The national average gas price sits at $3.17 as of April 2025, according to the Bureau of Transportation Statistics—up from $3.02 in December 2024. For many drivers, that means tightening an already stretched budget.

Whether you’re commuting to work, planning a summer trip, or just filling up for errands, it’s frustrating to see prices creeping higher without a clear end in sight. So why are gas prices rising?

Here’s a look at what’s happening with fuel costs in 2026, where prices could go next, and how to stay afloat if gas costs more than your budget allows.

Table of Contents

What’s happening with gas prices in 2025?

Gas prices are ticking upward in 2025. But so far, the rise has been gradual.

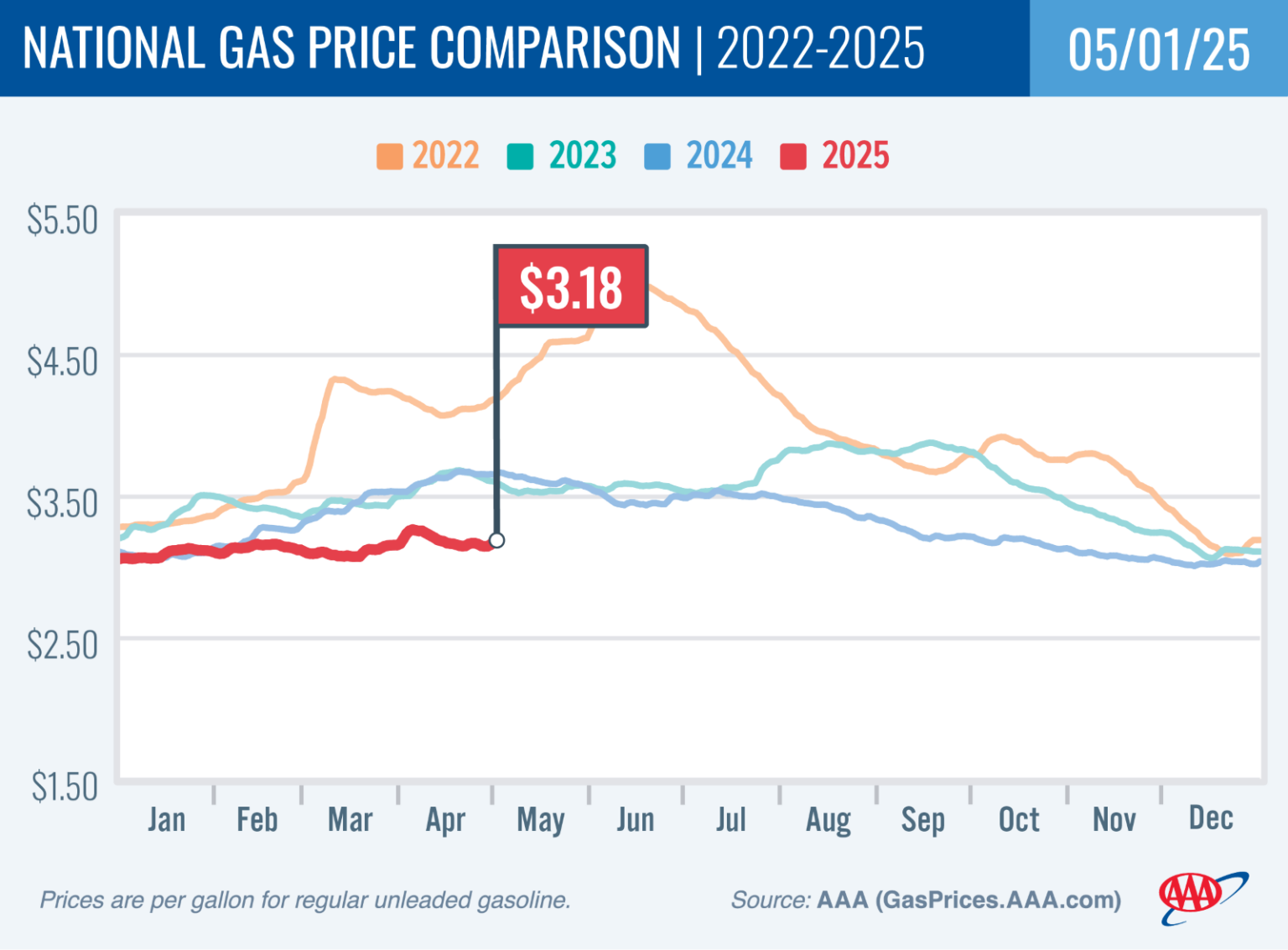

As of May, the national average sits at $3.18 per gallon for regular gas, according to AAA. That’s up from $3.17 in April and $3.02 at the end of 2024. Diesel prices are climbing, too, averaging $3.57 in April, compared to $3.49 in December.

It’s a modest climb, but it’s nowhere near the highs we experienced in 2022 (as shown in this chart).

So which states are getting hit the hardest? According to AAA data, the most expensive states to buy gas in are:

- California ($4.77)

- Hawaii ($4.50)

- Washington ($4.26)

- Oregon ($3.90)

- Nevada ($3.84)

- Alaska ($3.62)

- Illinois ($3.40)

- Pennsylvania ($3.35)

- Idaho ($3.31)

- Utah ($3.31)

On the flip side, these are the 10 cheapest states to buy gas in:

- Mississippi ($2.66)

- Louisiana ($2.73)

- Tennessee ($2.74)

- Alabama ($2.76)

- Texas ($2.76)

- Arkansas ($2.78)

- Oklahoma ($2.80)

- South Carolina ($2.82)

- Kansas ($2.85)

- Missouri ($2.85)

Fluctuating oil prices, post-winter maintenance at U.S. refineries, and uncertainty in global energy markets are all feeding into this uptick in fuel costs.

At the same time, inflation and interest rates are still high, which can add extra pressure if you’re already juggling higher grocery bills and rising debt.

Advertisement

Higher APYs than the national average

- Some limited-time boosts for increased APYs

- No monthly fees

- FDIC-insured accounts

What’s causing gas prices to rise in 2025?

Gas prices are nudging up again this year, but not because of one single issue. Instead, it’s a mix of global production shifts, trade uncertainty, and slower demand that’s keeping prices unpredictable.

Here’s what’s going on behind the scenes:

OPEC production increases are flooding the market

After holding back supply for much of 2023 and 2024, the Organization of the Petroleum Exporting Countries (OPEC) has started ramping up oil production again in 2025. The group recently announced an accelerated output hike for June, and some members have already been exceeding quotas. While higher output might sound like good news for drivers, the rollout has triggered volatility instead of stability.

Too much supply, too fast, has pushed crude oil prices down. The U.S. Energy Information Administration (EIA) now expects Brent crude to average around $66 per barrel in 2025, down from $81 in 2024. But this seesaw effect is causing oil prices (and by extension, gas prices) to swing more than usual.

Tariffs are adding to global uncertainty

The U.S. and other countries have been adjusting tariffs in response to shifting trade priorities and geopolitical tensions. That includes a temporary suspension of some tariffs and new levies elsewhere. These changes are creating uncertainty for producers and importers, and uncertainty tends to spook energy markets.

The value of the U.S. dollar also plays a role here. Since oil trades globally in U.S. dollars, a weaker dollar can drive up the cost of imported fuel and put more upward pressure on gas prices at home.

Demand is weaker than expected

The global economy isn’t booming, and oil demand is showing it. The EIA recently lowered its forecast for global petroleum demand by about 500,000 barrels per day. In the U.S., economic growth is projected to slow to 1.5% in 2025, down from 2.8% in 2024, which also contributes to softer oil demand.

Lower demand has helped offset some of the upward pressure from supply disruptions. However, it also makes prices more sensitive to even small shifts in policy or output.

U.S. production growth is leveling off

Although the U.S. is still the world’s top oil producer, growth is slowing. The EIA expects U.S. output to rise only slightly in 2025—reaching 13.4 million barrels per day. Some producers are even warning that domestic oil production may have peaked for now due to lower prices and tighter margins.

At the same time, technological advances are making U.S. production more efficient. According to the EIA, the average number of wells completed per location in the Lower 48 states more than doubled from 2014 to 2024. That means producers can bring oil to market faster—but they’re still hesitant to oversupply when prices are this unstable.

Will gas prices keep going up in 2025?

Not likely. While prices have ticked up slightly from late 2024, the EIA expects retail gas prices to decrease by about 3% in 2025 compared to last year.

That’s largely thanks to falling crude oil prices, which are the main driver of what you pay at the pump. The EIA also expects only a modest increase in gas demand this year, along with higher gasoline imports to make up for reduced refinery output following the closure of a major facility in Houston.

Still, prices could fluctuate. Regional supply constraints, shifting refinery margins, or new tariffs could create temporary bumps throughout the year. But overall, the EIA doesn’t anticipate a repeat of 2022’s price surge.

What could bring prices down:

- Lower global oil prices

- Stable or weakening demand

- Increased EV adoption and fuel efficiency

What could push prices up:

- Summer travel demand

- Tariff changes or supply disruptions

- Refinery closures or reduced U.S. production

Gas prices also vary by region. If you live in California, Washington, or Hawaii, for example, you’re likely paying more than someone in Texas or Georgia due to state taxes, regulations, and local supply chains.

Most people have regular travel patterns and driving needs (e.g., to and from work, regular activities around the area like grocery shopping, and any planned travel). I recommend having a defined budget and tracking your average expenses over time. Gas prices will fluctuate, and it’s not necessarily a concern for most individuals unless you have regular, heavy travel.

What to do when gas costs more than your budget allows

When gas prices rise, it can throw your whole budget out of balance, especially if you commute long distances or drive a vehicle that’s less fuel-efficient. Although gas prices may be out of your control, you can take steps to soften the blow.

Here are some realistic ways to cut gas costs or stretch your budget further:

1. Plan smarter driving days

Instead of making separate trips throughout the week, combine errands into one loop to save time and fuel. Use Google Maps or Apple Maps to plan the most efficient route with multiple stops.

2. Use gas price tracking apps before you fill up

Prices can vary dramatically even within the same neighborhood. Apps like GasBuddy and Upside show real-time prices nearby, and some even offer cashback when you upload a receipt.

3. Ask your employer about commuter perks

Some companies offer pre-tax commuter benefits, mileage reimbursements, or even gas stipends for in-office days. If you’re not sure what’s available, a quick email to HR could be worth it.

4. Don’t skip maintenance

Keeping your tires properly inflated can improve fuel efficiency by up to 3.3%, according to the U.S. Department of Energy. And using the right motor oil and changing air filters regularly can also help stretch your mileage.

5. Switch to grocery chains with fuel rewards

Stores like Kroger, Safeway, and Costco often offer gas discounts for members or frequent shoppers. If you already shop there, you might be missing out on savings just by not scanning your rewards card.

6. Drive more efficiently

Avoid hard braking and fast acceleration. (They burn more fuel.) Try using cruise control on highways and aim to drive during off-peak hours when traffic is lighter and speeds are steadier.

Need gas money before payday?

If your tank is running low and your paycheck is still a few days away, a cash advance app like EarnIn can help cover the gap. You can access part of your earnings early with no mandatory fees, and it’s faster than applying for a loan or overdrafting your account.

If you’re having financial challenges, the most important thing is to budget! If you track and understand where your money is going, you’ll have more control over your situation. This helps you adapt and make changes as needed in case, for example, gas prices go higher and cut into your budget.

FAQ

Are gas prices expected to go down in 2026?

Yes, projections indicate a decline in U.S. gasoline prices by 2026. The EIA forecasts that average retail gasoline prices will decrease by approximately 6% in 2026 compared to 2025. This anticipated drop is attributed to factors such as lower crude oil prices and reduced gasoline consumption due to improvements in vehicle fuel efficiency.

Do electric vehicles help insulate consumers from rising gas prices?

Absolutely. EVs offer a buffer against the volatility of gasoline prices. EV owners typically benefit from more stable and often lower fueling costs, especially when charging at home.

For instance, over the past decade, EV owners charging at home have saved an average of $81 per month compared to those driving gasoline-powered vehicles. This financial predictability not only benefits individual households but also contributes to greater economic stability, as consumer spending constitutes a significant portion of the U.S. GDP.

Why do gas prices vary so much by state?

Gas prices vary by state due to differences in taxes, environmental regulations, and supply infrastructure. States like California impose higher fuel taxes and require special fuel blends, which raise costs at the pump.

Local supply issues, such as refinery capacity or distance from fuel sources, also play a role. Add in market factors like competition and demand, and you get significant differences in gas prices across the country.

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Eric Kirste, CFP®

Reviewed by Eric Kirste, CFP®Eric Kirste, CFP®, CIMA®, AIF®, is a founding principal wealth manager for Savvy Wealth. Eric brings more than two decades of wealth management experience working with clients, families, and their businesses, and serving in different leadership capacities.