You need to borrow, but you’re torn between using a HELOC or a 0% interest credit card to cover planned or unplanned expenses.

A home equity line of credit (HELOC) lets you convert equity into cash and repay what you owe over five to 20 years. Zero-interest credit cards let you make purchases and pay no interest during a set period, typically six to 21 months. Once the promotional period ends, the regular rate applies to any remaining balance due.

Which is better? Keep reading to learn how to compare HELOCs and credit cards to decide which one best suits your needs.

Table of Contents

What is a HELOC?

A HELOC is a revolving line of credit that’s secured by your home. HELOCs are, in some ways, like credit cards: As you use your credit line, your available limit shrinks. If you make a payment, you can free up available credit.

How does a HELOC work?

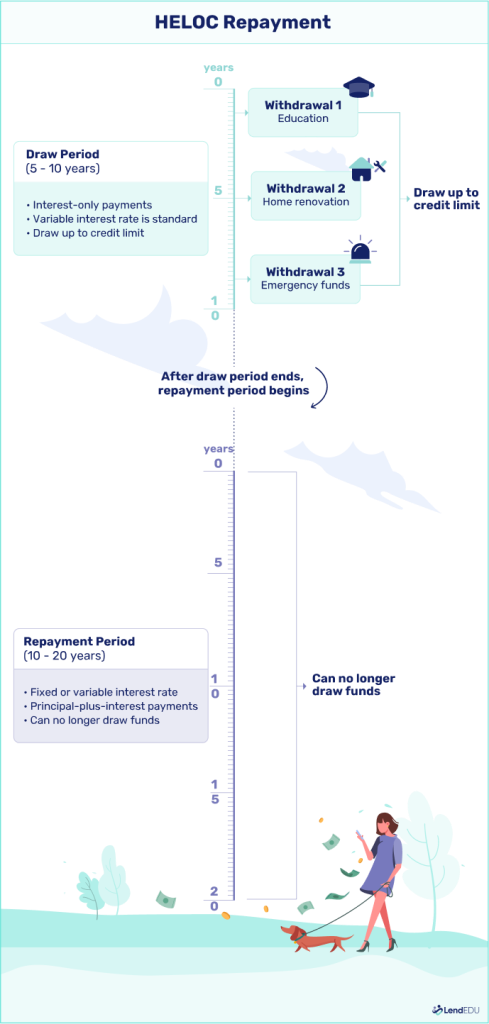

A home equity line of credit is a type of second mortgage you repay, on top of the primary mortgage you used to buy your home. Here’s how a HELOC works, typically.

- You’re approved for a line of credit based on your home equity, credit scores, income and other factors.

- During the draw period, you can access your credit limit. You may be required to make interest-only payments during this time.

- After the draw period ends, you pay back what you borrowed with interest.

Your lender can explain the specifics of how your HELOC works if you decide to apply for one.

HELOC vs. credit cards

HELOCs and 0% interest credit cards differ in several ways. To keep things simple, we’ve summarized the main differences in the table below.

| HELOC | Credit card | |

| Rates | 8.12% APR* (often variable) | 0% APR for 6 – 21 months, depending on the card; after that, a regular variable APR |

| Repayment term | 5- to 10-year draw period, then up to 20 years for repayment | Only the minimum payment due is required |

| Borrowing limit | Up to a combined LTV (often 85%) | Varies by card |

| Min. credit score | 720 | 670 |

| Collateral | Secured by your home | None |

| Monthly payments | Interest-only during draw period; principal and interest during repayment | Min. principal and interest payment, typically 1% – 5% of the balance due |

| Benefits | Autopay rate discounts; interest may be tax-deductible when you use your HELOC to make home improvements | Rewards on purchases, introductory welcome bonuses, travel perks, exclusive discounts or access to special events |

Here’s a side-by-side comparison of the Figure HELOC (our choice for the best HELOC) and the Chase Freedom Unlimited card, a popular 0%-interest credit card.

Visit Site

Visit Site

|

Visit Site

Visit Site

|

|

| Rates (APR) | 6.35% – 10.85% fixed | 0% intro on purchases and balance transfers; regular variable 18.99%–28.49% rates |

| Rates (APR) | Rates (APR) | |

| 6.35% – 10.85% fixed | 0% intro on purchases and balance transfers; regular variable 18.99%–28.49% rates | |

| Repayment term | 5, 10, 15, or 30 years | 0% intro APR for the first 15 months |

| Repayment term | Repayment term | |

| 5, 10, 15, or 30 years | 0% intro APR for the first 15 months | |

| Credit limit | $20,000 – $400,000 | Varies |

| Credit limit | Credit limit | |

| $20,000 – $400,000 | Varies | |

| Credit score | 720+ preferred | 670+ preferred |

| Credit score | Credit score | |

| 720+ preferred | 670+ preferred | |

| Benefits | 100% online application process; option to redraw up to 100%; competitive fixed rates | $200 intro bonus; cashback rewards on eligible purchases; no annual fee |

| Benefits | Benefits | |

| 100% online application process; option to redraw up to 100%; competitive fixed rates | $200 intro bonus; cashback rewards on eligible purchases; no annual fee | |

| See our full list of the best HELOC lenders. | ||

Repayment

HELOCs have structured terms, split between the draw period and repayment period. Your lender will provide an amortization schedule that outlines your monthly payment due, the total number of payments required, and the estimated date when your HELOC will be paid off.

Credit cards only require a minimum payment due each month. With a 0% interest card, you’ll need to pay the balance off before the promotional period ends to avoid accruing interest charges on your balance.

Interest and fees

HELOCs may have fixed or variable interest rates; some offer both. For example, you might pay a fixed rate for the first six months and then switch to a variable rate, or vice versa. Some lenders charge origination fees, annual fees, or prepayment penalties. Some, including our team’s picks for the three top-rated HELOC lenders, Figure, Aven, and FourLeaf, offer no-closing-cost HELOCs.

Zero-interest credit cards have no interest charges until the promotional period ends. Some cards may charge an annual fee, and most cards charge a fee for late payments. If you’re using a 0% card to transfer a balance, a balance transfer fee will likely apply.

Limits

HELOCs tend to have higher borrowing limits than credit cards. Based on your home equity, credit scores, income, and debt, you may be able to borrow up to $750,000 with Figure or even $1 million with FourLeaf Credit Union.

Credit card limits are usually lower. For example, you might be approved for a $5,000 limit initially when applying for the Chase Freedom Unlimited card, and your limit may increase over time.

Eligibility

A HELOC is usually harder to get than a credit card. HELOC requirements include equity to borrow against, good credit, steady income, and low debt. Most HELOC lenders in our experience won’t approve borrowers with credit score below 720.

There’s no set minimum credit score required to get a credit card. A card like Chase Freedom Unlimited is typically geared for people with good credit, which means a FICO score of 670 or higher. But you can find 0% interest cards that accept lower credit scores.

I typically recommend a 0% interest credit card when the amount needed is relatively small, such as $10,000 to $20,000, and the client is confident they can pay it off within the promotional period.

For larger borrowing needs, I generally recommend a HELOC, provided the client qualifies, can access the necessary funds, and can manage the payments without disrupting their budget or long-term financial goals.

When to use a HELOC vs. 0% interest credit card

If you’re unsure when to use a HELOC vs. 0 interest credit card, looking at real-world examples can help you make a decision.

When a HELOC makes more sense

Generally, using a HELOC makes sense for planned expenses when the monthly payment required fits your monthly budget. Common HELOC uses include:

- Home improvements and repairs. HELOCs can help you tackle big or small home renovation projects. If HELOC funds are used to improve your home, you might be able to deduct the interest and save at tax time.

- Debt consolidation. You might use a HELOC to pay off high-interest credit cards or other debts, and streamline monthly payments. You could save money if your HELOC rate is less than what you were paying to your debts.

- Large purchases. Vacations, weddings, college expenses: They all add up, and a HELOC can give you the flexibility you need to cover the costs.

HELOC pros and cons

HELOCs have advantages and disadvantages.

Pros

-

Access larger credit limits

-

Interest-only payments during the draw period

-

Lower payments when you choose a longer repayment term

Cons

-

Longer repayment terms mean more interest paid overall

-

Default could result in losing your home

-

Variable-rate HELOCs can cost more if rates rise

When to use a 0% interest credit card

A zero-interest credit card could be a good fit if you’re confident you can pay off the balance before the promotional period ends. Examples of when to use a credit card include:

- Balance transfers. Transferring a balance from one card to another could save money on interest if you lock in a 0% rate.

- Rewards and bonuses. Some cards pay you back when you spend, in the form of miles, points, or cash back. You may also qualify for an introductory bonus when you meet a minimum spending requirement.

- Emergencies. In a pinch, a 0% credit card can help you cover expenses fast, without waiting for loan approval or a lender to disburse funds to you.

Credit card pros and cons

Pros

-

Easy to qualify for

-

Pay no interest with a 0% APR card

-

Flexible repayment

Cons

-

No fixed payoff date can make it easier for debt to pile up

-

Interest may accrue

-

Credit card APRs can be higher than HELOC rates

In my experience, many clients are able to successfully pay off their credit card balances by the end of the introductory period, often with the support of a financial coach or a trusted friend or family member to help them stay motivated and accountable.

However, industry research shows that some people struggle, either by rolling their balance into another 0% card and continuing the cycle, or by only paying off part of the debt and then facing steep interest charges once the promotional period ends. That’s why it’s important to approach this strategy with a clear payoff plan and proceed with caution.

Whether you choose a HELOC or a credit card, do your research. If you’re learning toward a HELOC, shop around. Compare the best HELOC lenders to find the loan that best meets your needs. And if you’re interested in a credit card, consider the rate, fees, and benefits you’ll have access to as a cardmember.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.