Credit tradelines are the accounts that appear on your credit report, along with important information about those accounts. Your tradelines show how much you first borrowed, how much you still owe, and how well you’ve kept up with your payments.

Depending on your payment history, tradelines can either help or hurt your credit score. Read on to learn more about how credit tradelines work—and how to use them to your advantage.

Table of Contents

What are credit tradelines?

Credit tradelines are detailed reports about every account that makes up your credit history. Think of it like this: If your credit report were a buffet, each of your tradelines would be an individual dish. The details about those tradelines would be a list of ingredients.

Most of us have several types of tradelines on our credit reports, and they usually fall into one of three buckets:

| Category | What it is | Examples |

| Revolving account | Credit you can borrow from over and over | Credit cards, home equity lines of credit (HELOCs) |

| Installment loan | Fixed amount received in a lump sum | Mortgages, auto loans, student loans, personal loans, buy now, pay later loans |

| Open accounts | Receive goods or services now, pay in full later | Charge cards |

| Collection accounts | Tradelines that are closed due to nonpayment | Charge-offs, unpaid utility bills, unpaid medical bills |

Open accounts are less common than revolving accounts and installment loans. You’ll see these more on business credit reports than personal, but it’s not unheard of for individuals to have them.

We’ll focus on personal tradelines here. Going forward, any references to “open accounts” will mean active tradelines that haven’t been closed or sent to collections.

For any of these tradelines to appear on your credit report, you must be listed on the account as one of the following:

- The primary account holder

- An authorized user

If you’re the primary account holder, you bear legal responsibility for the tradeline in question. If you’re an authorized user, you can use the credit line and benefit from the account holder’s payment history, but you typically won’t have direct account access.

We’ll dig deeper into what that means for your credit later. Before we do, it’s important to understand how to read your tradelines.

Each of the major credit bureaus—Equifax, Experian, and TransUnion—uses its own formatting for tradelines and credit reports. No matter how the tradeline looks, it should contain roughly the same information, including:

- When you opened the tradeline

- How much you first borrowed

- How much you now owe

- Your payment history

- Your creditor’s name and contact details

- The type of tradeline

- Whether you have a cosigner or joint account holder

If you pull your TransUnion credit report, for example, here’s how your tradelines may appear:

The data you see when you review your tradelines is the same information lenders get when they run your credit. But how do lenders use this information? Just as importantly, how should you use it?

What are tradelines on your credit report for?

Tradelines serve one overarching purpose: laying bare all that makes up your credit history.

For lenders, tradelines weave a story about your borrowing habits. When lenders review your tradelines, they’re usually trying to determine:

- How much debt you carry

- How much that debt costs you each month

- How often you pay your accounts as agreed

Tradelines provide meaningful context about who you are as a borrower. As you might expect, that information is crucial when it comes to lenders’ decision-making.

To better illustrate what we mean, pretend you’re a lender evaluating personal loan applications. You get two applications, both requesting $30,000. In examining each borrower’s tradelines, you notice the following:

At first glance, Applicant B may seem like the better borrower. They have less debt overall, and they have lower monthly payments. However, upon closer inspection, you realize that Applicant A may be more creditworthy.

Sure, Applicant A carries a higher dollar amount of debt, but they also have a stronger payment history. It’s been a year since their last late payment, compared to just a month for Applicant B.

Furthermore, Applicant A’s average account age indicates they’re not new to managing debt. Applicant B is a fairly new borrower struggling to juggle their debts. Without tradelines, lenders might miss these insights.

Wondering why someone in debt may take out a personal loan? In some cases, using a personal loan to pay off debt could save you money and streamline your payments.

How do tradelines affect your credit score?

Tradelines can either help or hurt your credit score, depending on what they say about your financial habits.

In general, tradelines that reflect a positive payment history and careful borrowing can boost your score. Conversely, if your payment history is on the shaky side or if you carry high balances, your tradelines could do more harm than good.

It may help to understand what goes into your credit score. In the table below, you’ll see what factors make up your FICO score and the impact each one has.

| Factor | What it is | FICO weight |

| Payment history | How often you pay on time | 35% |

| Amount owed | Total debt balance across all accounts | 30% |

| Age of accounts | How long ago you established your credit | 15% |

| Credit mix | Types of tradelines on your report | 10% |

| New credit | Accounts opened in previous 1 – 2 years | 10% |

Several credit scoring models exist, and each one weighs these elements differently. Payment history makes up 41% of your VantageScore, for example, while your credit age accounts for 20%.

Regardless of the scoring model, this information comes from what’s reported in your tradelines. That’s why it’s so important to pay on time, communicate with your creditors, and check your tradelines for accuracy.

Adding new tradelines could improve your credit score—if you are adding an existing account (for example, somebody adding you as an authorized user to their account), you will want to make sure the account has a positive payment history and a low utilization ratio.

If you are opening a new account, it is important to know the possible hard inquiry (which lowers your credit score for a period of time until on-time payments are reflected in the account and your other obligations), the “young” age of the account can damage your credit history until positive behaviors are reflected over time, and, of course, be aware of fees associated with the new account.

Erin Kinkade, CFP®

What happens if you are removed from or close a tradeline?

You might think closing a tradeline will improve your credit. After all, you’re eliminating debt, right? In theory, this makes sense. But in reality, being removed from or closing a tradeline can damage your score. Here’s why:

- Your average account age decreases.

- Your credit utilization increases.

Remember those credit factors? A lower account age and less available credit can decrease your score. That’s true even if you repaid the debt in full. How far your score drops depends on how old the tradeline was and how much open credit you forfeited with the closure.

Have a paid-off credit card you never use? Consider rerouting a low-cost bill to this card, like your monthly Netflix subscription, and paying it off in full each month. This will keep the card from closing due to inactivity while letting you rack up additional positive payments.

Now, removing a tradeline with negative information could improve your score.

Say you’re an authorized user on a maxed-out credit card. Removing yourself from the account might temporarily lower your age of accounts, but it will keep that high utilization from hurting your score.

Because of the potential credit hit, choosing whether to remove yourself from a tradeline or close it altogether requires careful consideration. If you’re debating the pros and cons, these scenarios might help you decide:

| If you… | It may be best to… |

| Don’t have many other tradelines | Keep it open |

| Have to pay an annual fee | Close it |

| Plan to apply for a mortgage soon | Keep it open |

| Are getting a divorce | Close it |

| Have had the account for several years | Keep it open |

In some cases, closing a tradeline may be unavoidable. If you find yourself in that situation, don’t stress. You can bring your score back up to its pre-closure level with patience and intention. After all, time heals all things—including credit.

How much will a tradeline boost your credit?

Tradelines that demonstrate responsible money management can raise your score, but how large an increase you see depends on a few variables:

- How long it’s been open

- Whether you’ve paid on time

- How high a balance you carry relative to your credit line amount

The number of tradelines you have makes a difference, too. Say you have 10 separate tradelines and add an 11th. Your latest tradeline is one of many and may not have as noticeable an impact, at least not right away.

The opposite is true for someone who just started building their credit. If you only have two active tradelines, each makes up 50% of your score. As a result, your respective balances and payment histories could more significantly increase—or decrease—your credit rating.

While these elements play an integral role in how much a tradeline will boost your score, the real determinant is your own money management. To maximize your tradelines’ positive influence, consider adopting habits such as:

- Paying on your debts biweekly instead of once a month

- Making additional principal-only payments

- Paying more than the minimum amount due

- Using the snowball or avalanche method to reduce your credit utilization

You might also consider refinancing or consolidating your debt. Debt consolidation loans can help you save on interest, streamline your payments, and increase your credit utilization.

Another solid choice for new tradelines? Cash advance loans. Also known as upfront credit builder loans, these loans often don’t require a credit check. Some offer no fees and rates as low as 0%, making them an affordable way to use tradelines to your benefit.

Is it worth buying tradelines to boost credit?

You may have heard that buying tradelines can provide a quick score increase. But in our humble opinion, buying tradelines is neither worth it nor necessary.

Before we go into why, here’s a quick explainer of the tradeline buying process:

- Contact a tradeline rental company.

- Select a type of tradeline and reporting period length.

- Submit payment.

- Provide your contact details and identifying information.

- Wait for the tradeline to appear on your credit report.

Behind the scenes, the tradeline rental company is tacking you on an established tradeline as an authorized user. A few promise no-credit-check approvals for primary tradelines—for a fee, of course.

In theory, this might sound like a convenient way to build up a strong credit history. In reality, it’s anything but. Here’s why we don’t recommend this strategy:

- You run the risk of identity theft. Buying tradelines requires you to furnish your Social Security number, which you should only do if you can verify a business’s legitimacy, which isn’t always possible with tradeline rental companies.

- Transactions seem less than transparent. Several tradeline rental companies require you to pay via Cash App—in Bitcoin. If that’s not a red flag, we don’t know what is.

- The tradeline is temporary. Despite the wording, buying a tradeline doesn’t mean you own it. Eventually, you’ll be removed as an authorized user, and the tradeline may be removed from your report shortly after.

- Buying tradelines can be expensive. Some of the companies we saw charge $1,000 for a single tradeline. Imagine how your financial future might change if you used that sum to pay down debt instead.

Rather than forking over four figures for a rented tradeline, consider a credit builder loan instead.

With credit builder loans, you pay toward your loan before funds are disbursed. Each prepayment is reported to the credit bureaus, and you get your money back once the loan is paid in full. These are a much safer—and more permanent—way to raise your score.

How long do tradelines stay on your credit report?

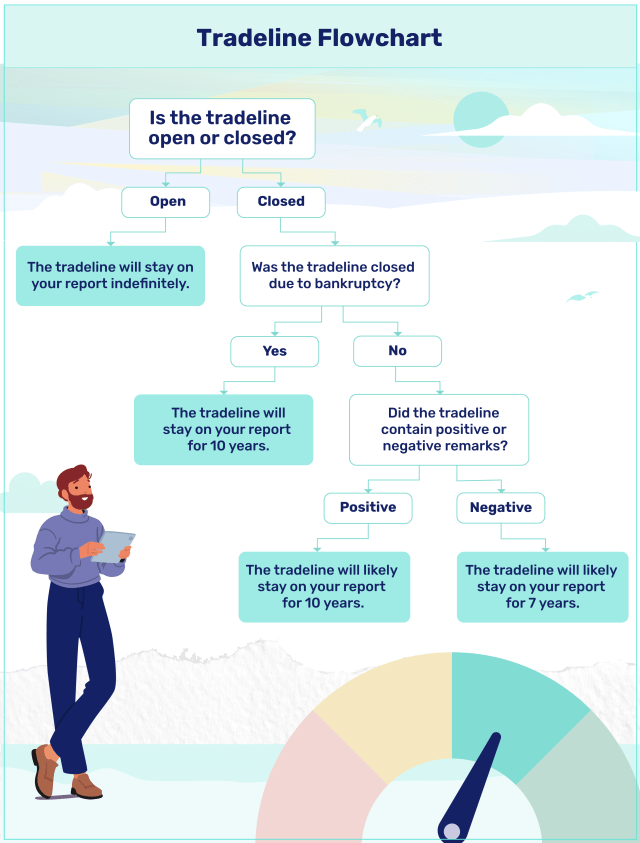

Open tradelines stay on your credit report indefinitely, while closed tradelines stay a max of 10 years. This timeline depends, too, on why the tradeline closed and whether the account history is positive or negative.

When you have your credit report handy, use the flowchart below to gauge how long your tradelines might last.

We should note that these timelines are typical but not guaranteed. They also only apply to primary account holders.

If you’re an authorized user on someone else’s tradeline, you’ll see that tradeline on your own credit report. Once your authorized user privileges are rescinded, the tradeline could disappear from your report within a couple of months.

Can my tradelines affect my eligibility for a loan?

Because they explain why your credit score is what it is, tradelines influence your eligibility for loans, credit cards, and cash advances.

Lenders use the information reported in your tradelines to determine your creditworthiness. This in turn determines whether you’re approved for new credit and, if so, at what rate. To that end, you’re more likely to qualify for loans or other forms of credit if your tradelines contain positive information.

Several companies, including EarnIn and MoneyLion, help you monitor your tradelines and what they say about your ability to handle debt. But how often should you check in on your tradelines, and what should you look for?

How should you manage the tradelines on your credit report?

The best way to manage your tradelines is by reviewing them periodically. You don’t need to check your tradelines as often as you do your bank account. Instead, aim for a quarterly or monthly cadence, especially if you’re preparing to apply for new credit.

When you audit your tradelines, be as thorough as possible. By the time you’re finished, you should be able to answer these questions:

- Are there any tradelines you don’t recognize?

- Are any tradelines missing that you expected to see?

- Is your payment history accurate?

- What do you owe on each tradeline?

- What interest rate are you paying for each tradeline?

If you spot any errors, reach out to the creditor listed. It can help you verify whether what you’re seeing is correct. Depending on what you find out, you may need to contact the three credit bureaus to dispute a mistake or report possible fraud.

Many of our readers use credit monitoring services to track their tradelines. Your creditors might also provide a monthly overview of your credit report, but these overviews aren’t as comprehensive as your full credit report.

You can pull your official credit report every week for free. When you do, we recommend downloading a copy to your phone or computer. That way, you’ll have a record of how your tradelines evolve over time—and how your money management efforts are paying off.

About our contributors

-

Written by Sarah Sheehan, MAT

Written by Sarah Sheehan, MATSarah Sheehan is a writer, educator, and analyst who focuses on the impact of health, gender, and geography on financial equity. Her ultimate goal? To live beyond the confines of chasing the next dollar—and to teach everyone else how to do the same.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.