A subordinate mortgage, such as a home equity loan or line of credit (HELOC), is repaid only after your primary mortgage if your home is sold—whether voluntarily by you or through foreclosure by the lender. While subordination affects the order in which lenders are paid, it doesn’t affect your regular payments.

Understanding how subordinate mortgages work is essential, especially if you’re refinancing or juggling multiple loans. With the right knowledge, you can make confident and informed financial decisions.

Table of Contents

What is a subordinate mortgage?

A subordinate mortgage is any loan taken out against your home after your primary mortgage. It’s called “subordinate” because it comes second (or later) in line regarding repayment. If your home is sold, the primary mortgage must be repaid before funds go to a subordinate mortgage lender.

When you use a mortgage to buy a home, your lender secures the loan by placing a lien on your property. This means the lender has a legal claim to your home and the proceeds if you sell it. If you only have one loan, your primary lender has the first and only claim to the property.

However, if you take out an additional loan—such as a home equity loan or HELOC—this new loan is considered subordinate because it stands behind the primary loan in repayment order. The lien position on the second mortgage is subordinate to (behind) the primary mortgage.

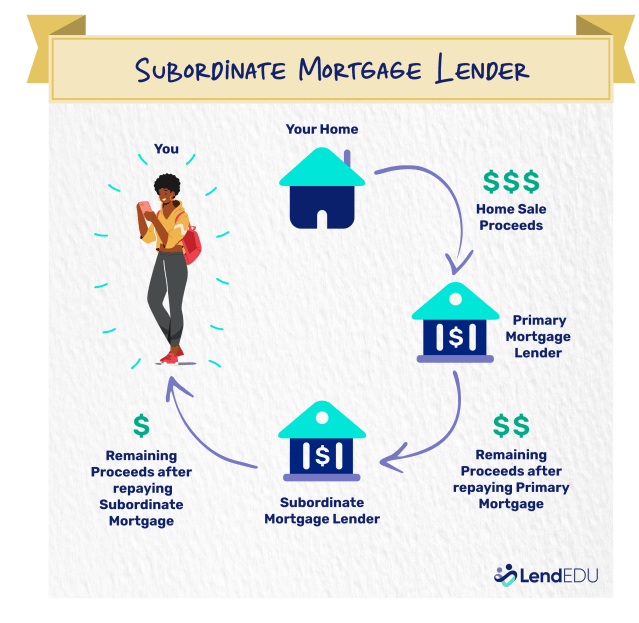

In simple terms, if your home is sold, the lender of your primary mortgage will get paid first. The lender of the subordinate mortgage will only receive repayment from whatever money is left over. Any remaining money after all the mortgage debt is repaid in full is yours.

The image above shows the process of distributing the proceeds from the sale of your home to the primary mortgage lender, subordinate mortgage lender, and you.

Lenders in a subordinate lien position to the primary mortgage lender have more risk because they’ll only be repaid if enough money is left after paying the first mortgage. This higher risk is why subordinate mortgages often come with higher interest rates.

For homeowners, taking out a subordinate mortgage can be a practical way to access funds to make home improvements or consolidate debt. However, it’s essential to consider the costs and risks involved.

Knowing how lien positions work and how sale proceeds are distributed can help you make confident decisions about whether a subordinate mortgage is the right choice for your financial situation.

What does it mean if my HELOC or home equity loan is a subordinate lien?

If you have a HELOC or home equity loan and find out it’s a subordinate lien, it means the proceeds from selling your home will first go toward paying off your primary mortgage.

Only after the primary mortgage is repaid are the remaining funds applied to your HELOC or home equity loan.

To clarify:

- A mortgage is a loan that uses your home as collateral.

- A lien is the legal claim lenders have on that collateral.

- A subordinate mortgage or lien means the subordinate lender’s claim comes after the primary lender’s in the repayment order.

Defaulting on a loan means failing to make the payments required under the terms of the agreement. When this happens with a HELOC or home equity loan, the lender has the right to foreclose on your home, even if its lien is subordinate.

Foreclosure allows the lender to force the sale of the property to recover the owed amount.

It’s important to remember that defaulting on the primary mortgage or a subordinate loan puts your home at risk. HELOCs and home equity loans can be helpful tools for accessing your home’s equity, but failing to repay as agreed could result in losing your home.

Understanding how these loans work and planning repayment is vital to protecting your financial stability—and your home.

If I have a client weighing the benefits or taking out a HELOC or home equity loan as a subordinate mortgage, I first remind them that if they have a mortgage, all HELOCs and home equity loans are subordinate mortgages.

I want to know the purpose of the loan to ensure it provides an economic benefit to them. If they plan to sell the home in the near term, I would advise them to look elsewhere for needed funds due to the costs associated with establishing a HELOC and home equity loan.

If they determine they want to move forward with a subordinate mortgage, we will list the pros and cons associated with each to ensure they are financially stable to absorb any negative impact acquiring the second mortgage may pose. And again, I want to help them decide whether they’re getting an economic benefit by taking out the HELOC or home equity loan.

Erin Kinkade, CFP®

How does mortgage subordination affect me?

Mortgage subordination primarily benefits lenders by defining the order in which they’re repaid when your home is sold. This can happen voluntarily, through a sale, or involuntarily, through foreclosure.

For the most part, mortgage subordination doesn’t affect your day-to-day financial life. However, it’s helpful to understand how it influences the phases of home equity and mortgage borrowing.

Repayment

Mortgage subordination doesn’t change anything while you’re making payments as agreed. You’ll continue to pay your primary mortgage and any subordinated loans—a HELOC, for example—as outlined in your loan agreements.

If you sell your home before repaying the loans in full, the proceeds will go first to the primary mortgage lender. Any remaining funds go to subordinate lenders, such as HELOC lenders. You’ll get the leftover funds after all debts are repaid.

In the case of foreclosure, the same rules apply. The primary lender is repaid first. Subordinate lenders get funds if anything remains. If you stay in the home and repay your loans in full, the subordination does not affect you.

Refinancing

If you refinance your primary mortgage and have a HELOC or other subordinate loan, your HELOC lender must agree to remain in a subordinate position. This requires the HELOC lender to sign a subordination agreement, a legal document confirming the new lender’s primary lien position.

Your HELOC lender will typically agree to sign the subordination agreement if your finances and home equity remain sound. However, getting this legal document signed may add time to the refinancing process.

Credit

Subordination doesn’t affect your credit score. Credit bureaus don’t track lien positions; these are about lenders’ repayment rights, not your creditworthiness. Your credit score depends on your payment history, outstanding balances, account types, and the length of your credit history.

What does a subordination agreement look like?

A subordination agreement is a legal document lenders sign to set the order of their lien positions on your home. It’s typically required when you refinance your primary mortgage while keeping a HELOC or home equity loan. Each lender has its own format, so how it looks will vary.

Refinancing involves filing a new lien, and the new primary lender must ensure it holds the first lien position. To do this, the new mortgage lender will require the second mortgage lender to sign a subordination agreement, confirming that the home equity loan or HELOC remains subordinate to the new mortgage.

The contents of a subordination agreement vary by lender but generally include:

- Borrower information: Your name and details as the homeowner.

- Collateral description: A description of the property securing the loans.

- Lender details: The names of the lenders involved.

- Loan details: Information about the loans, such as amounts and terms.

- Priority order: A statement identifying which lender has the first lien position and which is subordinate.

You can review this document to verify the priority of your loans, but it’s mainly relevant to the lenders’ repayment rights. For you, it doesn’t affect how you make payments or manage your loans.

If refinancing or keeping a HELOC or other subordinate loan is part of your plans, ask your new mortgage lender how the subordination process may affect the timeline or requirements.

About our contributors

-

Written by Megan Hanna, CFE, MBA, DBA

Written by Megan Hanna, CFE, MBA, DBADr. Megan Hanna is a finance writer with more than 20 years of experience in finance, accounting, and banking. She spent 13 years in commercial banking in roles of increasing responsibility related to lending. She also teaches college classes about finance and accounting.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.