Have you been declined much-needed funding due to a low or non-existent credit score?

Are you preparing to take on a mortgage, and trying to get the best possible rate?

We’re here to help.

Improving your credit score can open doors to financing approval, lower interest rates, better loan terms, and increased financial stability over the long term.

Whether you need a quick boost or a long-term change, this guide offers step-by-step strategies for raising your credit score fast.

We’re talking over a 90-day period.

And we’ll work on building good habits that last a lifetime in the process, so your score will never hold you back again.

- Improve your credit score +45 to +86 1

- Plans starting at $15 per month

- No minimum credit score required

- No hard credit check

Table of Contents

- What affects your credit score?

- How to improve your credit score in 3 months

- Long-term credit strategies

- How to handle collections and bad credit

- How to build credit without a credit card

- Tips if you’re preparing to buy a house

- How to monitor and maintain a high credit score

- When to get professional help

- FAQ

What affects your credit score?

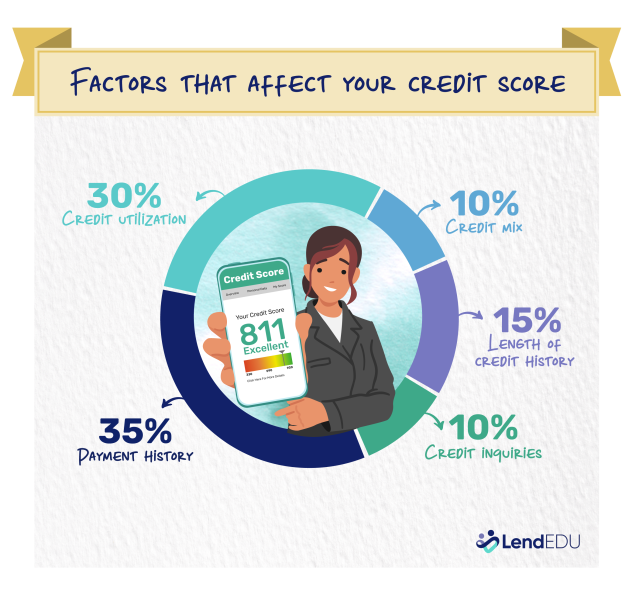

According to FICO, the five main components of your credit score are:

- Payment history (35%): Late payments stay on your report for up to seven years.

- Credit utilization (30%): Ideally, use less than 10% of your total credit.

- Length of credit history (15%): Keep your oldest accounts open.

- Credit mix (10%): A mix of credit cards, loans, and other accounts can help.

- New credit/inquiries (10%): Too many hard inquiries in a short period can hurt your score.

Other important notes:

- Checking your credit score won’t hurt it.

- You don’t need to carry a balance to build credit.

How to improve your credit score in 3 months

Weeks 1–4: Quick wins

Start your credit improvement journey with these fast-impact strategies:

- Dispute credit report errors: Errors are common—fixing them can deliver fast results.

- Request a credit limit increase (with a soft pull only): Lowers your utilization.

- Pay down existing credit card balances: Aim for under 10% of your limit.

- Use Experian Boost or UltraFICO: Add utility or phone payments to your credit report.

- Become an authorized user: Piggyback on someone else’s strong credit history.

- Move debt to a personal loan: Can help improve your utilization and credit mix.

Month 2: Establish momentum

- Set up autopay: Avoid late payments by automating minimum payments.

- Make payments twice a month: Keeps balances low when statements close.

- Use a credit builder loan: Start building payment history even without a credit card.

- Negotiate collections: Contact agencies and settle if possible.

- Create an emergency fund: Avoid future debt by setting aside savings.

The time frame for improving your credit score depends on your level of debt or the credit you need to build. I set an expectation of six to 18 months.

Erin Kinkade, CFP®

Month 3: Lock in good habits

- Stick to a debt payoff plan: Snowball or avalanche method can accelerate results.

- Avoid new hard inquiries: Hold off on applying for new credit unless necessary.

- Continue tracking your utilization: Keep credit card balances low.

- Check your credit score monthly: Use free monitoring tools like Credit Karma.

Long-term credit strategies

Even after you see progress in three months, stick with these habits:

- Keep old accounts open to build credit age.

- Refinance loans for lower interest if eligible.

- Diversify credit types only when necessary (e.g., a car loan or personal loan).

- Use secured cards if you’re rebuilding from bad credit.

- Avoid maxing out cards—even temporarily.

How to handle collections and bad credit

Recent changes have made it easier to recover from collections:

- Monitor reports monthly to prevent new collection accounts from appearing.

- Medical debt under $500 is no longer reported.

- Verify debts before paying—dispute any errors.

- Settle older accounts and ask for pay-for-delete if possible.

How to build credit without a credit card

- Become an authorized user on a family member’s card

- Apply for a reputable credit builder loan

- Report your rent and utility payments

- Pay other installment loans (e.g. student loans) on time

Tips if you’re preparing to buy a house

Want to improve your credit score to qualify for a mortgage?

- Don’t take on new loans or credit cards once preapproved.

- Dispute errors and address collections at least three months before applying.

- Work aggressively to reduce debt and improve DTI.

- Ask lenders what credit scores yield the best interest rates.

How to monitor and maintain a high credit score

- Set a target: A FICO score above 740 can get you the top loan rates.

- Use free tools to check your score regularly.

- Dispute inaccuracies on all three bureaus’ reports annually.

- Avoid late payments: Autopay helps.

- Watch your debt-to-income ratio, even though it doesn’t affect your score directly.

Tracking your credit helps detect fraud and protects your long-term financial health.

Erin Kinkade, CFP®

When to get professional help

- Avoid credit repair scams. Always work with trusted, certified professionals.

- Credit counselors can help with budgeting and payment strategies.

- Debt relief companies like National Debt Relief may help settle accounts if you’re overwhelmed.

FAQ

How long does it take to improve your credit score?

You may see results within a few months, especially after paying down balances or fixing errors. Bigger changes (like resolving collections) may take six to 12 months.

Can I improve my credit score without a credit card?

Yes. You can report rent and utilities, use credit builder loans, or pay other loans on time.

How can I quickly improve my score?

Pay off credit card balances, request credit line increases, and dispute incorrect information on your credit report.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.