For some, tax season means the promise of a big tax return to help pay for bills, go on vacation, or fund home renovations. For others, it’s a source of dread—whether it’s the pain of navigating a complex tax system or the realization they simply can’t afford to pay what they owe.

To learn more about the IRS tax challenges average Americans are dealing with, LendEDU surveyed 600 U.S. adults online. The most shocking finding: Roughly 2 in 5 Americans have faced, or are currently facing, fees, penalties, interest, and/or collections because of their tax debts.

Among the thoughts these taxpayers shared were several words indicating real fear and deep trauma about their tax situation: stressed, uncomfortable, nervous, anxious, scared, defeated, uncertain, lost, overwhelming, awful. These are the words of Americans who want to pay what they owe—but can’t afford it, or don’t know how.

Nearly 39% of Americans grapple with IRS fees, penalties, interest, or collections

In our survey, almost 2 in 5 respondents said they’ve been hit with IRS fees, penalties, or interest and/or are facing collections efforts.

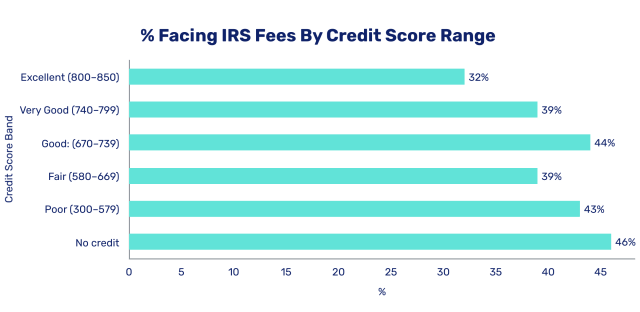

These IRS tax challenges plague Americans from all walks of life—across all income and credit score levels, all education levels, all races, all ages, and all regions of the country.

That said, Americans with poor credit, or no credit at all, are disproportionately affected by tax problems. Forty-three percent (43%) of Americans with poor credit and 46% of Americans with no credit history have dealt with fees, penalties, interest, or collections activities, compared to 32% of Americans with excellent credit.

Younger Americans and those without employment are struggling the most. More than half of Millennials and half of Gen Z Americans told us they had unfiled taxes from 2024—three days after the tax deadline. Similarly, 52% of Americans who are temporarily unemployed hadn’t filed their 2024 taxes by the April 15 deadline this year.

Why? Many simply don’t have the money to pay what they owe; others are confused by the process (as also indicated by survey results); but a shocking 5% are actually waiting to see what the Trump administration will do to the IRS before taking action.

“It’s awful, but maybe Trump will just do away with the IRS and I’ll be free.”

2025 LendEDU Tax Challenges Survey Respondent

1 in 4 Americans who have issues with the IRS can’t afford to pay their taxes

Nearly 25% of Americans who are currently dealing with IRS tax challenges said affordability was the main reason they’re having trouble.

Unsurprisingly, those with very low income (less than $25,000 a year) are disproportionately affected by affordability issues; nearly a third said they can’t afford to pay the IRS, compared to 22% of high-income earners ($100,000 or more a year).

Affordability is increasingly becoming a problem for high-income earners. More than half (53%) said their tax issue started within the last year, which could reflect higher levels of inflation, a rising unemployment rate, and price hikes resulting from tariffs.

Similarly, a higher percentage of Americans with poor credit (28%) and no credit history at all (33%) reported they don’t have enough money to pay their taxes.

More than 63% owe $10,000 or more

Among Americans who currently owe taxes to the IRS, more than 63% reported they owe $10,000 or more—and over 10% said they are $100,000 or more in debt to the federal government.

Though discouraging, this isn’t surprising: According to Bankrate’s 2025 Annual Emergency Savings Report, nearly 60% of Americans couldn’t use money in a savings account to cover a $1,000 emergency. Instead, they’d pay for it with a credit card (25%) or personal loan (5%), borrow from loved ones (13%), try to cut other expenses (13%), or try something else (4%).

If nearly half of Americans would have to finance $1,000 emergencies, they’d clearly also have trouble paying the $10,000—or $100,000—they owe to Uncle Sam.

Tax complexity is also creating major problems

Affordability is a major reason Americans aren’t paying their taxes and getting slapped with fees, penalties, interest, and, in worst-case scenarios, collections activities, such as wage garnishment. But it’s not the only reason.

Of those Americans currently facing IRS tax challenges:

- 14.8% said they didn’t know the tax rules.

- 10.5% said they don’t know what went wrong.

- 6.9% said they made a mistake when filing.

“I’m seriously lost on how to even start.”

2025 LendEDU Tax Challenges Survey Respondent

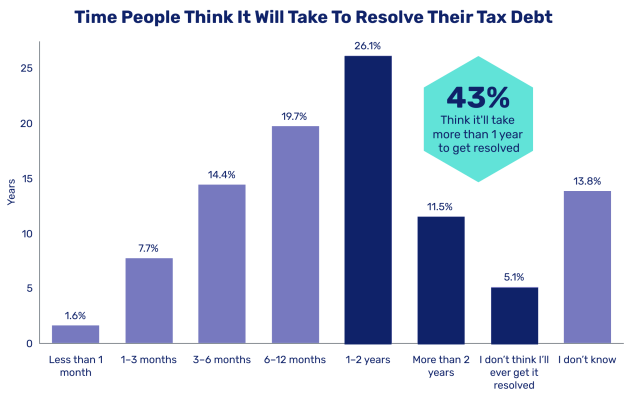

More than a third expect their tax issues to take years to resolve

For most Americans, their tax situation is so complex that there’s no easy overnight solution.

We asked Americans struggling with taxes how long they think it will take to resolve; nearly 43% said it’ll take a year or longer, or may never get resolved. Another 14% have no clue how long it will take, highlighting how confusing taxes can be—and how unclear the path forward often is.

Over half say they aren’t confident they can settle debts on their own

More than half (55.7%) of Americans facing tax issues with the IRS did not agree they could take care of their tax debts on their own. Those with low or very low income and poor or no credit were more likely to indicate they wouldn’t be able to settle debts themselves.

“It frightens me to even think about. I have no idea what to even do to help resolve it.”

More than 16% indicated they don’t know what they’ll do about their tax debts, and another 5% are in wait-and-see mode. That means roughly 1 in 5 Americans with tax issues is not currently taking action, while penalties and interest continue to accumulate.

Many of these Americans want to do something about their tax problems, but:

- 15.7% said they’re worried they’ll make things worse.

- 11.3% reported they don’t have the time or energy.

- 26.2% said the hardest part is simply figuring out what steps to take.

“I’m feeling like I want to ignore it and I don’t know what to do next.”

2025 LendEDU Tax Challenges Survey Respondent

Roughly half believe a tax relief company could help

Taxes may be difficult to navigate, but you don’t have to go it alone. In fact, nearly half (49.2%) of Americans struggling with taxes are currently working or would consider working with a tax relief company. Another 27.0% are considering other services, such as a tax attorney.

“I’m feeling uncomfortable about my tax situation but if I work with a tax relief company, it will take some stress off of me.”

2025 LendEDU Tax Challenges Survey Respondent

That said, 24.4% of respondents worry that tax relief companies are too expensive. That’s a valid concern: We found that tax relief services cost between $250 and $7,500 or more, depending on what you owe and which company you go with.

Not all tax relief companies are created equal, either. More than 15% of respondents facing IRS tax challenges said they’re worried about being scammed by a tax relief company. To help, we’ve thoroughly vetted more than 20 firms and recommended only reputable options in our roundup of the best tax relief companies. We’ve also put together common signs of bad tax relief companies—those that might charge high fees for no results, or that may downright scam you.

Not sure if this is the right path for you? Find out what tax relief companies do and how they work in our full guide to tax debt relief.

Methodology

The IRS and Tax Challenges Survey, conducted on April 18, 2025, sampled 600 U.S. adults online through a third-party platform to explore Americans’ experiences with IRS issues, tax debt, and financial obstacles related to taxes.

The survey was deployed via Random Device Engagement (RDE) technology, which recruited respondents during their typical browsing across websites and mobile apps. This approach minimized selection bias and enhanced respondent diversity across devices and digital environments.

A stratified random sampling strategy was used to ensure demographic representation by segmenting the population by factors such as age, income, education, region, and credit score. Participants were randomly selected within each stratum, allowing for representative insights while reducing sampling error.

The questionnaire included single-select, multi-select (checkbox), and open-ended questions to capture a range of categorical, behavioral, and qualitative responses. Questions addressed IRS penalties, tax filing status, payment plans, confidence in resolving debt, and openness to third-party assistance, among other topics.

Descriptive statistics and subgroup breakdowns (e.g., by generation, income, and credit tier) were used for analysis. Stratification was observed during reporting, though no post-stratification weighting was applied.

Given the sample size of 600, a margin of error of ±4.0% at a 95% confidence level was calculated using the standard formula:

MOE = z × √[ p(1 – p) / n ], where:

- z = 1.96 (z-value for 95% confidence)

- p = 0.5 (maximum variability)

- n = 600 (sample size)

This survey provides a snapshot of how Americans are navigating back taxes, IRS communication, and debt relief decisions in 2025.

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.