For decades, a college degree was supposed to be your golden ticket to a steady paycheck. But in 2025, that ticket isn’t cashing in like it used to.

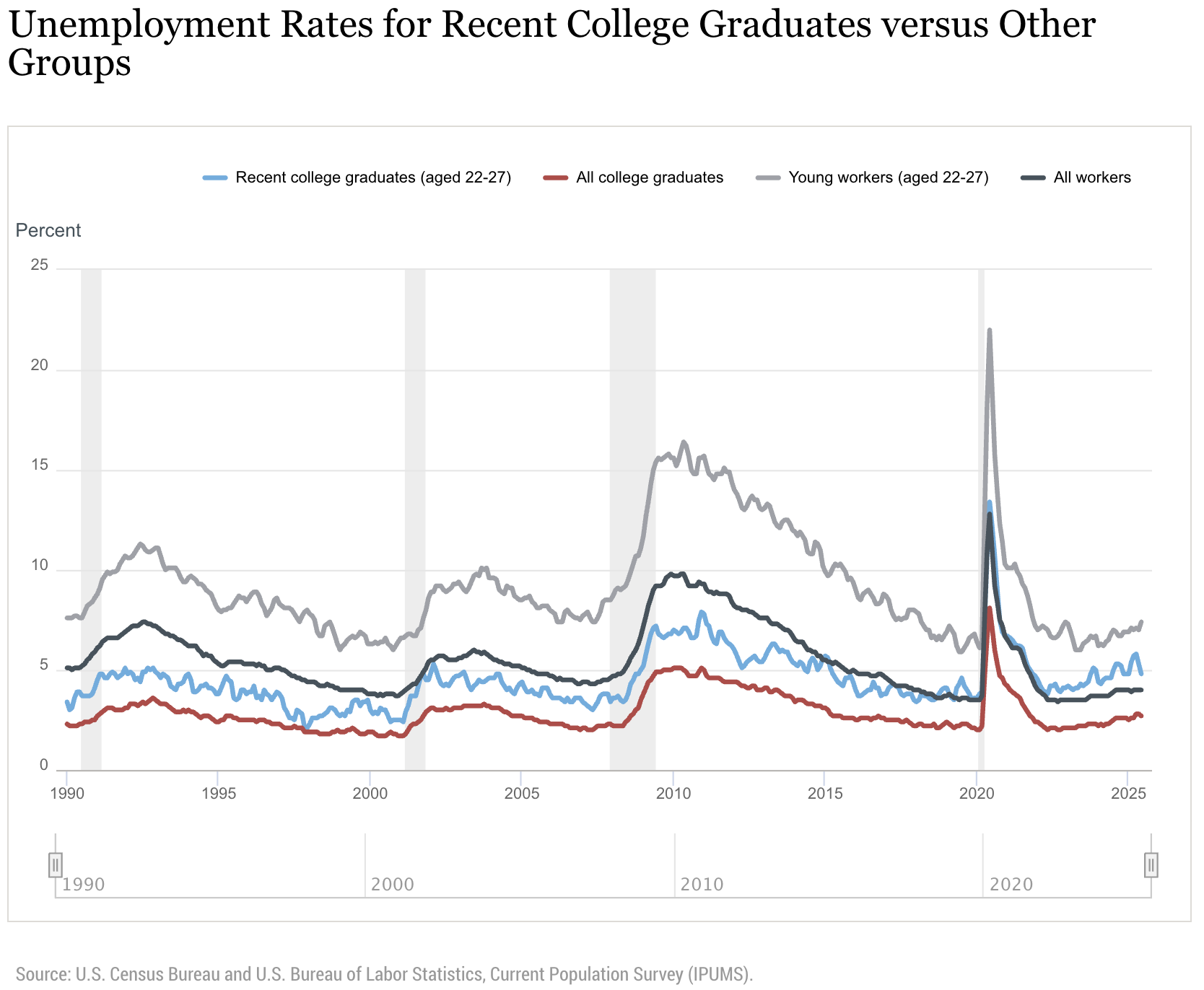

Right now, 4.8% of recent college graduates are unemployed, compared with just 4.0% of the overall workforce, according to the New York Fed. Historically, those numbers ran in the opposite direction: Grads almost always had lower unemployment than average. Now, the gap is widening in the wrong direction.

The result? A wave of resumes disappearing into job-application black holes, graduates settling for jobs outside their field, and student loan bills looming over smaller-than-expected paychecks.

Here’s why the job market has turned against recent grads and how to boost your odds of landing a job, even in a tough economy.

Table of Contents

Unemployment gap widens for recent grads

The jobless rate for recent college graduates has been climbing since 2022. By June 2025, it reached 4.8%, compared with 4.0% for all workers. Just a few years ago, the opposite was true. Grads typically had unemployment closer to 2% or 3%, well below the national average.

The shift has been especially tough on young men. Data from EdSource shows Gen Z men with degrees now face about the same unemployment rate as those without college at all. Women with degrees are doing somewhat better because healthcare (a field where many women work) is still adding jobs.

Why the job market feels like a black hole

For many new grads, 2025 has been a discouraging year to start a career. Job postings are limited, competition is fierce, and applications often go unanswered.

NBC News reported graduates sending out more than 100 applications without landing a single interview, even in fields like computer science and engineering that were once considered safe bets.

Adam Mitchell, a computer science graduate from Georgia State University, told NBC he thought three years of internship experience would make job hunting “a cakewalk.” Instead, after more than 100 applications, his only offer was a 4 a.m. shift at Starbucks.

The very few openings that there were would be so competitive that you would pretty much get a rejection notice as soon as you apply.

—Adam Mitchell

Several forces are behind this employment slowdown.

- Employers are cautious in the face of tariff shifts, government cuts, and general economic uncertainty.

- AI adoption is nibbling away at some entry-level tasks, like customer support and basic software development.

- Industries that used to be heavy recruiters of young grads, including tech, government, and consulting, have all been trimming jobs instead of adding them.

What this means for your finances

If you’ve just graduated and are trying to get a foot in the door, the openings are fewer and the competition is fiercer.

This slow start in the job market isn’t just discouraging; it’s costly. Lower starting pay makes it harder to cover student loans, build savings, or move out on your own. Raises are often based on your current salary, so starting low can drag down your earnings for years.

As a result, many graduates could be relying on credit cards or gig work to fill the gap, which adds to their debt and instability. Others are living at home to save money, putting off milestones like renting an apartment, buying a car, or saving for retirement.

Many grads eventually land better-paying jobs. But in the meantime, the gap between expenses and income can make everyday money management stressful.

What to do while you’re still in college

The best time to prepare for a shaky job market is before graduation. Employers now expect more than just a diploma. They want proof you can hit the ground running.

- Stack up experience early. Internships, part-time jobs, or even campus leadership roles show you can apply classroom skills in the real world.

- Build your network. Connections with professors, alumni, and mentors can open doors that online applications won’t.

- Add practical skills. Certifications, coding bootcamps, or side projects can set you apart in a crowded field.

- Look to stable industries. Healthcare, education, and the skilled trades are hiring steadily, even as other fields pull back.

How to boost your odds after graduation

If you’re already out of school, the key is to stay flexible and persistent.

- Think stepping stones. Your first job doesn’t need to be forever. Even roles outside your field can help you build transferable skills and keep your resume active.

- Tailor every application. Generic resumes and cover letters get lost in the shuffle. Highlight the specific skills and experiences that match each job posting.

- Work your network. Alumni connections, informational interviews, and even LinkedIn cold messages can help you avoid the online-application black hole.

- Stay open to alternatives. Contract work, temp jobs, or freelance projects can keep money coming in while you keep applying for your preferred job.

- Manage money carefully. Look into income-driven repayment for student loans, trim expenses where you can, and use side gigs to avoid piling on debt.

The 4.8% reality check

Recent grads now face a higher unemployment rate than the overall workforce: 4.8% vs. 4.0%. It’s a sharp turn from the old idea that a degree guaranteed security. The gap may look small, but it’s a sign of how much harder it’s become to turn a diploma into a stable paycheck.

Now, most grads eventually land jobs that fit their skills and pay better over time. But right now, the path may look less like a straight line and more like a zigzag, with side hustles, temporary roles, or a little more time living at home.

College can still be an investment for many people. But in today’s market, it may require a little more patience and persistence to pay off.

Recommended readings

- Create a Budget for Student Loan Repayment

- Student Loan Debt Statistics (August 2025)

- Are Private Student Loans Worth It? 71% of Borrowers Surveyed Say “Yes”

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.