Both gold and bitcoin fall under the category of alternative investments, i.e., holdings beyond the traditional stocks and bonds. Climbing inflation, unsteady interest rates, and recent developments like the launch of spot bitcoin ETFs motivate investors to explore cryptocurrency and precious metals as potential hedge assets.

You may wonder how gold vs. bitcoin perform, and which would be a smarter addition to your portfolio. Today, we’ll cover the key differences between the two, including price trends, security, and market caps.

Table of Contents

Gold vs. bitcoin at a glance

Although some refer to bitcoin as “digital gold,” the two are actually opposites in many ways.

Purpose

- Gold: A stable store of value often chosen as a safe-haven asset during economic upheavals.

- Bitcoin: A decentralized digital asset that could hedge against dollar devaluation.

Scarcity

- Gold: A precious metal with a finite supply. Approximately 216,000 tons of gold have been mined to date.

- Bitcoin (BTC): A fixed amount of 21 million BTC. About 19.8 million BTC are in circulation today.

Volatility

- Gold: A stable commodity that tends to appreciate steadily over time.

- Bitcoin: Extremely volatile with major price swings.

Accessibility

- Gold: Shipping bullion can take days or weeks.

- Bitcoin: Instantly accessible through crypto exchanges.

Security

- Gold: Needs secure storage; vulnerable to theft and natural disasters when kept at home.

- Bitcoin: Cold storage wallets are the safest storage option. Key loss and hacking can jeopardize bitcoin holdings.

Regulation and taxation

- Gold: Established regulation and capital gains taxes.

- Bitcoin: Evolving regulation, gains could be taxable.

Price of gold vs. bitcoin over time

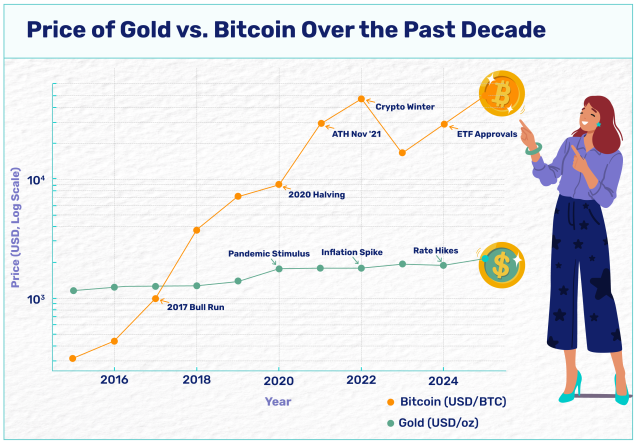

The price of gold fluctuates but follows an overall upward trend. In contrast, bitcoin has seen breathtaking upswings followed by sharp downfalls.

Check out the gold vs. bitcoin chart below for a visual breakdown of both assets’ performance.

Gold

Over the past decade, gold prices have increased from approximately $1,600 per ounce in March 2015 to around $3,000 today. After a dip in 2022, gold regained its footing and has been growing strong for the past two years. The shiny yellow metal has appreciated by about 50% since March 2023.

Economic uncertainty, shifting interest rates, geopolitical tensions, and rising demand from central banks all contribute to gold’s climbing prices.

Bitcoin

Compared to gold, bitcoin prices show a much more dramatic pattern. In March 2015, 1 BTC was worth about $250; by November 2021, 1 BTC had traded at over $60,000. A crash followed, with 1 BTC equaling under $17,000 at the start of 2023. Bitcoin then entered another period of impressive growth, surpassing $100,000 in January 2025.

While bitcoin’s linear performance chart may seem like an unpredictable rollercoaster, if you peek at the bitcoin price log chart here, you’ll see an exponential growth pattern that looks much more consistent. In simple words, while bitcoin can crash, you may expect it to reach even higher peaks down the line.

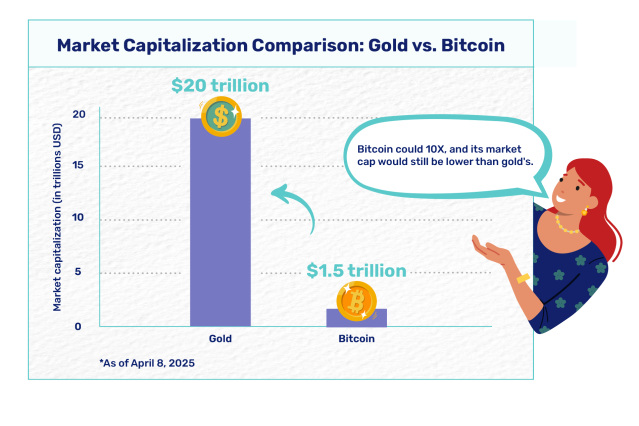

Market cap of gold vs. bitcoin

“Market cap” equals a circulating asset’s total value.

For gold, it’s:

Price per ounce X Total worldwide supply

For bitcoin, it’s:

BTC price X Total circulating bitcoins

When looking at gold market cap vs. bitcoin market cap, it’s obvious that gold is still, by far, the more widely used and universally accepted store of value.

In early April 2025, the market cap of gold was over $20 trillion, whereas bitcoin’s market cap was only a little over $1.5 trillion.

Nevertheless, the bitcoin market cap is growing, which means more people and financial institutions are adopting it as a valid currency.

Can bitcoin reach the market cap of gold?

This seems unlikely, at least in the near future. Bitcoin is just beginning to enter mainstream finance, whereas gold is a historically established, fully mature commodity with a stable market cap.

Bitcoin’s market cap is much less stable since the asset is still in an early adoption phase. Cryptocurrency tends to react more sharply to regulations, interest shifts, and other major economic events.

However, bitcoin could grow significantly if it gains wider adoption, so many investors believe it has a higher upside potential than gold.

Gold vs. bitcoin correlation: Do they move together?

Despite bitcoin’s image of “digital gold,” gold and bitcoin prices don’t necessarily move in tandem. A study published in the Journal of Behavioral and Experimental Finance found a “near-zero correlation” between the performance of bitcoin and gold.

Why gold and bitcoin may act similarly

Both bitcoin and gold can attract investors flocking to hedge assets during times of economic instability. For example, the onset of the COVID-19 pandemic in 2020 saw increased demand for both gold and cryptocurrency.

However, a study from 2022 suggests that bitcoin failed to act as a safe haven asset for stock and oil markets during the pandemic.

Investor profile matters here: Traditional investors and financial institutions still prefer the dependability of gold, while bitcoin attracts younger, tech-savvy investors with a high risk tolerance.

When bitcoin and gold diverge

Gold has a long-standing reputation as a stable, reliable asset, while bitcoin remains a more speculative investment with higher returns. Thus, during a bull market, when more investors tend to take risks, bitcoin may outperform gold. In 2021, bitcoin appreciated by almost 72%, while gold had a negative ROI.

When the market looks uncertain, investors lean toward gold as a safer investment than bitcoin. In 2022, when inflation surged, BTC dropped from over $40,000 in April to about $17,000 by the end of the year. The collapse of Terra may have contributed to an overall loss of trust in cryptocurrency. The same year saw strong demand for gold.

Gold ETF vs. bitcoin ETF: Which is better in 2026?

First, the basics: An exchange-traded fund (ETF) holds assets and trades on a stock exchange. Investing in an ETF essentially means purchasing shares of this fund.

Gold ETFs may hold gold bullion, mining stocks, or futures. Bitcoin ETFs hold either futures or actual bitcoin.

When did bitcoin ETFs start?

Bitcoin futures ETFs launched in October 2021. These ETFs don’t hold bitcoin per se but invest in contracts speculating on bitcoin’s future prices.

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the first spot bitcoin ETFs, which hold bitcoin directly. Spot bitcoin ETFs made it even easier for investors to tap into bitcoin’s potential growth without purchasing and managing actual crypto.

Research shows a growing interest in bitcoin, particularly among institutional portfolios, like those of universities and hospitals. In my experience, clients are also showing increased interest—often allocating a small portion of their assets (around 1%) to bitcoin as a way to participate in this emerging asset class while limiting their exposure to an amount they can afford to lose.

Major bitcoin and gold ETFs

Right now, spot bitcoin ETFs dominate the overall bitcoin ETF charts. These include:

- iShares Bitcoin Trust ETF (IBIT): Over 48B assets under management (AUM)

- Fidelity Wise Origin Bitcoin Fund (FBTC): Close to 16.46B AUM

- Grayscale Bitcoin Trust ETF (GBTC): 16.24B AUM

The leading gold ETFs in early April 2025 are physical gold ETFs that track the gold bullion price, specifically:

- SPDR Gold Shares (GLD): Close to 90B total AUM

- iShares Gold Trust (IAU): Over 41B AUM

- SPDR Gold MiniShares Trust (GLDM): Around 12.53B AUM

Performance

The performance of bitcoin ETFs ties closely to bitcoin prices, which can rise and fall dramatically. Spot bitcoin ETFs track BTC values more precisely than ETFs holding bitcoin futures.

Gold ETFs reflect the price of gold bullion and are generally more predictable since gold is much more stable than bitcoin.

Expense ratios

The expense ratio represents how much your ETF ownership costs, similar to a management fee. It’s a small percentage of your investment that covers the fund’s operation.

- You can find different expense ratios if you browse bitcoin ETFs, from 0.12% for IBIT to 0.95% for ProShares Ultra Bitcoin ETF (BITU).

- Gold ETFs show a similar variety, e.g., 0.10% for GLDM, 0.40% for GLD, and 0.95% for ProShares Ultra Gold (UGL).

Accessibility

The main appeal of ETFs is easy access to gold or bitcoin without the hassle of buying, managing, or storing cryptocurrency or precious metals. You don’t need to arrange for a bullion depository or a crypto wallet.

With so many bitcoin and gold ETFs available today, you can choose the option that fits your investment profile. For example, GLDM has a smaller share size and lower-priced shares than GLD, making it more accessible for individual investors.

Gold ETF or bitcoin ETF?

Bitcoin ETFs aren’t “better” than gold ETFs, or vice versa. The two are different investment vehicles that suit different goals.

Bitcoin ETFs involve higher risks but also have higher growth potential. Gold ETFs are more dependable and tend to hold their worth during economic crises.

Bitcoin vs. gold in the next 5 – 10 years

Investing in bitcoin or gold is a long game. When you consider adding either of these to your portfolio, you’ll want to look at bitcoin vs. gold in 10 years.

Bullish case for BTC

JPMorgan Chase analysts suggest that investing in both gold and bitcoin as hedge assets is becoming a sustained pattern. The crypto market saw an inflow of $78 billion in 2024. At this point, it’s pretty safe to say bitcoin isn’t a fad but has gained a firm place as a digital store of value.

According to State Street Global Advisors, high-net-worth investors see both crypto and gold as assets with long-term potential. The two act as complementary investments: gold contributes to portfolio resilience, while crypto offers growth, innovation, and flexibility.

The same report states that “over half of surveyed institutions plan to invest in blockchain-related funds within the next two to three years,” which shows an increasing adoption trend. Goldman Sachs, one of the world’s largest investment banks, has increased its bitcoin ETF holdings by 88% in the last quarter of 2024.

Bullish case for gold

On the other hand, James Gorman, former CEO of Morgan Stanley, doesn’t see bitcoin as “a core investment” and describes it as a “speculative asset.” Conservative investors and government institutions will likely continue to lean toward gold as a safe-haven commodity. JPMorgan Research views gold as a stable long-term investment that performs well during economic uncertainty.

Currently, it appears that gold and bitcoin will continue to coexist in the next decade, allowing holders to achieve robust, balanced, and diverse portfolios. Be sure to keep an eye on geopolitical shifts, central bank policies, and new legislation that could affect bitcoin or precious metals.

Can you hold bitcoin or gold in an IRA?

You can invest in both gold and bitcoin via a self-directed IRA (SDIRA). This strategy offers substantial tax advantages, just like a conventional IRA. Contributions and distributions follow the same general guidelines as in traditional or Roth IRAs.

Gold vs. bitcoin IRA

A gold IRA can hold precious metals that meet the IRS purity standards (99.5% for gold, 99.9% for silver, and 99.95% for palladium and platinum). A licensed custodian sets up and supervises the account, and the bullion is stored in an authorized depository. Many gold investors choose American Hartford Gold for its accessibility, transparency, and superb ratings.

Like gold IRAs, bitcoin IRAs run under custodial management. A secure crypto wallet holds the bitcoin and any other eligible cryptocurrencies in the account. With both IRA types, you’ll pay setup, management, and possibly transaction fees. Holding gold bullion in an IRA also involves storage and insurance costs.

In my view, gold will continue to serve as a stable asset for wealth preservation, an inflation hedge, and a portfolio stabilizer. Bitcoin, on the other hand, is emerging as a potential “haven” for growth, with its inflation-resistant characteristics and the potential for outsized returns. A well-diversified portfolio in 2025 might include gold at 5% to 10% for stability and downside protection, and bitcoin at 1% to 5% as a high-upside, high-volatility asset with increasing institutional legitimacy.

Which option is right for you?

Gold IRAs appeal to investors who prioritize stability, wealth preservation, and security against inflation. Bitcoin IRAs are a popular choice with investors who seek high growth and can tolerate risks.

However, a gold or bitcoin IRA isn’t necessarily an “either-or” decision. You could include both assets in your retirement plan. For example, iTrustCapital is a flexible, user-friendly platform that allows investors to manage and trade gold and crypto holdings through the same account.

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.