Auto loans

- Loan aggregator that matches borrowers with partner lenders

- Offers loans to buy out your car lease or purchase a company car

- Low credit score and income requirements

- Access to a large network of lenders

- Financial advisor guides you through your offers

- Does not offer new or used car purchase loans

- Does not disclose loan rates or terms on its website

| Rates (APR) | Not disclosed |

| Loan amounts | No minimum or maximum |

| Repayment terms | Varies by lender |

Auto loan refinance

- Prequalify online with just a soft credit check

- View refinancing offers from a large network of lender to lower your rate and payment

- Financial advisor guides you through your offers

- Lack of transparency about rates and terms

| Rates (APR) | Not disclosed |

| Loan amounts | No minimum or maximum |

| Repayment terms | Varies by lender |

Established in 2007, Tresl is an auto loan aggregator that matches borrowers with partner lenders. Tresl works with a large network of banks, credit unions, and other financial institutions. Applicants can receive multiple auto loan offers for refinancing, leases, and company car purchases.

Tresl also provides service protection products, such as vehicle service contracts, road hazard protection, and guaranteed asset protection. Prequalifying involves inputting the required information online and receiving your offers. A dedicated financial advisor will guide you through the process to select the right loan for you.

Our take on Tresl auto loans

Tresl also offers auto loans to buy out your car lease or purchase a company car. It does not offer typical auto loans on new or used cars.

The biggest benefit we found with Tresl’s auto loans is its lenient eligibility requirements. Auto loans are available to adults in the U.S. who are 18 years of age or older with at least a 500 credit score with no active bankruptcies and at least $1,500 per month in household income.

With low credit score and income requirements plus access to a large network of lenders, Tresl is a good option for buyers who struggle to get loan approval. The application process is straightforward but if you need assistance, customer service can be a challenge—it’s only available by phone and reps may provide conflicting information.

Our take on Tresl’s auto loan refinance

Refinancing your auto loan with Tresl works the same as getting an auto loan. The same eligibility requirements apply, which makes refinancing with Tresl a good option for borrowers with bad credit and/or limited income.

According to the website, customers save an average of $1,182 annually by refinancing through Tresl. The initial application only requires a soft credit check to view offers without damaging your credit score.

The most concerning issue with Tresl is its lack of transparency. Information about loan qualifications is not readily available on its website, and customer service is reluctant to provide straightforward answers.

We were repeatedly encouraged to complete the application and then talk with a “Financial Advisor” to get the information requested.

Rates, terms, and more

Auto loan and refinance rates and terms are not published on the Tresl website. To determine what loan terms would apply, you need to complete the initial application and view lender offers.

Details on loan origination and other fees are also unavailable; when asked for this information, customer service declined to give a response and directed us to complete the application.

Tresl’s auto loans and refinancing are available to residents in all 50 states. There is no published minimum or maximum loan amount.

Rates and repayment terms vary by lender. Once you complete the application, you can view loan offers to see the terms provided. There is no charge to use Tresl’s service, but you may be assessed a loan origination fee depending on the offer and lending institution used.

| Term | Details |

| Rates | Varies by lender |

| Loan amounts | No minimum or maximum |

| Repayment terms | Varies by lender |

| Availability | Available in all 50 states |

| Fees | May be subject to a lender fee |

Who’s eligible for Tresl auto loans?

To qualify for an auto loan with Tresl, you must be at least 18 or older. Tresl works with a wide range of lenders, so applicants with low credit scores—as low as 500—can apply. However, keep in mind that borrowers with open bankruptcies will not be approved.

The minimum income requirement for loan approval is $1500 combined household gross per month with at least one source of verifiable income. If you have difficulty getting loan approval, applying with a cosigner is permitted. When submitting a joint application, both the primary applicant and the cosigner must meet the minimum requirements for the loan to be approved.

To be eligible for financing, vehicles must be in the 2014 model year or newer with 150,000 miles or less. The loan requirements for refinancing, company car purchase, and lease buyout are all the same. Tresl is licensed across the U.S., so residents of all 50 states are free to apply.

| Requirement | Details |

| State of residence | Available in all 50 states |

| Vehicle requirements | 2014 or newer, 150,000 miles or less |

| Minimum credit score | 500 with no open bankruptcies |

| Minimum income | Gross household income $1500/ month |

| Age | 18 years of age or older |

How do you repay an auto loan from Tresl?

Specific repayment terms are presented to you once you complete the loan application. You’ll be shown offers from various lenders; you can select which loan terms and repayment options work best for you.

Once you’ve received your loan, you can repay your loan through your chosen lender.

Pros and cons of Tresl auto loans

Pros

-

Easy application

The prequalifying process is user-friendly, fully online, and only requires a soft credit check, so your credit score remains unaffected.

-

Reasonable requirements

With lower income and credit score requirements compared to other online lending platforms, Tresl is accessible to a broader range of applicants.

-

Multiple options

Thanks to Tresl’s large network of lenders, potential borrowers typically have several loan options to choose from.

Cons

-

Limited loan types

Tresl only offers auto loan refinancing, lease buyouts, and company car purchases. For standard auto loans on new and used cars, you’ll need to work with another lending platform.

-

Possible lender fees

Borrowers may be charged a loan origination fee; this information is only disclosed after prequalification when viewing loan offers.

-

Lack of transparency and support

The Tresl website provides few details about loan products, rates, and repayment terms. Customer service at Tresl often lacks clarity and responsiveness.

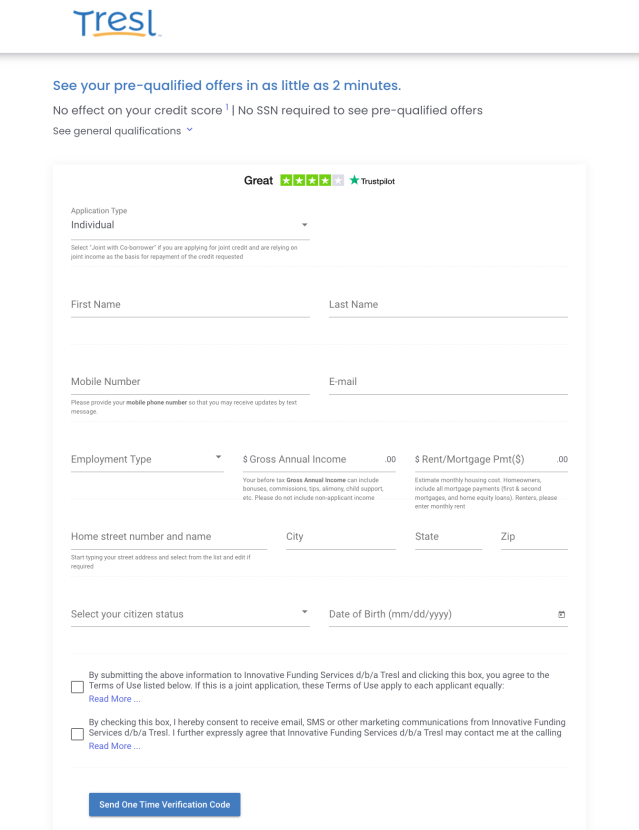

How do I apply with Tresl?

Tresl’s application process is simple on its website.

To apply for a lease buyout or company car purchase, simply fill out the one-page application to prequalify. You will receive a verification code, and then be able to see prequalified offers in as little as two minutes.

To apply for auto loan refinancing through Tresl requires a few more steps. Here’s a closer look:

1. Indicate what you want to change about your current auto loan.

2. Select the model year of the vehicle you’re refinancing.

3. Provide the vehicle’s make.

4. Identify the model.

5. Choose the vehicle trim options to help identify which package features and upgrades the car includes.

6. Enter the estimated payoff amount and mileage.

7. Provide your personal information and indicate if you’re applying alone or with a cosigner.

8. If applying with a cosigner, you’ll need to provide their name, email, phone number, and date of birth, residence, and employment information.

9. Supply information about your residence.

10. Provide details about your employment status, employer name, job title, income, etc.

11. Review all the information you’ve entered then agree to the terms and click “submit” to view your loan options.

Recap of Tresl auto loans and refinance

| Product | Our rating | |

| Tresl auto loans | 3.3 out of 5 | View rates |

| Tresl auto refinance | Not rated | View rates |

About our contributors

-

Written by Christi Gorbett

Written by Christi GorbettChristi Gorbett is a finance writer with a master’s degree in English and years of experience. She specializes in creating financial content that simplifies complex topics, making them easier for a wide audience to understand.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.