Equity Sharing Home Loan

- Access up to $400,000 in cash

- Rates as low as 5.59% APR and cost $314 per month on a $100,000 loan.

- New type of second mortgage driven by future appreciation of the property

- Lower monthly payments—Unison claims they are half of what you’d pay with competing companies

- Low rates

- No prepayment penalties

- Only available in Arizona, California, Colorado, Florida, Oregon, and Utah

- Third-party fees, including appraisal and settlement fees

- 3% origination fee

Founded in 2004, Unison provides homeowners with innovative ways to access their home equity, primarily through its new Equity Sharing Home Loan. This product offers competitive interest rates on a second mortgage, featuring low monthly payments made possible thanks to partially deferred interest and sharing a portion of your home’s future appreciation. This allows homeowners to manage their finances with lower monthly costs.

Unlike traditional home loans, the Equity Sharing Home Loan uses a shared future home appreciation model, aligning Unison’s interests with the homeowner’s. It’s ideal for those looking for reduced upfront financial strain while tapping into their home’s equity.

Note that Unison also offers a Home Equity Sharing Agreement product.

Table of Contents

- About Unison’s Equity Sharing Home Loan

- Does Unison have any control over my home or its condition?

- Pros and cons of Unison Equity Sharing Home Loan

- Alternatives to Unison to tap your home equity

- Unison customer reviews

- Does Unison have a customer service team?

- How to apply for a Unison Equity Sharing Loan

- How we rated Unison

About Unison’s Equity Sharing Home Loan

Unison’s Equity Sharing Home Loan is designed for homeowners who want to tap into their home equity while keeping monthly payments low. It’s a 10-year loan with fixed, interest-only payments—meaning homeowners pay only part of the interest each month, deferring the rest. In exchange, Unison receives a share of the home’s future appreciation.

This setup reduces monthly costs compared to traditional loans, since homeowners don’t repay the full interest and principal right away. Instead, Unison is repaid later, using both the deferred interest and a portion of the home’s value when it sells or the loan ends.

Terms

- Loan amounts: Depending on their home’s value and credit profile, homeowners can access between $30,000* and $400,000. (*The minimum loan amount may vary by state).

- Interest rates: Unison offers lower rates than the standard market for second mortgages. Check Unison’s website for the latest competitive rates.

- Monthly payments: Interest-only payments keep monthly payments low, helping homeowners manage their cash flow.

- Repayment options: At the end of the 10-year term or upon early payout, homeowners repay the original loan amount, deferred interest, and Unison’s share of the home’s future appreciation. No prepayment penalties apply, allowing flexibility to the homeowner if they want to settle the loan early.

- Unique features: This loan structure combines the benefits of traditional home loans with Unison’s shared appreciation model, which, combined with the deferred interest, results in lower monthly payments.

Eligibility requirements

Here’s how to qualify for the Unison Equity Sharing Home Loan:

| Properties | Single-family homes, townhouses, and condominiums |

| Credit score | Min. 680 FICO |

| Max. CLTV | 70% |

| Max. loan amount | 35% of property value |

| Max. DTI | 40% |

| States | Only available in Arizona, Colorado, Florida, Oregon, and Utah |

| Other factors | Independent appraisal required to determine the home’s value before final approval |

The Equity Sharing Home Loan is only available as a second or third mortgage that is subordinate to the homeowner’s primary first mortgage loan.

How do you repay the Unison Equity Sharing Home Loan?

Homeowners will repay the loan at the end of the 10-year term or sooner. They’ll settle the principal, deferred interest, and Unison’s share of the home’s future appreciation.

Deferred interest accrues over the loan term but does not need to be paid in full monthly, giving homeowners the flexibility to manage their finances with low, predictable payments until maturity.

Fees and conditions

Be prepared for these costs associated with the equity sharing home loan:

- Origination fee: 3% origination fee (deducted from loan proceeds at closing)

- Third-party costs: Homeowners are responsible for the appraisal, title, and inspection fees, which are paid at closing via their funds.

- Deferred interest: While homeowners will make interest-only payments each month, a portion of the interest is deferred and compounded, adding to the balance due at the loan’s end.

- Shared appreciation: Unison typically takes 1.5 times the percentage of its investment as its share of the home’s appreciation, adding a unique cost component compared to traditional loans.

Does Unison have any control over my home or its condition?

As an investor, Unison shares in the future value of the home, but it doesn’t take ownership or control over the property, and it has no occupancy rights. You control the property and retain the benefits of homeownership.

Do certain home projects require permission from Unison?

Most home projects don’t require specific permission from Unison. However, if you plan to make significant changes that could substantially affect the value of your home, it may be wise to consult with Unison to understand how those changes might affect your agreement.

Can you renovate the home with funds from Unison or personal funds?

You can use the funds from Unison or your personal funds to renovate your home. Unison’s investment is tied to the home’s value, so renovations that increase the home’s value could affect the amount you owe at the end of the term.

Are there any inspections during the term?

Unison doesn’t conduct inspections during the term of the agreement. However, you are responsible for any costs related to home inspection as part of the closing process.

Pros and cons of Unison Equity Sharing Home Loan

Before making any financial decisions, we recommend considering all the pros and cons.

Pros

-

Lower monthly payments, competitive interest rates

The Equity Sharing Home Loan offers lower monthly payments, making it an attractive option for those looking to improve their cash flow.

-

Access to significant cash upfront

You may gain access to substantial cash amounts, providing flexibility for home renovations, debt reduction, or other financial needs.

-

No prepayment penalties

The home loan allows you to pay off the loan early without incurring extra fees, providing greater flexibility.

Cons

-

Third-party fees

You’ll cover third-party costs, including appraisal and settlement fees, which can add to the overall expenses of entering into an agreement with Unison.

-

Origination and transaction fees

A 3% origination fee applies to the Equity Sharing Home Loan.

-

Deferred interest

A portion of the interest is deferred and compounded until the end of the Equity Sharing Home Loan term, which could increase the overall repayment amount.

Alternatives to Unison to tap your home equity

When considering alternatives to Unison, you have a variety of options to access your home equity.

Home equity loans or HELOCs vs. Unison

Traditional home equity loans and lines of credit (HELOCs) allow homeowners to borrow against the value of their property, using it as collateral. These products typically require monthly repayment of both principal and interest—either through fixed terms (for home equity loans) or draw-based terms (for HELOCs). Homeowners retain full ownership of their property, including any future appreciation.

Unison’s Equity Sharing Home Loan takes a different approach. It offers lower monthly payments by deferring a portion of the interest and, in exchange, Unison receives a share of the home’s future appreciation. Instead of repaying the full cost through monthly installments, repayment occurs at the end of the loan term or when the home is sold, using both deferred interest and a portion of the home’s value.

Home equity loans or HELOCs may be better suited for homeowners who want to preserve their full home equity and can manage monthly payments, while Unison’s product may appeal to those who prioritize lower monthly costs and are open to sharing future appreciation.

Home equity agreements vs. Unison

Homeowners exploring equity-sharing options may come across home equity agreements (also known as home equity sharing agreements), which offer a lump sum of cash upfront in exchange for a share of the home’s future appreciation. These agreements typically do not require monthly payments or interest, and repayment usually occurs when the home is sold or after a set period.

Unison’s Equity Sharing Home Loan differs from most traditional home equity agreements in a key way: it is a true loan. Homeowners make fixed, interest-only monthly payments for 10 years, with part of the interest deferred. In addition to the deferred interest, Unison also claims a share of the home’s future appreciation—combining elements of a loan with an equity-sharing agreement.

To help homeowners compare their options and understand how Unison stacks up against other equity-sharing providers, the following resources offer detailed side-by-side comparisons:

- Unison vs. Unlock comparison: A detailed comparison of Unison’s hybrid loan-equity model and Unlock’s traditional home equity agreement, highlighting key differences in repayment structure and homeowner obligations.

- Unison vs. Point: An insightful comparison between Unison and Point, another equity-sharing provider, focusing on how each structures its agreements and what that means for long-term cost and flexibility.

- Unison competitors and alternatives: A comprehensive overview of companies offering home equity sharing agreements, comparing their terms, availability, and suitability based on homeowner goals.

- List of home equity companies: A comprehensive list of providers to help you explore options for tapping your home equity, including taking out a home equity loan or HELOC, or exploring other home equity sharing agreement providers.

Each company has unique terms, eligibility requirements, and cost structures, which can vary based on your home’s location, your financial profile, and the amount of equity you want to access. Comparing these alternatives can help you find the best fit for your needs, whether you prefer traditional loan structures or innovative equity-sharing agreements.

| Company | Best for… | Product | Rating (0-5) |

|---|---|---|---|

|

|

Best Overall | HELOC |

|

|

Best Customer Reviews | HELOC |

|

|

Best Overall | Home Equity Sharing Agreement |

|

|

Best for Large HELOCs | HELOC |

|

|

Best for Partial Payments | Home Equity Sharing Agreement |

|

|

Best for Longer Terms | Home Equity Sharing Agreement |

|

|

Best Marketplace | HELOC & Home Equity Loan |

|

Unison customer reviews

Reviews from reputable sources such as the Better Business Bureau (BBB) and Trustpilot can offer a balanced view of Unison’s services.

| Source | Overall rating | Number of reviews |

| BBB | 1.7/5 | 23 |

| Trustpilot | 4.1/5 | 203 |

Common themes from BBB reviews include being declined by Unison, disagreements with appraisals, and slow communication. In the last year, Unison has closed nine complaints with the BBB.

Trustpilot rates Unison’s program as “Great.” Many customers note the quick and easy application and approval process.

Does Unison have a customer service team?

Unison’s customer service team can assist homeowners with inquiries or issues they may face. Here are the ways to contact Unison:

- Email: [email protected]

- Phone: Call 1-855-864-7664 from 9 a.m. to 6 p.m. Central with questions about the Equity Sharing Home Loan

- Mailing addresses:

- 650 California St. Suite 1800, San Francisco, CA 94108

- 1299 Farnam St. Suite 940, Omaha, NE 68102

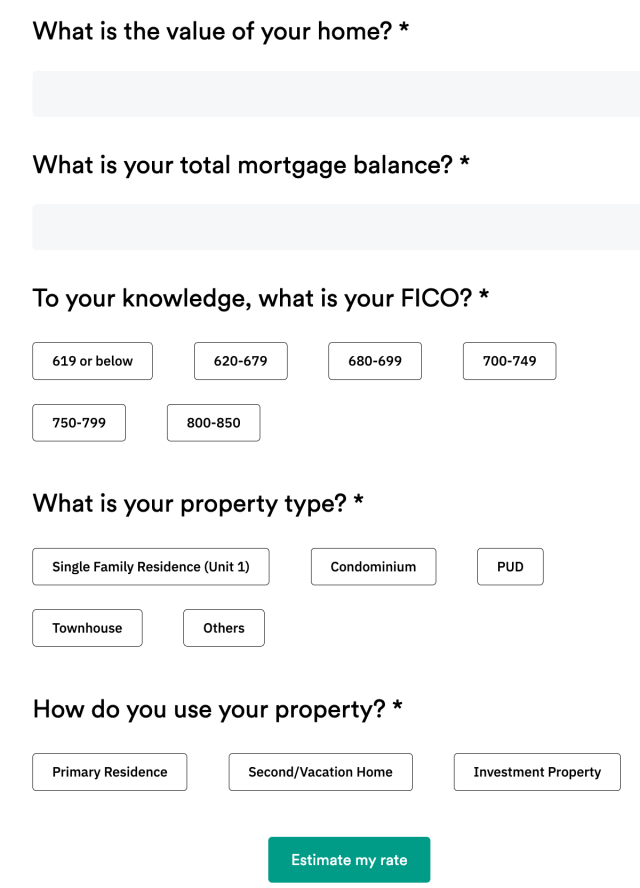

How to apply for a Unison Equity Sharing Loan

Applying for a Unison Equity Sharing Home Loan is a straightforward process. Here’s a step-by-step guide:

- Prequalify and get an estimate: Click “Estimate my rate,” type in your address, answer several questions about the property, and provide your name and email to get an estimate of how much home equity you can unlock. Unison will guide you through the pre-qualification process without any financial obligation or impact on your credit score.

- Apply online: If you’re satisfied with the estimate, fill out the application.

- Appraise your home: Unison will set up an appraisal to determine your home’s value. Remember, Unison requires the home to be your primary residence and has other eligibility factors.

- Unlock your equity: Decide how much cash you want to access, and Unison will work to release the funds as fast as possible.

How we rated Unison

We designed LendEDU’s editorial rating system to help readers find companies that offer the best home equity products. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Unison to several home equity lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company/product | LendEDU rating |

| Unison Equity Sharing Home Loan | 3.8/5 |

About our contributors

-

Written by Kristen Barrett, MAT

Written by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.