Fidelity is one of the largest brokerage firms in the world, offering a wide variety of products and services for both novice and experienced investors. But can you buy bitcoin on Fidelity? And what about other digital currencies?

Fidelity offers access to a few individual cryptocurrencies for as little as $1, and you can also invest in a variety of crypto-focused funds. If you’re looking for a robust virtual asset experience, however, you might need to look elsewhere. Here’s what you need to know.

Table of Contents

Can I buy cryptos on Fidelity?

With a Fidelity Crypto account, you can invest in the following virtual currencies:

- Bitcoin

- Ethereum

- Litecoin

Alternatively, you can invest in the Fidelity Wise Origin Bitcoin Fund or the Fidelity Ethereum Fund with a regular brokerage account. If you want access to other popular cryptocurrencies, such as ripple (XRP), tether (USDT), or BNB, you’ll need to find another platform to buy and sell them.

Fidelity Crypto account details

The Fidelity Crypto account allows you to buy select virtual assets with as little as $1. Once you set up an account, you can trade 23 hours a day, seven days a week. If you’d rather invest in a fund, you can do so through your standard Fidelity brokerage account, again starting at $1.

Unlike dedicated crypto exchange platforms, however, Fidelity doesn’t allow you to transfer the digital assets you buy to another platform or an external wallet. You also can’t transfer cryptocurrencies bought on another platform to your Fidelity Crypto account.

In other words, if you want to use digital assets for payments or to access certain blockchain-based services, you won’t get that with Fidelity.

Who can open a Fidelity Crypto account?

To qualify for a Fidelity Crypto account, you must be a current Fidelity customer with an individual or joint brokerage account. You must also be a U.S. citizen over the age of 18.

The Fidelity Crypto account is currently available in 38 states. If you live in one of the following states, you’ll need to look elsewhere for individual crypto trading:

States Fidelity isn’t available

- Alaska

- Arizona

- Connecticut

- District of Columbia

- Georgia

- Hawaii

- Louisiana

- Maryland

- Minnesota

- New Mexico

- North Carolina

- Rhode Island

- West Virginia

How to invest in cryptocurrencies with Fidelity

If you’re interested in opening a Fidelity Crypto account, here are the steps you can take to get started.

1. Verify your eligibility

Check the citizenship and age requirements and the state list above to ensure you’re eligible to open an account. If you don’t already have a Fidelity brokerage account, you can open one while creating your Fidelity Crypto account.

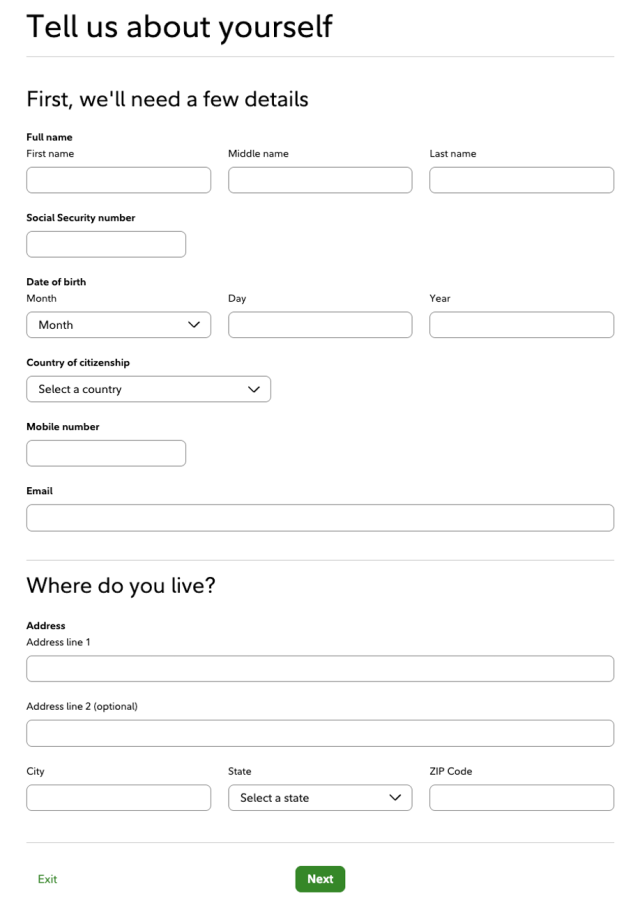

2. Fill out an application

If you’re a Fidelity customer, you can log in to populate the application. You’ll then verify your information, select your funding account, and open the account.

If you’re not already a Fidelity customer, you’ll start by choosing between an individual or a joint account. You’ll then provide the following information for all account owners:

- Full name

- Social Security number

- Date of birth

- Country of citizenship

- Mobile number

- Email address

- Address

- Employment and income information

You’ll then verify your information and apply to open an account. Once your account is open, you’ll create a username and password.

3. Fund your account

Fidelity doesn’t allow you to fund your Crypto account with a bank transfer. Instead, you’ll need to fund your account with a transfer from one of the following eligible Fidelity accounts:

- The Fidelity Account (standard brokerage account)

- Fidelity Cash Management Account

- Stock Plan Services brokerage account

It’s also important to note that your funding account must have been opened after October 2003, and it can’t be linked to another Fidelity Crypto account. It also must be owned by an individual or two individuals—no trust or entity owners.

If you don’t have cash in your funding account, you’ll need to complete a transfer from your bank account to your funding account. It can take one to three business days for the money to be available to move to your Crypto account.

4. Buy your crypto

Once your Fidelity Crypto account is funded, choose the virtual currency you want to buy, and place a trade. Buy orders settle instantly after they fill.

Remember, though, that you can only use up to 95% of your cash if you place an order based on coin amounts rather than dollar amounts. This is because crypto price movements can be volatile.

If you don’t have sufficient funds in your Crypto account to complete the order, you can transfer them from your funding account when placing your buy order.

5. Selling crypto

If you want to sell some of your virtual currency holdings, your sell order will settle immediately after it fills.

If you’re placing a sell order based on dollar amount, though, you can only sell up to 95% of your holding due to price volatility. If you want to sell more than that, you can choose “sell all” or specify the number of coins you want to offload.

I would recommend a Fidelity Crypto account for a client, given Fidelity’s long-standing reputation since its founding in 1946. I have over a decade of experience working with clients who held their investment accounts at Fidelity; therefore, I trust that the company conducts thorough due diligence before introducing new offerings.

However, if a client seeks a broader range of cryptocurrencies, I may suggest exploring Coinbase as an alternative. In either case, I advise allocating no more than 5% of their total investable assets (excluding real estate) to crypto, especially when they are just beginning with this type of investment.

Fees and costs to trade crypto on Fidelity

Fidelity allows you to buy crypto with as little as $1, and all crypto trades are commission-free.

Now, the broker factors a spread of 1% into each trade. This is the difference between your execution price and the price Fidelity buys or sells digital assets to fill your order.

While that’s not cheap, it’s transparent, which is hard to find with traditional crypto exchange fee structures. Some of the fees you may face with a crypto exchange include network fees, exchange fees, withdrawal fees, trading fees, conversion fees, deposit fees, smart contract fees, and more.

With Coinbase, for instance, fees can range from 0.5% to 4.5% for each transaction, depending on the currency, volume, and payment method. Crypto.com’s fees can range from 0% to 2.99%.

Best alternatives to Fidelity to buy XRP and other cryptos

If you want to invest in crypto assets, it’s important to shop around and compare different brokers and exchange platforms to find the right fit for you. Here’s a rundown of several other popular crypto platforms.

Coinbase

Why it’s a good alternative to Fidelity

Coinbase is a well-known crypto platform that offers access to hundreds of virtual currencies. In addition to buying and selling crypto, the platform offers:

- Coinbase Wallet

- Staking

- Learning rewards (earn specific cryptocurrencies by learning about them)

- Prepaid debit card with crypto rewards

While transaction fees can be high, Coinbase offers a premium membership called Coinbase One, which includes no trading fees, boosted staking rewards, and priority support, among other things. It costs $29.99 per month.

The platform uses state-of-the-art encryption and security features to keep your investments safe. It also employs multifactor authentication, password protection, multiapproval withdrawals, and more.

Coinbase currently has an average rating of 3.9 out of 5 stars on Trustpilot, based on more than 16,000 customer reviews. In comparison, Fidelity has an average rating of 1.4 out of 5 stars, based on more than 800 reviews.

| Number of currencies | 240+ |

| Minimum investment | None |

| Fees | 0.5% – 4.5% per transaction |

| Transferability | Transfer to and from other crypto platforms and external wallets |

| Accessibility | 50 states |

Crypto.com

Why it’s a good alternative to Fidelity

Crypto.com is another popular crypto exchange platform offering access to hundreds of digital assets. Features include:

- Onchain Wallet

- Staking

- Stock and ETF trading

- Sports event trading

- Prepaid debit card with varying rewards and features

The platform uses best-in-class security features, such as multifactor authentication, passkeys, email verification for withdrawals, and more. However, Crypto.com has overwhelmingly poor customer satisfaction, with an average rating of 1.5 out of 5 stars across more than 8,700 reviews on Trustpilot.

| Number of currencies | 400+ |

| Minimum investment | $1 |

| Fees | 0% – 2.99% per transaction |

| Transferability | Transfer to and from other crypto platforms and external wallets |

| Accessibility | 49 states (excluding New York) |

Robinhood

Why it’s a good alternative to Fidelity

Robinhood is primarily a mobile-first brokerage platform that offers access to several dozen cryptocurrencies, though some aren’t available in all states.

Robinhood doesn’t provide any other notable crypto-specific features. However, it offers a 3% cash-back credit card to its Gold members, and you can use your rewards to buy cryptocurrencies.

Most coins bought on Robinhood are held in cold storage, with just some in hot storage for day-to-day operations. The broker also carries crime insurance to help protect you from theft and breaches and uses two-factor authentication.

Like Crypto.com, however, Robinhood has poor customer satisfaction, earning an average rating of 1.3 out of 5 stars on Trustpilot, with nearly 4,000 reviews.

| Number of currencies | 26 |

| Minimum investment | $1 |

| Fees | Up to 0.85% per transaction plus network fees |

| Transferability | Transfer to and from other crypto platforms and external wallets |

| Accessibility | 50 states |

About our contributors

-

Written by Ben Luthi

Written by Ben LuthiBen Luthi is a Salt Lake City-based freelance writer who specializes in a variety of personal finance and travel topics. He worked in banking, auto financing, insurance, and financial planning before becoming a full-time writer.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.