Gold has a reputation as a safe haven for wealth and a hedge against inflation. However, no investment is guaranteed. It’s crucial to understand that this precious metal can—and sometimes does—lose value.

Rising interest rates and falling inflation are two factors that can cause demand for gold to drop, along with prices. That doesn’t mean you shouldn’t buy gold, but you should understand why gold can lose value and how to protect your investment.

| Company | Best for… | Rating (0-5) |

|---|---|---|

|

Best Overall (866) 525-9625 |

|

|

Best for Small Investments (888) 612-4511 |

|

|

Best Buyback Program (866) 427-7710 |

|

|

Best Online Experience (866) 515-6340 |

|

|

Best for Quick Setup (877) 583-2399 |

|

Table of Contents

Does gold lose value?

Gold typically maintains or gains value over time, but its price can drop annually. Over the past two decades, gold has lost value during six of those years.

Some years saw minor drops in gold prices. For instance, the most recent decline in gold values occurred in 2022, when the price declined 0.23%.

The largest recent drop in gold prices happened in 2013. In that year, the value of gold declined nearly 28% thanks to a booming economy and strong dollar. After the Great Recession of 2008, investors returned to the stock market, and demand for gold lessened.

It was a similar situation in 1981 when gold prices tumbled by nearly a third. That was the largest drop in the value of gold during the past five decades. Experts consider it the result of a strong dollar and high interest rates.

So does gold lose value? This chart shows how the price of gold has fluctuated since 1970. The largest drops occurred in 1981 and 2013, but smaller declines have been recorded in every decade except the 2000s.

What factors cause gold to lose value?

The value of gold is affected by factors including economic conditions, geopolitical conflicts, and demand by consumers, businesses, and government agencies.

Inflation and the value of the dollar

Typically, interest in gold is high when inflation is high. As the U.S. dollar loses some of its purchasing power, many people look for an investment to maintain its value. Gold is traditionally seen as a hedge against inflation, and demand for the precious metal tends to climb during these times.

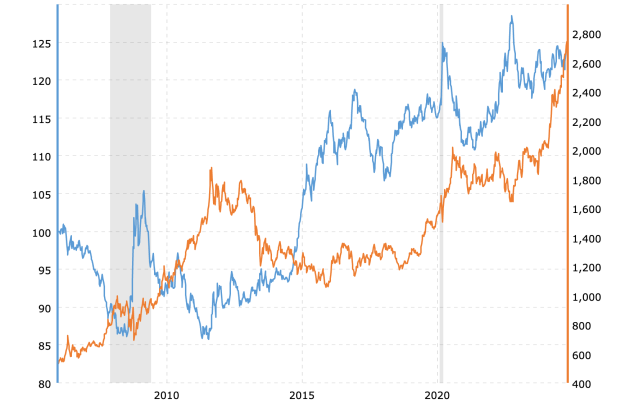

This chart shows the U.S. dollar and gold price correlation over 10+ years—the blue line and axis indicate the U.S. dollar index, and the orange line and axis indicate the price of gold.

As you can see, there is an inverse relationship between the strength of the dollar and the value of gold. When the dollar is weak, gold prices go up. When the dollar is strong, gold loses some of its value.

Meanwhile, the price of gold futures is tracked closely by the Consumer Price Index, which is the main measure of inflation in the U.S. When inflation spiked in 1980, 2011, and 2022, the price of gold futures rose sharply as well. As inflation fell, so too did the value of gold.

However, we are in an unusual time right now. Inflation is falling, but the price of gold continues to climb. That just goes to show that there are no guarantees when it comes to how an investment will perform.

Interest rates

Interest rates can also affect the value of gold. When other savings and investments are paying a higher rate of return, interest in gold wanes. Then, as fewer people buy precious metals, its price can drop.

When interest rates dropped after the Great Recession and the start of the COVID-19 pandemic, the price of gold increased. As interest rates rose and investors moved money to other assets, the price leveled off or declined.

We may be seeing this phenomenon in action now. The price of gold reached a record high after the Federal Reserve cut interest rates in September.

Geopolitical events

Although not as easy to quantify as the factors above, political and economic uncertainty can also affect the value of gold.

For example, gold prices have risen in correlation with major world conflicts for several decades. Values jumped when the Soviet Union invaded Afghanistan in 1979. They also surged after the start of the Iraq War and the Russian invasion of Ukraine.

This may happen because investors seek a safe haven in times of uncertainty. Gold isn’t tied to any country’s currency, which may provide peace of mind. And when the stock market is volatile, the price of gold may offer some stability.

On the flip side, in times of peace, people may feel comfortable investing their money elsewhere. This may cause gold demand—and prices—to fall.

Supply and demand

Supply and demand underlie all the above factors. When economic or geopolitical times are difficult, there may be higher demand for time-tested investments such as gold. However, gold is a finite resource, so there is only so much supply available. As a result, the value of gold rises and falls along with demand.

It’s not just consumer demand that affects gold prices, either. Many central banks invest heavily in gold. In 2023, they purchased 1,037 tonnes of gold, and their gold purchases continued robustly into this year as well. With central banks storing up gold, that means less supply to meet consumer demand.

Gold may also be in demand for industrial and commercial uses, such as the manufacture of electronics and jewelry. In addition, the demand for other precious metals, such as silver, may impact the demand for gold.

Common misconceptions about gold’s value

Not everything you hear about gold is true. Consider these common misconceptions.

Gold is a guaranteed inflation hedge

Gold is often used as a hedge against inflation because it can maintain its value when the dollar loses its purchasing power.

While this is often true, there is no guarantee that the value of gold will keep pace with inflation. In fact, on some occasions, gold has lost its value during inflationary periods. For instance, when inflation averaged 6.5% annually in the early 1980s, gold’s value declined for several years.

Gold is always a safe haven

Investors may also turn to gold as a safe haven that can withstand economic upheaval. But again, there is no guarantee that the value of gold will rise at a time when the stock market is volatile.

A 2024 study found that gold is a safe haven when the S&P 500 falls, but only in certain situations. Specifically, gold can be a strong safe haven when a market downturn happens for these reasons:

- Macroeconomic news and outlook

- International trade policy

- Terrorist attack

Meanwhile, gold is a weak safe haven for downturns caused by other reasons, such as elections and political transitions, corporate earnings, and government spending.

Gold prices can be easily predicted

Given how closely the price of gold tracks with some economic indicators, it can be tempting to think it’s easy to predict price fluctuations. For instance, it’s a common misconception that gold only appreciates when the dollar declines.

However, the price of gold is affected by complex, and sometimes contradictory, factors. There have been times, such as in the late 1970s, when the dollar index and price of gold have risen at the same time.

Long-term vs. short-term value of gold

The price of gold can change daily in response to the latest economic news and conditions. During the past 20 years, it has averaged about an 8% annual return, but don’t make the mistake of thinking the value of gold rises each year.

That average 8% return includes some years in which gold lost value, as much as 28%. However, years with a loss are balanced out by gains in other years, when gold’s value increased by as much as 32%.

The bottom line is this: Gold prices can be volatile in the short term, but they tend to gain value in the long term. That means it may be best to buy and hold gold rather than purchasing some in the hopes of selling quickly for a profit. However, be aware of maintenance costs and fees.

5 tips to prevent your gold investments from losing value

If you want to invest in gold, use the following tips to avoid losing money if the value of gold drops.

- Diversify your portfolio: This is smart advice for any type of investment. You don’t want all your money held in any single asset. If you buy physical gold, be sure to balance it with other investments.

Public and private securities, such as stocks and bonds are valuable diversifiers that can balance gold in a portfolio. Real estate is also a valuable diversifier. The money market in times of high interest rates may be appealing for risk-averse investors.

Kyle Ryan, CFP®

- Understand market cycles: Remember that the value of gold has historically risen and fallen in the short term. Knowing this can help you avoid being tempted to sell your gold if the price drops and, therefore, lock in any losses.

- Time investments strategically: While the value of gold is influenced by many factors, you can make an educated guess as to the best time to make a purchase. For instance, if you know an interest rate cut is coming, buying before that cut happens could mean you get a better price, as long as the interest rate cut hasn’t already been priced into the spot price of gold.

- Shop smart: Gold is subject to a markup. Compare prices at several dealers to ensure you are getting the best price. Also, consider buying items with a high purity level. These may more accurately follow the spot price of gold than collectible items that may have a variable value.

- Talk to a gold expert: A financial advisor may be able to guide how gold fits into your overall investment strategy. In addition to physical gold, they may be able to suggest gold ETFs and gold mining stocks that would be appropriate for your financial goals. Look for a financial advisor who has experience with gold and precious metals.

Before investing in gold, consider your rationale for purchasing it.

Kyle Ryan, CFP®

- Are you seeking growth? Depending on economic circumstances, that may or may not be the best place to invest your money.

- Are you seeking protection? Again, look at market conditions to determine if gold may or may not maintain its value. It is always subject to a decline, unlike fixed income assets such as bonds or CDs.

- Are you seeking diversification? If so, how will you hold the gold? ETF, mining stock, physical gold?

- How will you purchase it? Via an IRA? Make sure it fits with the IRS criteria and be aware of maintenance costs and fees. Are you storing it in a safe somewhere? Make sure you insure it and have it somewhere safe.

About our contributors

-

Written by Maryalene LaPonsie

Written by Maryalene LaPonsieMaryalene LaPonsie has been writing professionally for more than 20 years, including 15 years specializing in education, healthcare, and personal finance topics. She graduated from Western Michigan University, where she studied political science and international business. She resides in West Michigan.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Kyle Ryan, CFP®

Reviewed by Kyle Ryan, CFP®Kyle Ryan, CFP®, ChFC®, is a co-owner and financial planner at Menninger & Associates Financial Planning. He provides his clients with financial products and services, always with his clients' individual needs foremost in his mind.