Do you fight about your finances with your significant other?

If so, you might not be alone.

According to our data, couples across the United States are fighting quite a bit.

Managing your own personal finances isn’t easy and often times is a stressful process. When you add another individual into the mix, the process gets emotional and tricky.

As we head into Valentine’s Day, most of us are thinking about heart shaped hot tubs, rose petals, and making last minute restaurant reservations. But the passionate personal finance guys over here at LendEDU have been thinking about love and finances.

We thought it would be interesting to survey 800 individuals that are currently married or in a self described “significant relationship.” From our own experience, we know that love and finance is a tricky concoction. And in our research, we found that there is a surprising number of hidden bank accounts, secret spending, and stress.

Can you believe that 32.25% of people would say that honesty about personal finance is more important than honesty about fidelity?

Sticks and stones may break my bones, but my credit report is forever. Or nearly forever.

Managing finances in a relationship requires a high level of communication and transparency. In our survey, we asked individuals 20 different questions related to managing finances as a couple. Our survey was split 50/50 between males and females and 50/50 between married individuals and individuals in unmarried significant relationships.

Higher Income Equals Less Stress But More Deception

Our survey was conducted to individuals of all income tiers. We thought it would be interesting to compare how views on personal finance within a relationship change with income. Here are the household income tiers used in our survey:

- Low income: Under $25,000 to $49,999

- Middle income: $50,000 to $99,999

- High income: $100,000 to above $150,000

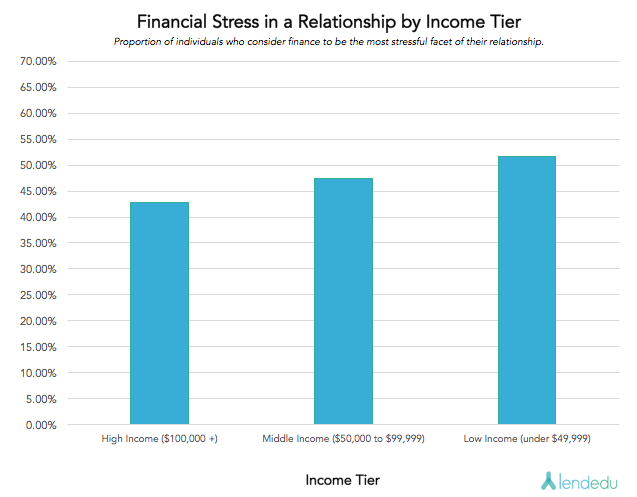

In Question #7 we asked respondents if they considered finance to be the most stressful facet of their relationship. Here are the results broken down by income tier.

We found that 42.86% of high income individuals reported finances to be the most stressful facet of their relationship, 47.46% of middle income individuals reported finances to be the most stressful facet of their relationship, and 51.66% of low income individuals reported finances to be the most stressful facet of their relationship.

Money may not buy happiness, but it appears that money does buy less stress on your relationship. We found that as income increases, there is less financial stress in a relationship.

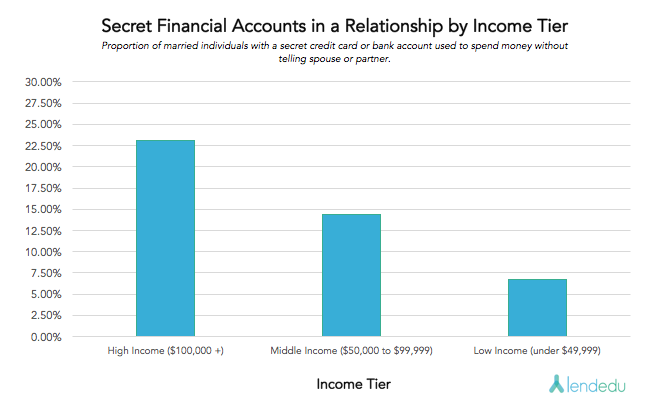

In Question #16 we asked married respondents if they have a secret credit card or bank account used to spend money without telling their spouse or partner.

We found that 23.08% of high income individuals reported to have a secret credit card or bank account used to spend money, 14.39% of middle income individuals reported to have a secret credit card or bank account used to spend money, and only 6.70% of low income individuals reported to have a secret credit card or bank account used to spend money.

We found that as income increases, a higher proportion of individuals have a secret credit card or bank account used to spend money without telling their spouse or partner.

Males and Females View Spending and Saving Differently

Our survey was conducted 50/50 to males and females. We thought it would be interesting to compare how financial views change with gender.

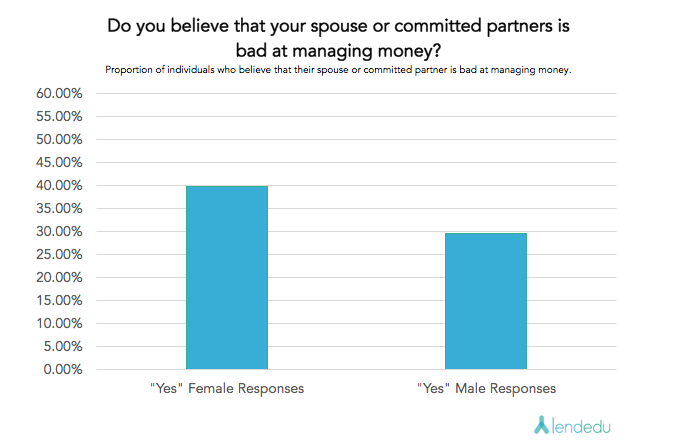

In Question #5 we asked respondents if they think their spouse or committed partner is bad at managing money. We found that 39.75% of women believe that their spouse or committed partner is bad at managing money, while only 29.50% of men believe the same about their female counterparts.

Two different statements could be made after analyzing this question. It could be true that men are actually worse at managing money, or women are better at managing money. Alternatively, it could be true that women are more critical of spending habits, or men are less critical of spending habits.

In Question #9 we asked respondents if they think their spouse or committed partner spends money wisely. We found that 55.50% of women believe that their spouse or committed partner spends money wisely, while 70.75% of men believe that their spouse or committed partner does the same.

Again, two different statements could be made after analyzing this question. It could be true that women spend money more wisely, or men spend money less wisely. Alternatively, it could be true that women are more critical of spending habits, or men are less critical of spending habits.

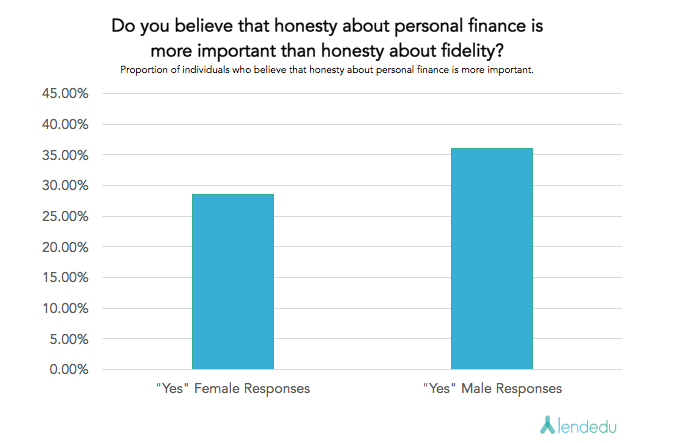

In Question #1 we asked respondents if they believed that honesty about personal finance is more important than honesty about fidelity.

We found that 36% of males believe that honesty about personal finance is more important, while only 28.50% of females hold that belief.

Financial Stress Increases with Marriage

Our survey was conducted 50/50 to married individuals and individuals in committed relationships. We thought it would be interesting to compare financial views before and after marriage.

In Question #7 we asked respondents if they considered finance to be the most stressful facet of their relationship.

We found that 52.75% of married individuals reported that they consider finances to be the most stressful facet of their relationship. However, we found that only 45% of individuals in committed relationships believe the same.

It appears that with marriage comes additional financial stress in a relationship.

Full 19-Question Survey Results

Our survey was conducted in January 2017 using Pollfish. Information was self reported by our respondents. We asked our respondents to answer our questions honestly and to the best of their ability.

Questions #1 – #13 Asked to All Respondents

1. Would you say that honesty about personal finances is more important than honesty about fidelity?

a. Yes – 32.25%

b. No – 67.75%

2. Do you know your spouse or committed partner’s credit score?

a. Yes – 69.88%

b. No – 30.13%

3. Would you say that financially savvy partners are more attractive?

a. Yes – 52.88%

b. No – 47.13%

4. Do you talk about financial goals and values with your spouse or committed partner?

a. Yes – 89.38%

b. No – 10.63%

5. Do you think your spouse or committed partner is bad at managing money?

a. Yes – 34.63%

b. No – 65.38%

6. Have you ever hidden purchases from your spouse or committed partner?

a. Yes – 31.25%

b. No – 68.75%

7. Do you consider finances to be the most stressful facet of your relationship?

a. Yes – 48.88%

b. No – 51.13%

8. Do you wish that your spouse or committed partner saved more money?

a. Yes – 64.13%

b. No – 35.88%

9. Do you think your spouse or committed partner spends money wisely?

a. Yes – 63.13%

b. No – 36.88%

10. Do you avoid talking about personal finances in your relationship?

a. Yes – 12.50%

b. No – 87.50%

11. Do you argue about finances on a regular basis?

a. Yes – 20.13%

b. No – 79.88%

12. Are you aware of how much debt, if any, your spouse or committed partner is in?

a. Yes – 84.25%

b. No – 15.75%

13. If your spouse or significant other had significant financial problems such as credit card debt or bankruptcy, would you leave the relationship?

a. Yes – 5.75%

b. No – 94.25%

Questions #14 – #17 Asked to Only Married Individuals

14. Before getting married, did you talk you regularly talk about money with your spouse or partner?

a. Yes – 66.67%

b. No – 33.33%

15. Have you ever withheld information from your spouse or partner regarding spending on discretionary items, such as apparel, accessories, electronics and entertainment.

a. Yes – 37.76%

b. No – 62.24%

16. Do you have a secret credit card or bank account used to spend money without telling your spouse or partner?

a. Yes – 10.49%

b. No – 89.51%

17. Do you have a joint checking account, or do you maintain separate accounts?

a. Joint checking account – 69.46%

b. Separate accounts – 30.54%

Questions #18 – #19 Asked Only to Unmarried Individuals in Significant Relationships

18. Do you believe that it is important to talk about personal finance and your financial history before marriage?

a. Yes – 93.80%

b. No – 6.20%

19. Do you help each other manage personal finances? Including help with budgeting, savings, investing, etc.

a. Yes – 92.18%

b. No – 7.82%

See more of LendEDU’s Research

About our contributors

-

Written by Dave Rathmanner

Written by Dave RathmannerDave Rathmanner has researched and developed content on a variety of finance topics, such as student loans, personal loans, credit cards, and small business loans.