It is no secret that the student loan debt situation in the United States is bad – really bad, actually. So bad, that it is more commonly referred to as a “crisis” than a situation.

According to LendEDU, there are 44 million student loan borrowers in the U.S. that collectively owe more than $1.41 trillion in student loan debt. Approximately 60 percent of college graduates leave campus with student debt. The most recent student loan borrowers graduated with an average student loan debt of $27,975, according to our statistics.

Just based off the numbers alone, it is clear that student loan repayment is a steep hurdle staring down many young Americans. Need more proof? 63 percent of borrowers have delayed buying a car because of their debt, 75 percent have delayed buying a home, and 29 percent have had to put off getting married.

After graduation, many student loan borrowers are put into a great predicament. They can focus solely on repaying their debt and neglect other important aspects of life like saving for retirement or buying a house, or, they could put off repaying their student loan debt, focus their resources on other things deemed more important, and watch as the interest on their student loans accrues into a mountain.

But, just like everything else in life, there is a fine line that can be toed by student loan borrowers in repayment. Debtors can make considerable, timely loan payments, while simultaneously budgeting for many of life’s other financial milestones.

However, according to a recent poll by LendEDU, a vast majority of student borrowers in repayment are prioritizing repaying their student loans and putting off spending their money on other things that could be deemed more important than repaying student debt.

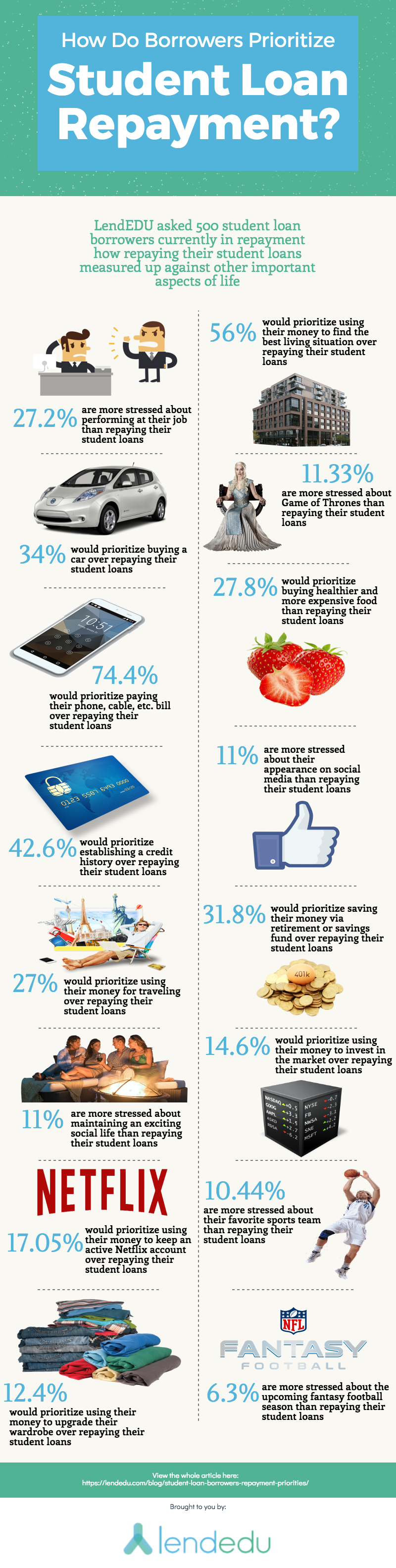

LendEDU polled 500 student loan borrowers that are currently in repayment to see how they prioritized repaying their educational loans versus other things like investing in the stock-market or buying a car.

Full Survey & Results from LendEDU’s Poll:

(an accompanying infographic can be found below)

1. What are you more stressed about?

- 72.80% are more stressed about repaying their student loans

- 27.20% are more stressed about performing at their job to strengthen their job security

2. What would you prioritize using your money for?

- 16% would prioritize using their money to buy gifts for their partner or loved one

- 84% would prioritize using their money to repay their student loans

3. What would you prioritize using your money for?

- 56% would prioritize using their money to find the best possible living situation

- 44% would prioritize using their money to repay their student loans

4. What would you prioritize using your money for?

- 31.80% would prioritize not using their money, but saving it via retirement/savings fund

- 68.20% would prioritize using their money to repay their student loans

5. What would you prioritize using your money for?

- 34% would prioritize using their money to buy a car

- 66% would prioritize using their money to repay their student loans

6. What would you prioritize using your money for?

- 27.80% would prioritize using their money to buy healthy food that is generally more expensive

- 72.20% would prioritize using their money to repay their student loans

7. What do you prioritize more?

- 42.60% prioritize establishing a credit history

- 57.40% prioritize repaying their student loans

8. What would you prioritize using your money for?

- 14.60% would prioritize using their money to invest in the market

- 85.40% would prioritize using their money to repay their student loans

9. What would you prioritize using your money for?

- 74.40% would prioritize using their money to pay their credit card bill, phone bill, utilities bill, etc.

- 25.60% would prioritize using their money to repay their student loans

10. What are you more stressed about?

- 11.33% are more stressed about Game of Thrones and figuring out what will happen next week

- 88.67% are more stressed about repaying their student loans

11. What are you more stressed about?

- 8.28% are more stressed about their appearance on social media

- 91.72% are more stressed about repaying their student loans

12. What are you more stressed about?

- 11% are more stressed about going out to maintain an exciting social life

- 89% are more stressed about repaying their student loans

13. What would you prioritize using your money for?

- 27% would prioritize using their money for traveling

- 73% would prioritize using their money to repay their student loans

14. What are you more stressed about?

- 10.44% are more stressed about their favorite sports team

- 89.56% are more stressed about repaying their student loans

15. What would you prioritize using your money for?

- 12.40% would prioritize using their money to upgrade their wardrobe

- 87.60% would prioritize using their money to repay their student loans

16. What would you prioritize using your money for?

- 17.05% would prioritize using their money to make sure their Netflix account is active so they can binge-watch TV

- 82.95% would prioritize using their money to repay their student loans

17. What are you more stressed about?

- 6.30% are more stressed about their upcoming fantasy football league

- 65.40% are more stressed about repaying their student loans

Methodology

This poll was commissioned by LendEDU and conducted online by polling company Pollfish. In total, 500 student loan borrowers that are currently in repayment participated in this poll. The poll was conducted online over a 2-day span from August 16, 2017 to August 17, 2017. Respondents were filtered so that only student loan borrowers who graduated from a 4-year college and are currently in repayment were able to participate in the poll. To get this exact group of poll participants, LendEDU used a screening question that had six possible answers, but only one answer was accepted. Respondents had to answer with the following: “I have graduated from a 4-year college, and I am currently repaying my student loans.” We did not ask respondents to specify if they are repaying federal or private student loans. All respondents were asked to answer each question truthfully and to the best of their ability.

See more of LendEDU’s Research

About our contributors

-

Written by Mike Brown

Written by Mike BrownMike Brown uses data from surveys and publicly available resources to identify emerging personal finance trends and tell unique stories.