trail can be helpful, especially if you plan to deduct HELOC interest when you file your taxes. If you don’t see this on your statement, however, it’s up to you to keep track of how you’re spending your line of credit.

What to look out for in a HELOC statement

It’s wise to review financial statements for errors, as they could cost you if you miss them. When reading your HELOC statements, pay close attention to the accuracy concerning your:

- Current balance

- Activity since last statement

- Finance charges

- Other charges

- Interest rate

If you’re keeping track month to month, it should be straightforward to spot a discrepancy. If you find one, reach out to your lender to correct it. Otherwise, you could pay unnecessary interest or fees.

You can also reach out to your lender if you have questions about something on your HELOC statement. A loan specialist will help you get the answers you need.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.