1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

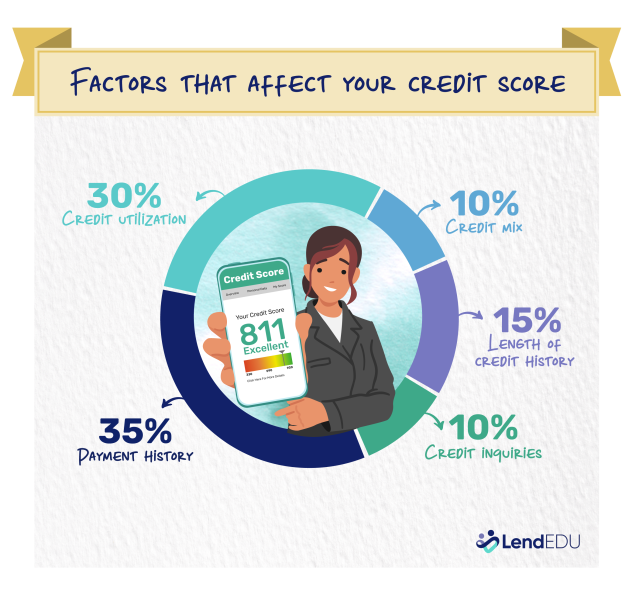

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

Latest on personal finance:

JG Wentworth Debt Relief Review 2025: Good Reputation, Mixed Customer Reviews

Min. required debt $7,500 Standout feature 30-year track record Settlement fee 18% – 25% of...

Current Fintech Review 2025: A Mobile Banking App Built for Speed, Rewards, and Flexibility

Does traditional banking feel slow and outdated? If you’re looking for a modern alternative that...

What Happens If I Can’t Pay My Credit Card?

If you can’t pay your credit card bill, you’re not alone. Many people fall behind...

New Era Debt Solutions Review 2025: A Trusted Option With No Upfront Fees

New Era Debt Solutions helps people navigate high debt and negotiates with creditors on their...

Money Management International Review 2025: Accredited, Specialized Financial Counseling

Money Management International (MMI) is a nonprofit credit counseling agency that focuses on debt management...

Current vs. Chime vs. Varo: Compare Fees, Features, and Perks in 2025

Current, Chime, and Varo are three of the most popular mobile banking apps in 2025....

Chime Fintech Review 2025: A No-Fee Mobile Banking App for Early Direct Deposit

Chime is a mobile-first fintech, not a bank. That means it offers mobile app-based banking...

Americor Debt Relief: Great Customer Satisfaction but Above-Average Fees

What does Americor debt relief do? Americor is a debt relief provider aimed at helping...

Trinity Debt Management 2025 Review: Christian-Centered Debt Relief?

It’s important to find a source you can trust when it comes to dealing with...

American Consumer Credit Counseling Review: ACCC Debt Management Plans That Don’t Tank Your Credit

What does American Consumer Credit Counseling do? American Consumer Credit Counseling offers a number of...