How to calculate your home equity in 5 steps

Table of Contents

- How to Calculate Your Home Equity in 5 Steps

- FAQ

Step 1. Learn the value of your home

First, you need to estimate the current value of your home. You can either get an idea of this with online tools, or have it done professionally.

How can I get an online estimate?

Online estimates, such as those from Redfin or Zillow, can give you a ballpark idea of your home’s value but are less reliable than an official appraisal. Redfin reports a median error rate of 2.26% for homes on the market and 7.40% for off-market homes. Zillow’s “Zestimates” have a similar margin of error, at 3.20% and 7.52%, respectively.

If you’re unsure of your current home value, consider contacting a local appraiser or checking with your appraisal district. Online estimates can provide a general idea but aren’t as precise as a professional appraisal.

How do I get a professional appraisal?

To get a professional appraisal, hire a third-party appraiser—it may cost several hundred dollars. If you’re applying for a cash-out refinance, HELOC, or home equity loan, your lender will likely require an appraisal and arrange for it, but the cost will be included in your closing costs.

Step 2. Check your current mortgage balance (and other lien balances)

This step should be simple enough. If you’re not already aware of the outstanding balance on your mortgage after your most recent payment, you can either check the last bill that came in the mail, log into your online account to view the balance digitally or call up your lender.

If you have any other liens outstanding on your home, for example, if you took out a home equity loan, have tax debt, or have a lien placed due to legal judgment, add these to this number as well. (Note: The calculator above gives you the ability to add these separately from your mortgage balance and still have them factor into the equity calculation.)

Step 3. Calculate your home equity

Now that you have the two numbers you need, you can use the simple formula we introduced earlier to calculate your home equity.

Value – Owed = Equity

And of course, you can make things even easier by using the calculator to get this number.

Step 4. Calculate the equity percentage you have in your home

To express your equity as a percentage, you can now divide your home equity by your home’s appraised value.

(Equity / Value) x 100 = % Equity

Step 5. Calculate your loan-to-value ratio (LTV)

We’re going to introduce one more percentage that’s helpful to have on hand, but please keep in mind that it’s different from your equity expressed as a percentage from step 4.

This next percentage is your loan-to-value ratio (LTV). This calculation tells you how much you owe on your mortgage (and other liens, if applicable) relative to your home’s value. The formula to calculate LTV is:

(Owed / Value) x 100 = LTV

A lower LTV indicates more equity, which benefits you when seeking a home equity loan, HELOC, or canceling private mortgage insurance (PMI). It’s important to know this number when seeking to leverage your equity. For example, when shopping for a home equity loan (HEL) or line of credit (HELOC), you’ll often see lenders mention the maximum LTV that they will accept from applicants.

That’s because LTV is directly related to the % equity you have in your home. Lower LTV = higher equity. They are two halves of a whole! If you subtract your LTV from 100%, you’ll get your percent equity.

100% – LTV = % Equity

And vice versa—if you subtract your % equity from 100%, you’ll get your LTV.

100% – % Equity = LTV

For example, with an LTV of 25%, you’d have 75% equity in your home.

Starting to make sense, right?

If anything still feels unclear, play around with the calculator until you get a better feel for how equity is calculated, or check out the FAQ below!

Step 6: Calculate equity over time

Now that you know all the basics of your home equity, you can start looking towards the future. Use the calculator below to figure out how much equity you’ll have in 5, 10, 15 or any number of years into the future of your choosing.

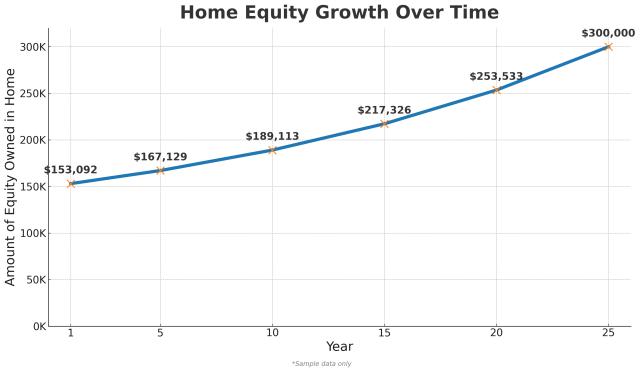

For example, if you have a home valued at $300,000, an outstanding mortgage balance of $150,000, 25 years left on your loan term, and a 5% interest rate:

- In 5 years you will have $167,130 in home equity and an LTV of 44.29%, after paying $17,130 in principal and $35,515 in interest.

- In 10 years you will have $188,434 in home equity and an LTV of 37.19%, after paying down $38,434 in principal and $66,856 in interest.

- In 15 years you will have $216,492 in home equity and an LTV of 27.84% after paying down $66,492 in principal and $91,444 in interest.

How much equity will I have in 1, 5, 10 or more years?

Let’s break it down year by year. Again, in this example, you have a home valued at $300,000, an outstanding mortgage balance of $150,000, 25 years left on your loan term, and a 5% interest rate:

| Year | Amount of equity | LTV | Principal paid | Interest paid |

| 1 | $153,092 | 49% | $3,093 | $7,430 |

| 5 | $167,130 | 44% | $17,130 | $35,483 |

| 10 | $189,113 | 37% | $39,113 | $66,113 |

| 15 | $217,326 | 28% | $67,326 | $90,513 |

| 20 | $253,533 | 15% | $103,533 | $106,919 |

| 25 | $300,000 | 0% | $150,000 | $113,066 |

And if you’re more of a visual person, here’s how the growth in your owned equity looks over time.

FAQ

Why don’t I have more equity when I pay my mortgage every month?

Most of your mortgage payments go toward interest early in your mortgage term, so your equity builds slowly. Over time, more of each payment reduces your principal, allowing your equity to grow faster. To build equity quicker, consider making extra payments directly toward your principal balance.

How do I increase my home equity?

You can grow your equity by improving your home’s value or paying down your mortgage. Making extra payments toward your principal is an effective strategy. For example, adding $100, $200, or $300 to your monthly payments or making one additional payment per year can significantly reduce the total interest paid and shorten the time to reach 100% equity.

What is 100% equity?

You have 100% equity if you’ve bought your home outright or fully paid off your mortgage (and other liens that you might have had).

What is negative equity?

You could have “negative equity” if you owe more than the home is worth, which might happen if its value decreases or you take out additional debt, including a home equity loan, HELOC, or cash-out refinance.

How can I tap into my home equity?

Sure, the obvious option is to sell. But you don’t need to sell your house to access your home equity. Consider these options:

- Cash-out refinancing: Replace your mortgage with a larger one, and get the difference in cash.

- Home equity loan: Borrow a lump sum with fixed payments.

- Home equity line of credit (HELOC): Withdraw funds as needed, with variable rates and payments.

How much of my home equity loan can I tap into?

Most lenders allow a combined loan-to-value (CLTV) ratio between 80% and 90%. To find out how much you can borrow, use this formula:

(Desired home equity loan + Outstanding mortgage balance) / Appraised home value

Do I have enough equity to qualify for a home equity loan or HELOC?

Requirements vary, but most lenders look for:

- A combined LTV of 90% or less

- A debt-to-income ratio of 45% or lower

- A credit score of at least 620

Since HELOCs and home equity loans are second mortgages, lenders will scrutinize your income to ensure you can afford both your mortgage and the new loan payments.

Do I have enough equity to cancel PMI?

If you put down less than 20% on your home, you might be paying PMI, which can increase your monthly costs. You can request to cancel PMI when you reach 80% LTV. If you miss this, your PMI will automatically be canceled once your LTV reaches 78%. For government-backed loans, such as an FHA mortgage, you’ll need to refinance to a conventional loan once you reach 80% LTV.

About our contributors

-

Written by Aly Yale

Written by Aly YaleAly Yale is a freelance writer with more than a decade of experience covering real estate and personal finance topics.