It’s mid-March, which means it’s college spring break season.

From the shores of Florida and Mexico to the islands of the Caribbean and Bahamas, college students flock to the beaches to unwind from midterms with the help of cold beverages and lots of sun.

If you’re like us, you might wonder how so many college students living on a shoestring budget can afford to go on a not-so-cheap weeklong getaway.

For many students, vacations are funded by the same source that helps pay for day-to-day college costs: their parents.

But LendEDU discovered another source for spring break funding that might be shocking to some: student loans.

56.78% of In-School Student Borrowers Going On Spring Break Will Use Loan Money for Trip in 2018

LendEDU conducted a survey of 1,000 student loan borrowers who are currently enrolled at a four-year college to find out how many are using student loan money to help pay for their spring break trips this year.

Our survey found that 56.78 percent of current college students who have taken out student loan debt and are going on spring break this year are using their loan money to help pay for their fun-filled excursions.

When including respondents who are not taking a spring break vacation in 2018, that still leaves 44.4 percent of college borrowers overall who are using student loan money to help pay for their weeklong trips.

You might be wondering how this nifty maneuver is even possible. Well, when a student debtor is approved for financial aid, those funds are sent and administered by that student’s college’s financial aid office. The financial aid office takes out the necessary money to pay the college for that student’s course load.

Whatever money remains is sent to the student loan borrower in the form of a refund check. The refund check is intended to be used on living expenses or other school-related expenses, but there is no way of keeping track of where that excess money is spent.

Apparently, this money will come in handy for student borrowers looking to put together the last leg of funding for their spring break trips. And, depending on how you look at the stats, there is more than a two-to-one chance that will happen.

It’s Not Just Student Loans. Parents Chip In, Too

As a follow-up question, we asked those student loan-borrowing college students who are going on spring break in 2018 if their parents were helping pay for the trip.

Just a little over half of this pool of respondents, 50.51 percent, will receive assistance from their parents to pay for a spring break vacation this year.

As a student debtor, it’s probably savvier to ask your parents to help you pay for a spring break excursion rather than tap into your financial aid. More likely than not, parents won’t ask to be paid back, but the Department of Education will!

Did Borrowers Use Student Loans For Spring Break in 2017?

In 2017, LendEDU ran a similar survey that asked student loan borrowers if they have ever used student loans for spring break.

See the results of that survey below:

Students Use Student Loan Money to Fund Spring Break

In our first question, we asked respondents: “Are you planning to use money received from student loans to help pay for your spring break trip this year? (Including spending on hotels, airline ticket, etc.)”

According to the LendEDU poll, 30.60% of college students with student debt claim that they are using money they received from student loans to help pay for their spring break trip this year. For reference, you can use student loan funding for living expenses.

The National Center for Education Statistics calculated that 20.5 million students will be attending college this year in the United States. Orbitz reported that 55% of students will be going on spring break. Using this data, we can roughly calculate that 11,275,000 students will be going on spring break this year. And, it is estimated that 69% of all current college students use student loan debt by the time of graduation. By doing some additional arithmetic, we can calculate that roughly 7,779,750 student debtors are going on spring break this year.

Factoring in our data, and assuming the claims made in our survey are accurate, this means that 2.38 million students are using money received from student loans to pay for their spring break excursion this year.

Considering the severity of the student loan crisis in the United States right now, this number is severely disappointing. In a previous study, LendEDU found that 49.80% of college students incorrectly believed the government would forgive their federal student loan balance. This means that a number of college students are using government money to pay for spring break and are fully expecting the government to forgive their lavish expenditures. In another study, 51.20% of parents that cosigned on their child’s student loan said their retirement has been put in jeopardy due to late payments made by their child. Many students are hamstringing their parent’s ability to retire because they are using their student loan money to pay for an island adventure.

Where Else is Student Loan Money Going?

Although not as severe, many students are using their student loan money to pay for things other than spring break.

Nearly a quarter (23.80%) of respondents stated that they have used money received from student loans to pay for drinking some type of alcohol. This answer also included spending money at bars.

A third (33.40%) of students answered that they have used money received from student loans to pay for clothing and other accessories.

Similarly, the same amount (33.40%) of students said that they have used money received from student loans to pay for restaurants and take-out.

6.60% of respondents responded saying that they have used money received from student loans to pay for drugs.

Finally, 5.60% of students that participated in our survey stated that they used money received from student loans on gambling or sports betting.

Should you use student loans for Spring Break?

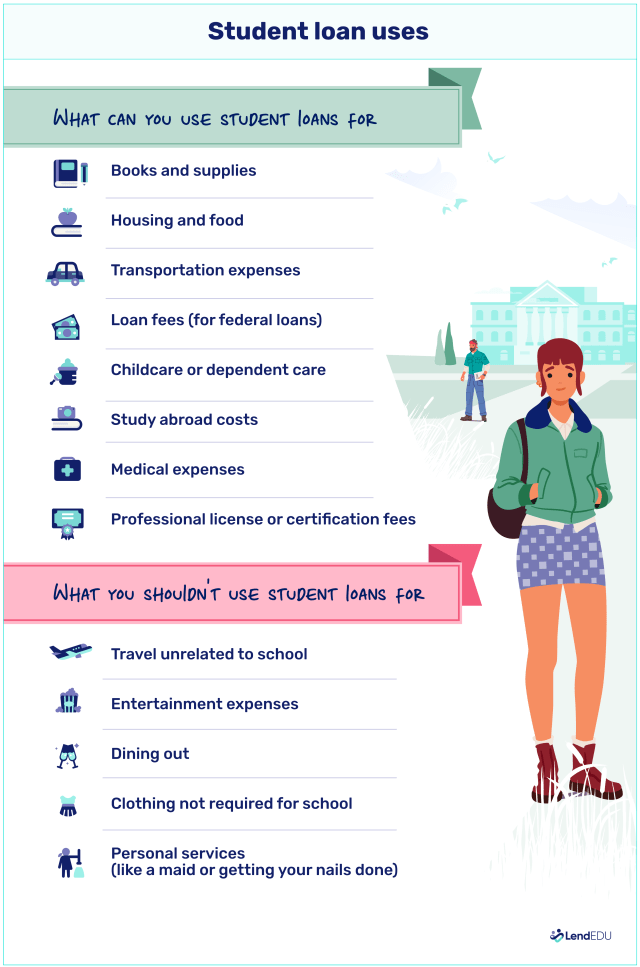

While our study showed many students are using student loan funds for Spring Break, we don’t recommend it. Here’s a look at the appropriate uses for student loans.

Methodology

All of the data that was used in this study was from an online poll commissioned by LendEDU and conducted online by polling company Pollfish. In total, 1,000 current four-year college students with student loan debt were surveyed. We did not specify what type of student loans the borrowers had to have (federal or private). The desired respondents were found and filtered via screener question. This poll was conducted over a five day span, starting on Mar. 8, 2018, and ending on Mar. 12, 2018. All respondents were asked to answer each question truthfully and to the best of their ability.

See more of LendEDU’s Research

About our contributors

-

Written by Mike Brown

Written by Mike BrownMike Brown uses data from surveys and publicly available resources to identify emerging personal finance trends and tell unique stories.