Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

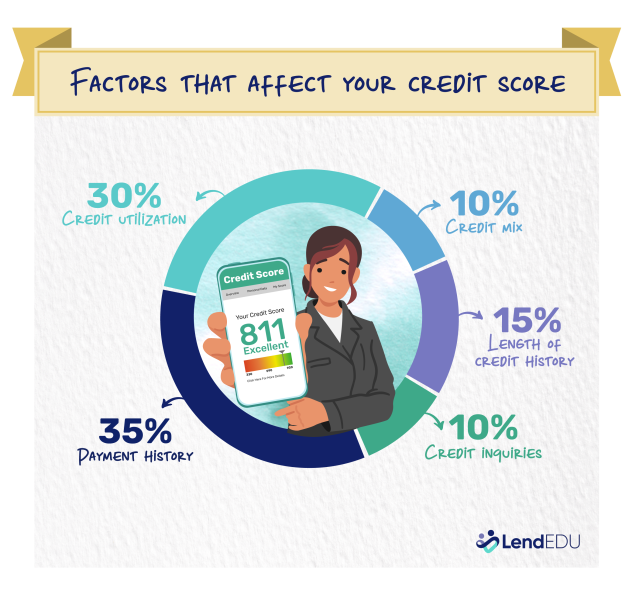

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

Why “Average” Net Worth Numbers Are Misleading (No Matter Your Age)

Headlines about wealth grab attention fast, especially when they tell you what’s “average.” But those numbers rarely tell the full story. Whether you’re in your 20s, 30s, 40s, 50s, or…

-

Do You Need an Attorney to File an Offer in Compromise? DIY vs. When to Hire a Pro

If you’re considering an Offer in Compromise (OIC), one of the first questions that often comes up is whether you need an attorney to file it. The short answer is…

-

Debt Validation Letters: What They Are And How to Send One

Few experiences are worse than checking the mail only to find a letter from a debt collection agency. It’s especially alarming if you don’t remember having the debt or if…

-

Invest Money: Trusted Companies and Resources

How would you like to invest your money? ‹ Savings Accounts Bonds Financial Advisors Gold IRA Crypto IRA › Savings accounts are designed to help you store cash while earning…

-

Reduce Debt: Trusted Companies and Resources

How would you like to reduce your debt? ‹ Refinance Student Loans Refinance Mortgage Refinance Auto Loans Personal Loans Home Equity Loans Tax Relief Debt Relief › Student loan refinancing…

-

Borrow Money: Trusted Companies and Resources

What type of borrowing are you looking for? ‹ Student Loans Personal Loans Cash Advance Home Equity Loans Mortgages Auto Loans › Student loans help cover education costs when savings,…

-

Venezuela’s 303 Billion Barrels: What the World’s Largest Oil Reserve Means for the U.S. Economy

Venezuela sits on an estimated 303 billion barrels of proven oil reserves, making it the country with the largest known oil deposits in the world. To put that number in…

-

Should You Pay Off Debts With a HELOC or Home Equity Loan? Experts Weigh In

If you’re a homeowner with credit card debt or student loan debt, you might be wondering if it’s a good idea to use a home equity loan or a home…

-

Best HELOCs for Investment Properties: February 2026 Rates

An investment property can pay for itself and then some if you’re collecting enough rent to cover the mortgage, plus a little extra. As your rental property’s value grows, so…

-

Is CCS Offices a Legit Debt Collector? How to Handle Calls and Texts

Credit Collection Services (CCS) Offices is a legitimate debt collection company. But before you respond, it’s important to know a few things. First and foremost: Just because CCS Offices says you…